Audio By Carbonatix

Data published by the Bank of Ghana (BoG) in its annual Fraud Report has revealed that the losses from fraud cases in the financial sector increased by 7 percent 2023.

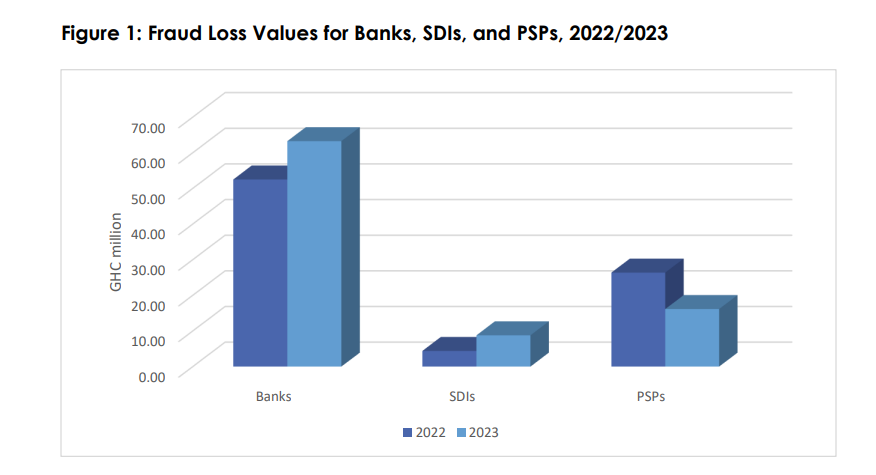

The cases corresponded to total loss value of approximately GH¢88 million in 2023 as compared to GH¢82 million in 2022.

From the three sub-sectors which include banks, Specialized Deposit-Taking Institutions (SDIs) and Payment Service Providers (PSPs), the report indicated that overall, the count of fraud cases increased to 15,865 in 2023 from 15,164 in 2022. This represents a 5 percent rise in the count of fraud cases recorded.

According to the report, an analysis of the 2023 data showed that fraud heightened in fraudulent withdrawals from victims’ accounts, cyber or email fraud, and cash theft (cash suppression).

“Another area of concern is SIM swap related fraud, where SIM numbers linked to banking accounts are fraudulently taken over and monies subsequently withdrawn from the accounts”, the report said.

The report explained that this form of fraud targets individuals who have banking applications on their mobile phones and have linked their bank accounts to mobile money wallets.

While attempted fraud cases in the banking and SDI sectors declined sharply by 59% in 2023 compared to 2022, the total loss value associated with these cases stood at approximately GH¢72 million, a 29% increase over the 2022 figure of GH¢56 million recorded.

The sharp increase in the loss value was influenced by outlier fraud cases involving foreign currencies, which when converted to Cedi, ballooned the 2023 attempted fraud value at loss. The PSP sector also recorded a loss of GH¢16 million involving 14,655 cases in 2023.

Although the loss value recorded in 2023 represented a 38% decline compared to the GH¢26 million recorded in the previous year, the incidents showed a 20% increase compared to the 12,166 cases in 2022.

Generally, bank and SDI sectors recorded increases in the loss values as a result of fraud, while the PSPs sector saw some decline.

The BoG said it will continue to engage institutions with high incidences of fraud to develop action plans to address such incidences in the industry.

The central bank assured that it has also strengthened its engagement with relevant stakeholders to enhance collaboration in the fight against cyber related fraud.

"The publication of the annual Fraud Report by the BoG seeks to create awareness of fraud occurrences and trends identified within the reporting year with the view to promote the soundness and integrity of the banking system".

The report has also highlighted some directives by BOG to banks, SDIs and PSPs which, if implemented, will help reduce the incidence of fraud in the sector.

Latest Stories

-

Kenyans drop flowers for Valentine’s bouquets of cash. Not everyone is impressed

10 minutes -

Human trafficking and cyber fraud syndicate busted at Pokuase

18 minutes -

Photos: First Lady attends African First Ladies for Development meeting in Ethiopia

30 minutes -

2026 U20 WWCQ: Black Princesses beat South Africa to make final round

1 hour -

World Para Athletics: UAE Ambassador applauds Ghana for medal-winning feat

2 hours -

Photos: Ghana’s path to AU Chairmanship begins with Vice Chair election

2 hours -

Chinese business leader Xu Ningquan champions lawful investment and deeper Ghana–China trade ties

2 hours -

President Mahama elected AU First Vice Chair as Burundi takes over leadership

3 hours -

Police work to restore calm and clear road after fatal tanker crash on Suhum–Nsawam Highway

3 hours -

Four burnt, several injured in Nsawam-Accra tanker explosion

4 hours -

Police arrest suspect in murder of officer at Zebilla

5 hours -

SUSEC–Abesim and Adomako–Watchman roads set for upgrade in Sunyani

5 hours -

CDD-Ghana calls for national debate on campaign financing

6 hours -

INTERPOL’s decision on Ofori-Atta: What it means for his U.S. bond hearing and the legal road ahead

6 hours -

Parties can use filing fees to cover delegates’ costs, end vote-buying – Barker-Vormawor

6 hours