Audio By Carbonatix

Auditing firm, Deloitte is advising government to reduce its reliance on the international capital market and switch towards concessionary loans to reduce the countries growing debt stock.

Data from the Bank of Ghana puts the country’s total debt stock at ¢393.4 billion in June 2022.

Assessing the 2022 Mid-Year Budget in its latest report, Deloitte maintained that it is time for government to take some drastic measures to control the debt stock.

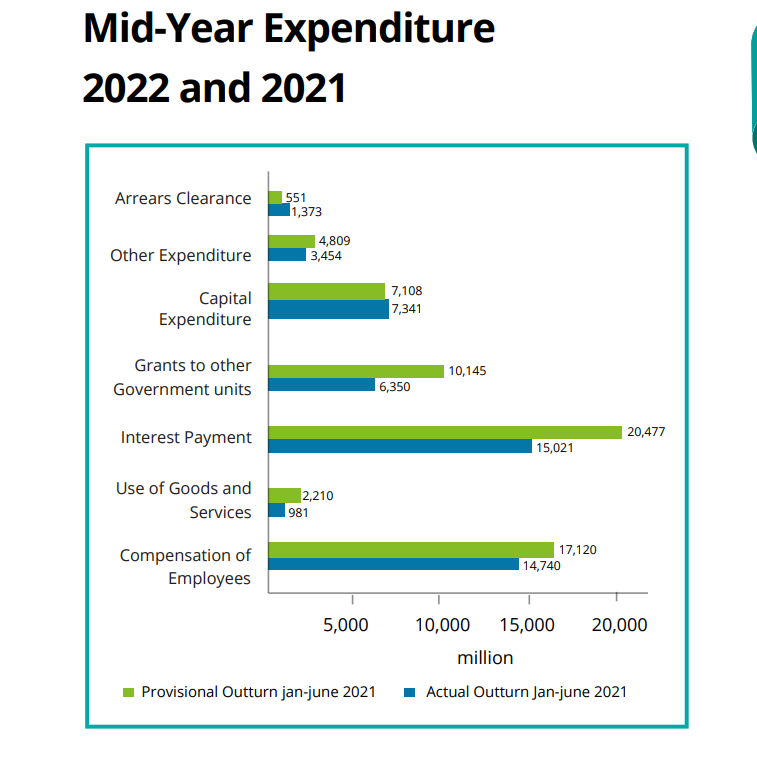

According to the report, even though government was able to maintain all expenditure items within the budget, government however paid high interest rates on Ghana’s loans due to the depreciation of the cedi against major trading currencies as well as higher cost of borrowing in the domestic market.

The report recommended that “government should consider reducing its reliance on the international capital markets and switch more towards concessionary loans in order to contain the rising interest expense”.

Additionally, the auditing firm proposed that “funds borrowed from the international capital markets should be invested more in capital projects with the ability to boost foreign exchange earnings and increase foreign exchange reserves”.

This, Deloitte says will help absorb some of the foreign exchange shocks accounting for the increase in interest expense.

The report also pointed out that the need for fiscal consolidation coupled with prudent spending is key to restoring macro-economic stability and growth prospects in the medium to long term, hence government must direct its expenditure the sectors of the economy that will help create jobs.

Latest Stories

-

Benny Bonsu named among 50 Most Influential African Women in Sport

28 minutes -

SFAN secures micro grant from British Council Ghana to train 100 creative entrepreneurs

39 minutes -

NPA pushes back on proposals to scrap Fuel Price Floor Policy

50 minutes -

Stanbic Bank, Asere-Amartse chiefs deliver sustainable water solution to St. Mary’s Anglican Primary School

1 hour -

Ghana’s macroeconomic gains has renewed investor confidence – Stanbic Bank’s Sydney Tetteh

1 hour -

Policy stability, currency strength and regulatory reforms key to attracting investors – Stanbic Bank

1 hour -

Stanbic Bank Ghana begins 2026 with thanksgiving service; reaffirms support for Ghana’s economic recovery

2 hours -

Nigerian imam honoured for saving Christian lives dies aged 90

2 hours -

What a seventh term for 81-year-old leader means for Uganda

2 hours -

AFCON: ‘Shameful’ and ‘terrible look’ – the chaos that marred Senegal’s triumph

2 hours -

Rashford scores but Barca lose to 10-man Sociedad

2 hours -

Diaz will ‘have nightmares’ over ‘Panenka’ failure

3 hours -

Tragic death of Chimamanda Adichie’s young son pushes Nigeria to act on health sector failings

3 hours -

‘I want to show the world what Africa is’: YouTube star brings joy and tears on tour

3 hours -

‘An ambassador for African football’ – Mane is Senegal’s Afcon hero

3 hours