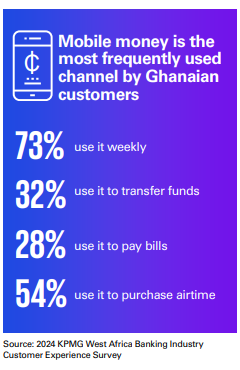

Mobile money is the most frequently used digital platform in 2024, the 2024 West Africa Banking Industry Customer Experience Survey has revealed.

This represented a 7-percentage point increase compared over the previous year.

According to the report, 73% of Ghanaian consumers use it weekly. Thirty two percent use it for transfer of money, while 28% use to pay bills and 54% use it to purchase airtime,

For the second consecutive year, retail banking customers ranked the ease of transferring money between their account and mobile wallet as the most important experience metric highlighting the importance of interoperability between systems.

The survey said mobile money interoperability continues to be a key driver of its adoption with the total value of mobile money interoperability transactions increasing by 23% as of October 2024.

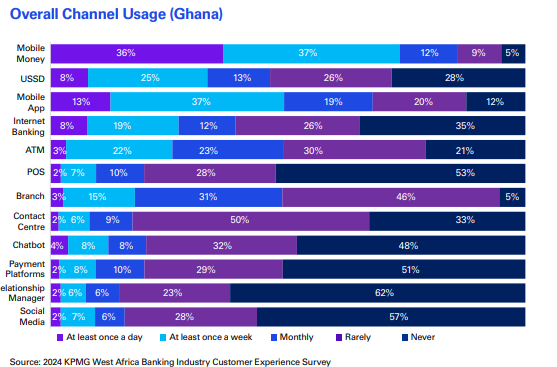

Again, the USSD banking is also driving payment interoperability.

The survey revealed that 33% of retail banking customers use USSD banking services weekly as compared to 28% of respondents in 2023. However, concerns over service reliability persist, with customers reporting intermittent downtime of their USSD banking channels.

Mobile apps, the second most used channel after mobile money, saw a slight decline in usage, with 50% of respondents indicating weekly usage compared to 53% last year.

Availability of service, ease of use and variety of features of mobile apps ranked among the ten most important experience measures for retail customers. While customers appreciate the convenience and features of banking apps, concerns around reliability remain prevalent.

There was a decline in Automated Teller Machines (ATM) usage, with monthly usage dropping from 59% in 2023 to 48% in 2024.

Despite this decrease, customers generally expressed satisfaction with the availability of cash and the service uptime when using ATMs.

While overall usage declined, ATMs remained the second most-used channel among Gen X and Baby Boomers highlighting a generational divide in channel preferences, with older customers continuing to rely on traditional channels for their banking needs while the younger generations prefer digital channels.

Latest Stories

-

Harvard patents targeted by Trump administration

5 minutes -

US judge blocks Trump administration limits on domestic violence grants

15 minutes -

Trump weighs reclassifying marijuana as less dangerous drug, WSJ reports

24 minutes -

Intel CEO to visit White House on Monday, WSJ reports

36 minutes -

Ugandan court denies bail to veteran opposition leader in treason case

48 minutes -

Chad’s former PM and opposition leader sentenced to 20 years

1 hour -

Zambia concerned by ‘financial strain’ of new US visa bond

1 hour -

South African court orders repatriation of ex-Zambian leader Lungu’s body

4 hours -

Zelensky says he discussed peace and Russia with South Africa’s Ramaphosa

4 hours -

Rwandan man accused in 1994 genocide repatriated from Norway

5 hours -

Trump nominates ex-Fox News host Tammy Bruce as deputy UN ambassador

5 hours -

France’s last newspaper hawker gets Order of Merit from his old customer – Macron

5 hours -

Adidas designer sorry for shoes ‘appropriated’ from Mexico

5 hours -

ICC issues arrest warrant for Libyan war crimes suspect

5 hours -

Trump demands homeless people ‘immediately’ move out of Washington DC

6 hours