A new Afrobarometer study has shown that a large majority of Ghanaians oppose the Electronic Transfer Levy (E-levy) because they think “it is a bad idea and will mean a greater tax burden on citizens.”

The survey adds that many do not trust that the government will even use the revenues generated to fund development programmes.

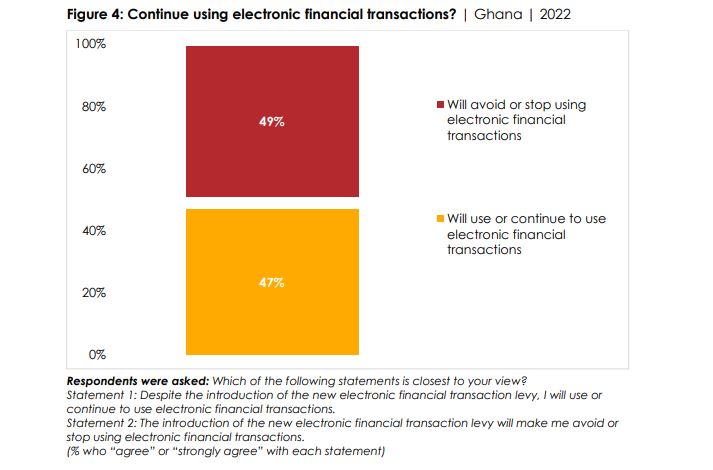

“Citizens are almost evenly split as to whether they will continue to use electronic financial transactions. The study also shows that a majority of Ghanaians believe there are several important goals that a tax revenue system must achieve.

“It includes ensuring that people understand the taxes they owe, reducing the tax burden, using tax revenues more effectively and ensuring that citizens and businesses pay taxes,” part of the report stated.

Key findings from the Afrobarometer survey:

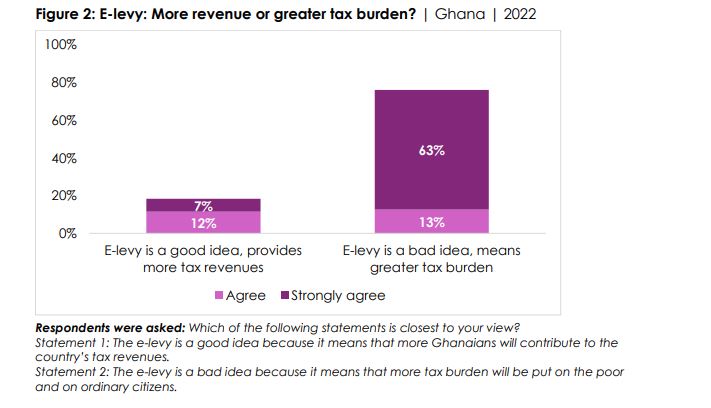

- Three-fourths of Ghanaians disapprove of the e-levy, including 67% who “strongly disapprove” of it (Figure 1). Only two in 10 (19%) endorse the new tax.

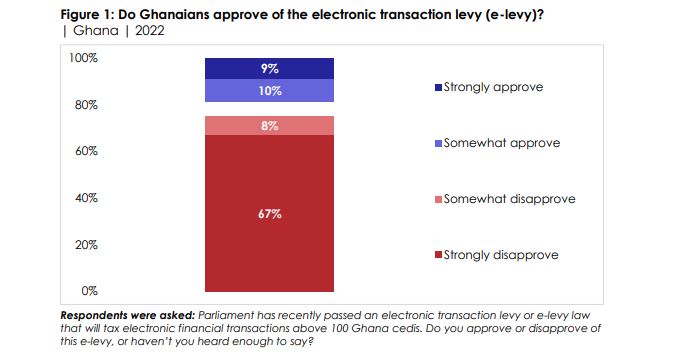

- A similar proportion (76%) think the e-levy is a bad idea because it will increase the tax burden on the poor and ordinary citizens (Figure 2). This includes 63% who “strongly agree” with this view.

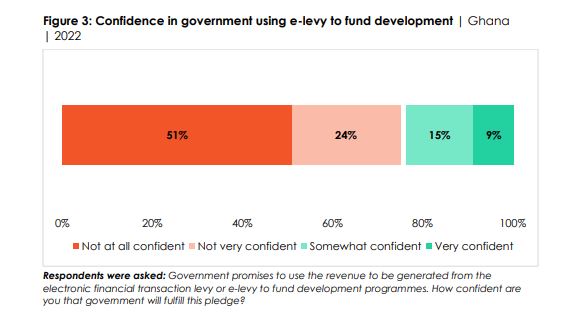

- Three-quarters are also “not very confident” (24%) or “not at all confident” (51%) that the government will fulfil its pledge to use the revenues generated by the e-levy to fund development programmes.

- Faced with the e-levy, Ghanaians are about evenly split as to whether they will continue to use electronic financial transactions (47%) or avoid using them (49%).

- A majority of Ghanaians agree that there are several important goals that a tax revenue system must achieve, including ensuring that people understand the taxes they owe (82%), reducing the tax burden (81%), using tax revenues more effectively (83%), and ensuring that citizens and businesses pay taxes (79%).

Below is the full report:

Latest Stories

-

We didn’t sneak out 10 BVDs; they were auctioned as obsolete equipment – EC

4 hours -

King Charles to resume public duties after progress in cancer treatment

4 hours -

Arda Guler scores on first start in La Liga as Madrid beat Real Sociedad

4 hours -

Fatawu Issahaku’s Leicester City secures Premier League promotion after Leeds defeat

5 hours -

Anticipation builds as Junior Speller hosts nationwide auditions

5 hours -

Etse Sikanku: The driver’s mate conundrum

6 hours -

IMF Deputy Chief worried large chunk of Eurobonds is used to service debt

6 hours -

Otumfuo Osei Tutu II celebrates 25 years of peaceful rule on golden stool

6 hours -

We have enough funds to pay accruing benefits; we’ve never missed pension payments since 1991 – SSNIT

6 hours -

Let’s embrace shared vision and propel National Banking College – First Deputy Governor

7 hours -

Liverpool agree compensation deal with Feyenoord for Slot

7 hours -

Ejisu by-election: There’s no evidence of NPP engaging in vote-buying – Ahiagbah

7 hours -

Ejisu by-election: Independent ex-NPP MP’s campaign team warns party against dubious tactics

8 hours -

ZEN Petroleum supports Tse-Addo Future Leaders School

8 hours -

NPP must win back Adentan seat in 2024 polls – Obeng Fosu

9 hours