Audio By Carbonatix

Nigerian banks have resumed the use of naira debit cards for international transactions and online payments, more than three years after financial institutions suspended the service due to acute dollar shortages.

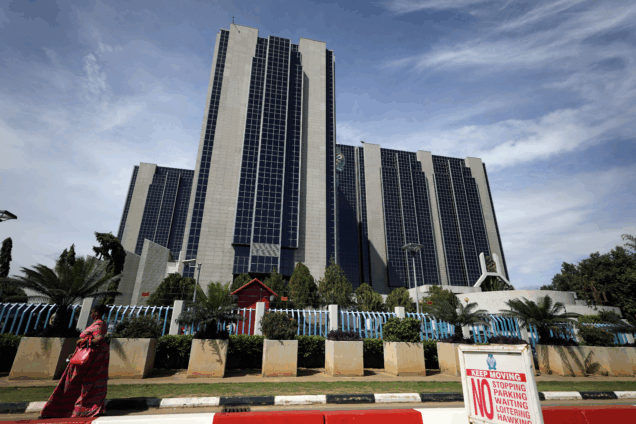

The move by the banks signals improved dollar availability following reforms under President Bola Tinubu, who in June 2023 scrapped currency controls, increasing the flow of dollars into the economy.

GT Bank, among the largest by market value, said naira debit cards could now be used with a limit of $1,000 a quarter.

"The quarterly limit covers all transactions, including ATM cash withdrawals, purchases on international websites, POS (point of sale) payments outside Nigeria, and many more," the bank said in a notice to customers.

Stanbic IBTC, a local unit of South Africa's Standard Bank, said up to $500 a month could be spent on local credit cards.

Other banks, including First Bank and Wema Bank, also set a $500 monthly limit on naira debit cards.

The restoration of international card use comes as the naira has held steady this year. It was trading around 1,528 naira to the dollar on Monday, LSEG data showed.

Analysts say the naira has been supported by improved reserves, which stood at $39 billion in May and higher foreign exchange inflows that increased to $28.92 billion in the first quarter of this year, according to central bank data.

Latest Stories

-

‘The law is the law’ – Mahama insists as Asake pleads on Cyborg’s behalf over firearm incident

3 minutes -

Police arrest 2 over illegal possession of 2,600 AK-47 ammunition in Ashanti Region

5 minutes -

Goldbod is rewriting Ghana’s gold story and restoring national value – Senyo Hosi asserts

15 minutes -

Goldbod: Loss or no loss? The price of everything and the value of nothing

20 minutes -

Government settles US$709m Eurobond obligations ahead of due date

21 minutes -

Low inflation and cheaper imports show Goldbod’s true economic value – Senyo Hosi

23 minutes -

VAT reforms: GRA raises registration threshold to GH¢750,000, cuts rate to 20% from Jan. 2026

25 minutes -

NPP Primaries: Dr Bawumia takes commanding 73% lead — latest Global InfoAnalytics report

37 minutes -

DGPP helped Ghana defy IMF currency forecasts and stabilise the Cedi – Senyo Hosi

38 minutes -

Guinea junta chief wins presidency in controversial election

41 minutes -

Cassava from reclaimed mine lands found to contain unsafe cyanide and lead levels – Study reveals

47 minutes -

Gov’t settles $709m eurobond payment ahead of schedule – Ato Forson

54 minutes -

Fuel prices set to drop from Jan 1, 2026 on cedi strength and falling crude prices

56 minutes -

‘Be vigilant, be professional’ – Private security guards urged to stay alert during festivities

1 hour -

NPP race: Bawumia holds commanding lead – Global InfoAnalytics

1 hour