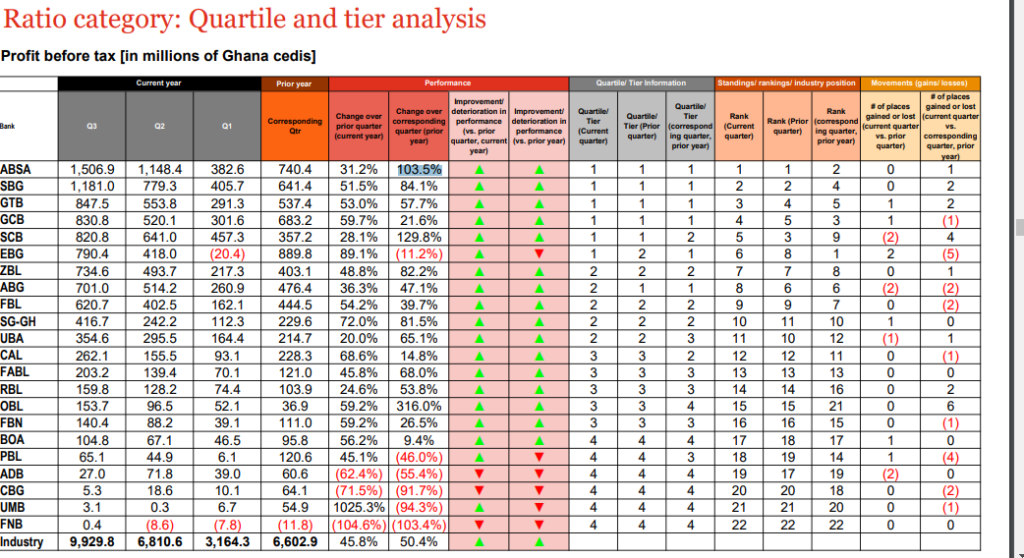

Absa Bank Ghana was the most profitable bank in Ghana in the third quarter of 2023, PwC’s quarterly analysis of the banking industry report has revealed.

This report is coming on the back of the Domestic Debt Exchange Programme.

According to the report, Absa Bank Ghana recorded an increase in year-on-year profit by 103.5% to ¢1.506 billion in the first nine months of 2023.

It was followed by Stanbic Bank Ghana with quarter 3, 2023, profit of ¢1.18 billion (84.1% growth year-on-year).

Guaranty Trust (GT) Bank came 3rd with a profit of ¢847.5 million (57.7% year-on-year increase).

GCB Bank (¢830.8 million), Standard Chartered (¢820.8 million), and Ecobank Ghana (¢790.4 million) came 4th, 5th, and 6th respectively.

The least profitable bank was First National Bank, with a 103% decline in profit to about ¢400,000.

However, all the banks registered profits in the first nine months of 2023.

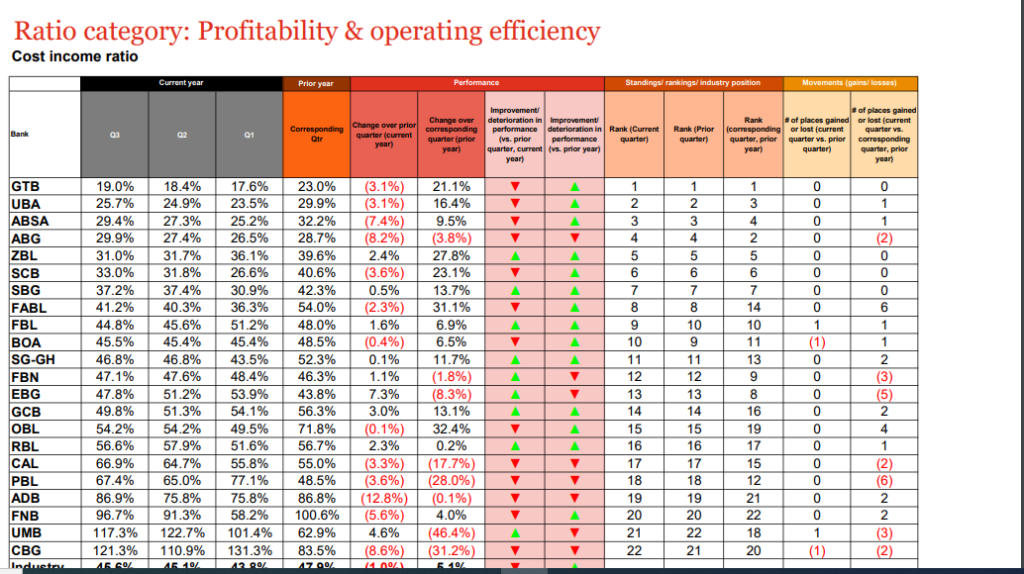

GT Bank most efficient bank

For efficiency, GT Bank (19.0%) was the most efficient bank in terms of cost-to-income ratio in quarter 3, 2023.

