Audio By Carbonatix

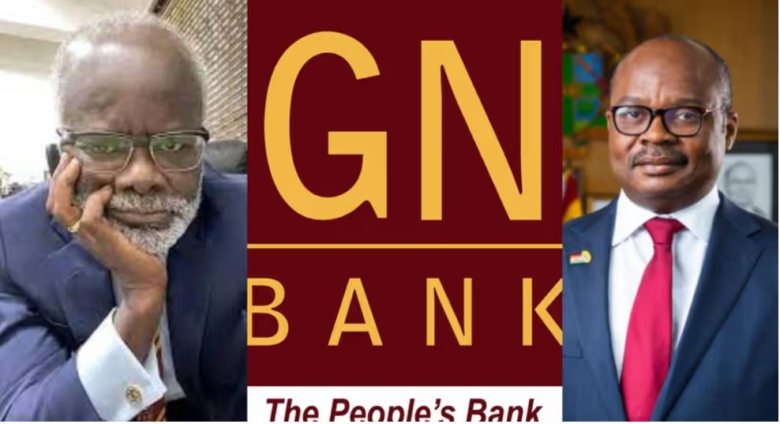

The Global Chairman of Groupe Nduom, Dr Paa Kwesi Nduom has hinted at an impending nationwide tour seeking to campaign for the return of the collapsed GN Bank.

In 2019, the Bank of Ghana revoked the licenses of 23 savings and loans companies and finance house companies which included the GN bank.

The bank subsequently sought legal action challenging the revocation of GN Savings and Loans’ license by the Bank of Ghana (BoG).

But in January 2024, an Accra High Court presided over by Justice Gifty Addo Adjei, upheld the legality of the Central Bank’s decision, emphasising the institution’s right to revoke the license due to governance deficiencies that rendered GN Savings and Loans unable to meet its debt obligations.

Following the ruling, Dr Nduom has filed an appeal.

However, in a series of Facebook posts in the last few days, the bank’s founder, Dr Papa Kwesi Nduom, has been given a hint about what to expect in the coming days regarding the defunct financial institution.

Some of the bank’s assets in the 300 branches nationwide have been left to rot in some parts of the country.

Dr Nduom posted images and videos showing the current state of the bank’s assets.

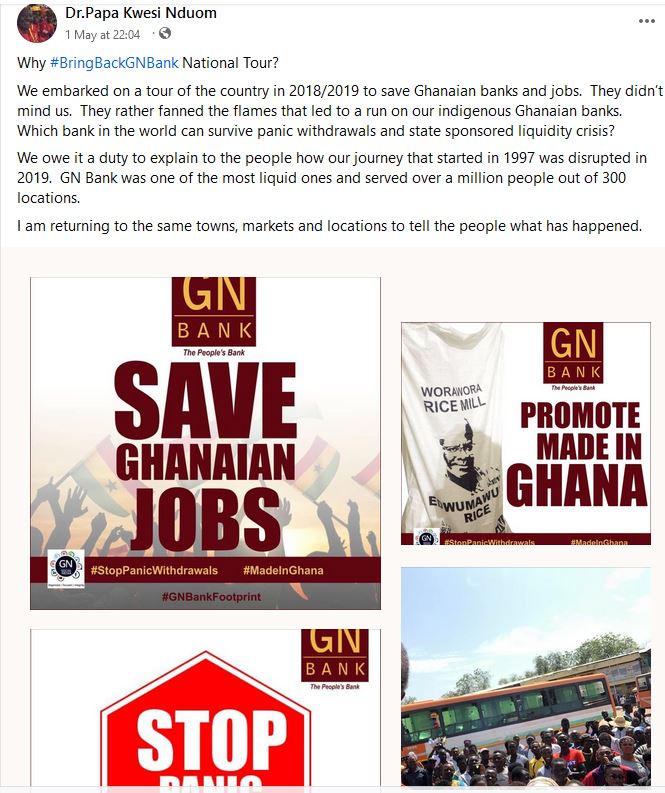

One of the Facebook posts on May 1, 2024, read “Why #BringBackGNBank National Tour?

We embarked on a tour of the country in 2018/2019 to save Ghanaian banks and jobs. They didn’t mind us. They rather fanned the flames that led to a run on our indigenous Ghanaian banks. Which bank in the world can survive panic withdrawals and state-sponsored liquidity crises?

In another post, Dr Nduom said, “#BringBackGNBank Soon, we will embark on a nationwide tour of all 300+ GN Bank locations. We will tell our story directly to the people and let them be the judges on whether the People’s Bank should come back or not.

If you live close to any one of the locations, help us clean its surroundings and join us in Wulensi, Wa, Widana, Daman, Kwame Danso, Kyekyewere, Gwollu, Tsito, and other locations, very soon. Join our campaign for jobs and small business development.

After sharing images of N Bank’s assets at Kokuedor in the Volta Region, Dr Nduom said “We asked for joint management of assets. We took the request to court. We have sent petitions. This is where we are, like this, all over the country. It took a judge four years to come and tell us to pursue the Ministry of Finance to retrieve debts owed to contractors in order to get our license back. After she had ordered the removal of the Minister of Finance from the list of those we had sued in court! And someone said, “This is Ghana for you.” But does it have to be like this?

Latest Stories

-

Paediatric Society of Ghana pens open letter to President Mahama on galamsey effects on Children

18 minutes -

Minimie Atsomo launches “Laugh It Off” creator challenge to celebrate Ghanaian humour and creativity

30 minutes -

Middle East crisis: Ablakwa assures all Ghanaians will be supported

35 minutes -

Voting underway in Ayawaso East as over 49,000 voters head to polls across 113 centres

45 minutes -

Bond market: Turnover rose by 43% to GH¢2.98bn

45 minutes -

Banks wrote off GH¢1.64 billion in 2025, NPL stock hits GH¢21.0 billion – BoG

50 minutes -

Let’s brace ourselves for Middle East war fallout—President Mahama to African leaders

50 minutes -

China removes three retired generals from national advisory body

52 minutes -

Andre Ayew’s 2026 World Cup inclusion won’t surprise me – Kofi Adams

53 minutes -

World Sustainability Organization launches Friend of the Earth sustainable packaging certification in Ghana

1 hour -

14-year-old boy seriously injured following alleged abuse in Ashanti Region

1 hour -

Nana Agradaa walks free from prison after release

1 hour -

Man arrested for alleged assault after accident at Maamobi

1 hour -

Government urged to review compensation fund to support vulnerable accident victims

1 hour -

Photos: Hasaacas Ladies beat Army Ladies to go top of WPL table

1 hour