Audio By Carbonatix

Ratings agency, Fitch has pointed out that Nigerian banks are making significant progress in raising core capital to meet new paid-in capital requirements and are meeting the first quarter 2026 deadline,

According to the UK-based firm, this is supporting a recovery in capitalisation from the impact of naira devaluation, providing fuel for business growth.

It again reduces the likelihood of significant banking sector consolidation.

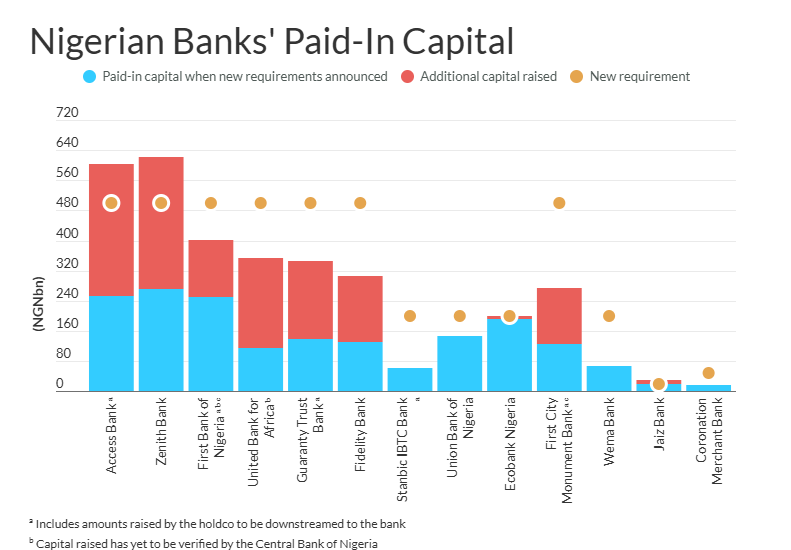

In a report, it said the two largest banks, Access Holdings and Zenith Bank, are the first to secure enough fresh capital to meet the Naira 500 billion requirement for an international licence.

First HoldCo, United Bank for Africa and Guaranty Trust Holding Company are also taking a phased approach. They have recently raised capital and have shareholder approval to begin raising more to meet the Naira 500 billion requirement. First HoldCo’s and United Bank for Africa’s recent rights issues are awaiting final regulatory approval.

Fidelity Bank and FCMB Group have completed initial capital raisings but Fitch said they will need to raise more to maintain their international licences. “As second-tier banks, they must raise significantly more capital relative to their balance sheets than larger banks. They have extraordinary general meeting approval for this, although they could consider downgrading to a national licence as they each have just one foreign subsidiary”.

Ecobank Nigeria Limited (ENG) and Jaiz Bank also needed only small capital injections to meet their requirements and have already achieved compliance.

“We estimate that ENG is still in breach of its total capital adequacy ratio (CAR) requirement of 10% but it has further capital-raising plans to restore compliance”.

Stanbic IBTC Holdings also has launched a rights issue to raise capital to maintain its national licence.

In March 2024, the Central Bank of Nigeria announced a significant increase in paid-in capital requirements (share capital plus share premium) for commercial, merchant and non-interest banks. Banks have three ways to comply – through equity injections, Mergers and Acquisitions and downgrading their licence authorisation.

Fitch-rated banks have also made notable progress towards compliance. Almost all have raised capital or formally launched the process to do so.

Latest Stories

-

Honeymoon is over; act decisively on galamsey, Franklin Cudjoe tells Mahama

48 seconds -

Karpowership Ghana empowers female engineering students at UG to mark International Women’s Day

38 minutes -

Government weighs options on Ghanaian troops in Lebanon after missile attack

41 minutes -

Dumelo commits to supporting UG’s School of Engineering Sciences at during IWD engagement

47 minutes -

Ghana’s tax system from a gender lens: Why women-entrepreneurs are integral to tax revenue mobilisation

53 minutes -

Mahama to embark on 5-day working visit to South Korea

1 hour -

When women lead, mining thrives…the story of Newmont’s Abena Acheampomaa Ankomah

1 hour -

COPEC urges creation of strategic fuel reserve fund to shield Ghana from supply shocks

1 hour -

Empowering women key to national prosperity – Mahama marks International Women’s Day

1 hour -

Brogya Genfi rejects claims of leadership gap at Defence Ministry

2 hours -

Explosion reported outside US embassy in Oslo, police say

4 hours -

Trump accuses UK PM of seeking to ‘join wars after we’ve already won’

4 hours -

See the areas that will be affected by ECG’s planned maintenance today, March 8

5 hours -

First Lady champions ‘Give to Gain’ spirit for International Women’s Day

5 hours -

Ghana@69: Ghana mission in Canada promotes investments and partnerships

6 hours