Audio By Carbonatix

The policy rate- the rate at which commercial banks borrow from the Bank of Ghana- will remain unchanged at 14.5%, at least until after the first quarter of next year, Fitch Solutions has disclosed.

This means cost of borrowing will stay largely same during the period.

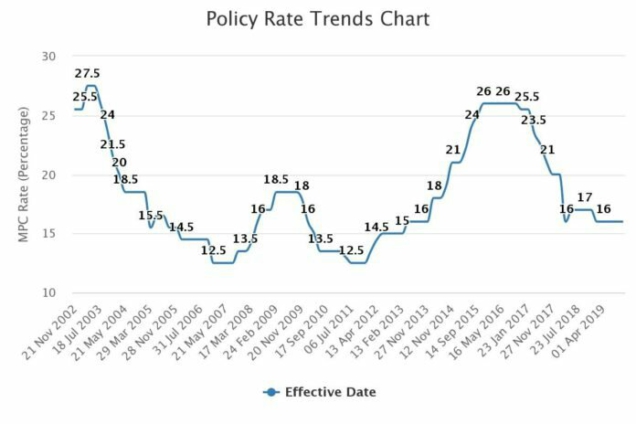

The Bank of Ghana cut its base lending rate by 1.5 percentage points to 14.5% in March 2020, the first time in 14 months. The move was to stimulate spending in the Ghanaian economy and increase money supply.

Senior Country Risk Analyst for Sub Saharan Africa, William Attwell told Joy Business that there will be some monetary policy easing getting to mid-next year when economic growth picks up.

“Interest rate decisions in Ghana could come, that’s of course, till then the Bank of Ghana will hold rate [policy rate] steady. The most recent inflation is still outside of the Central Bank’s target so we would expect that ratings will hold for some time being”

Furthermore, he said “looking ahead to next year though as the Central Bank is likely to encourage recovery to gather pace next year, we would expect a bit of monetary policy easing during mid-2021,” he said.

September 2020 MPC Report

The Bank of Ghana cited risks to inflation and growth as the reason to keeping its base lending rate unchanged in September 2020.

“The Committee’s view is that risks to the immediate outlook for inflation and growth are broadly balanced and decided to keep the policy rate unchanged at 14.5%”, it said in a statement.

It however emphasized that he drivers of economic growth are returning to normal with prospects for a good recovery, adding, monetary and fiscal policies have been supportive, providing the necessary underpinnings for the economy to withstand the negative output shock arising from the covid-19 pandemic.

Interest rate development

Interest rates on the money market saw mixed developments as rates on short to medium term instruments eased between Quarter Two and Quarter Three, but generally tightened at the longer-end.

On a year-on-year basis, the 91-day Treasury bill rate declined to about 14.0% in August 2020 from 14.7% a year ago.

Similarly, the interest rate on the 182-day instrument declined to 14.1% from 15.2%.

With the exception of the 6-year bond, yields on the 7-year, 10-year, 15-year, and 20-year bonds all increased.

Presently, treasury yields are hovering around 14.5%

Latest Stories

-

Six critically injured in gruesome head-on collision near Akrade

3 hours -

Gov’t to extradite foreign national who secretly filmed Ghanaian women to face prosecution – Sam George

3 hours -

U20 WWC: Black Princesses to play Uganda in final round of qualifiers

3 hours -

Burundi takes the helm as African Union declares ‘war’ on water scarcity

4 hours -

‘I will never forget you’ – Kennedy Agyapong thanks supporters, NPP delegates after primaries

5 hours -

Woman found dead in boyfriend’s room at Somanya

7 hours -

Woman feared dead after being swept away in Nima drain amid heavy rain

7 hours -

Court grants GH¢10k bail to trader who posed as soldier at 37 Military Hospital

7 hours -

Tano North MP secures funding to reconstruct decades-old Yamfo Market

7 hours -

Haruna Iddrisu discharged after road traffic accident

7 hours -

Kenyans drop flowers for Valentine’s bouquets of cash. Not everyone is impressed

8 hours -

Human trafficking and cyber fraud syndicate busted at Pokuase

8 hours -

Photos: First Lady attends African First Ladies for Development meeting in Ethiopia

8 hours -

2026 U20 WWCQ: Black Princesses beat South Africa to make final round

8 hours -

World Para Athletics: UAE Ambassador applauds Ghana for medal-winning feat

9 hours