It was followed by UBA (25.7%) and Absa Bank Ghana (29.4%).

The lowest-ranked efficient bank was Consolidated Bank Ghana (121.3%).

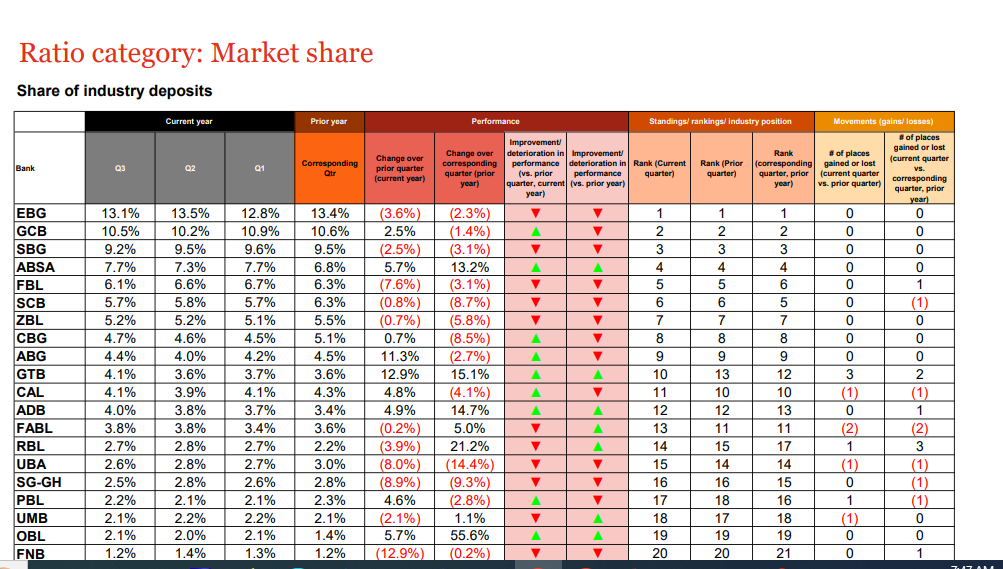

Ecobank Ghana remains biggest bank

For the market share, Ecobank Bank remained the biggest bank in Ghana, controlling the banking industry deposits by 13.1% as of September 30, 2023.

It was followed by GCB Bank and Stanbic Bank Ghana with 10.5% and 9.2% market share respectively.

The three banks also controlled the industry loans and advancement with a total share of 34.2%.

Latest Stories

-

Man remanded for allegedly stabbing businessman with broken bottle and screwdriver

16 mins -

Population in Kumasi Central Prison surges to 1800, threefold exceeding capacity

26 mins -

NPP to conduct La Dadekotopon parliamentary primary today

26 mins -

KPMG’s report on GRA and SML deal, government white paper on report and matters arising

27 mins -

I won’t reply to Chris Brown tour criticism – Ayra Star

29 mins -

British Columbia to back off drug decriminalisation project

37 mins -

Veteran commentator Joe Lartey Sr dies at 96

38 mins -

Livestream: Newsfile discusses KPMG report on SML deal, ILO on SSNIT reserves and NDC’s running mate

1 hour -

Ghanaian activist hugs over 1,100 trees in an hour to set Guinness World Records

1 hour -

Mathew Anim Cudjoe’s Dundee United promoted to Scottish Premiership after Championship win

1 hour -

NSMQ star Jochebed Adwoa Sutherland sweeps 12 awards at UG Vice-Chancellor’s Ceremony

2 hours -

Ghana’s Education Quality ranked 125 out of 183 countries in latest Global Youth Development Index

2 hours -

Emma Stone wants people to use her real first name

2 hours -

Verna Purified Water emerges as ultimate winner at Ghana Beverage Awards 2023

3 hours -

FIFA Club World Cup 2025: Sundowns, Esperance join Al Ahly and Wydad as CAF representatives

6 hours