A consortium of banks has confiscated some assets of the Produce Buying Company (PBC).

This was after it secured a court order to sell some of the company’s assets over nonpayment of debt running into more than GH¢300 million.

The assets include vehicles and some equipment.

The Court Bailiff [name withheld] told Joy Business at the company's premises that the head office of PBC will be auctioned if the company fails to honour its debt to these banks within the shortest possible time.

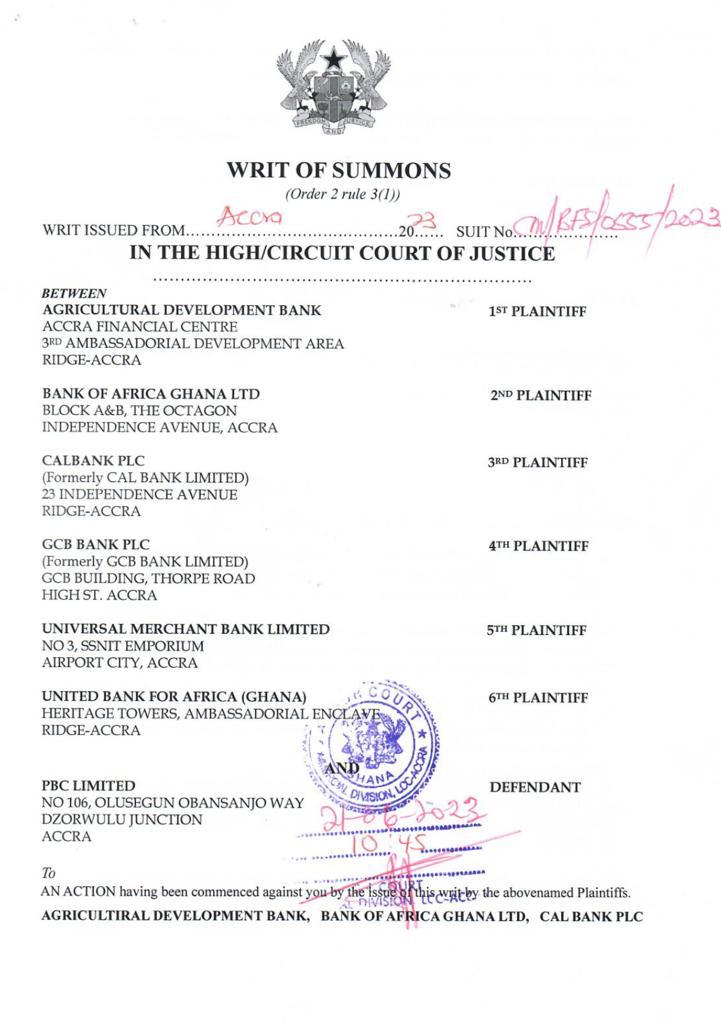

The banks include Agricultural Development Bank, GCB Bank, Bank of Africa, CalBank, UMB and UBA Ghana.

The financial institutions applied for summary judgement on October 9, 2023, under order 14 of C.I 47 against the defendant, PBC.

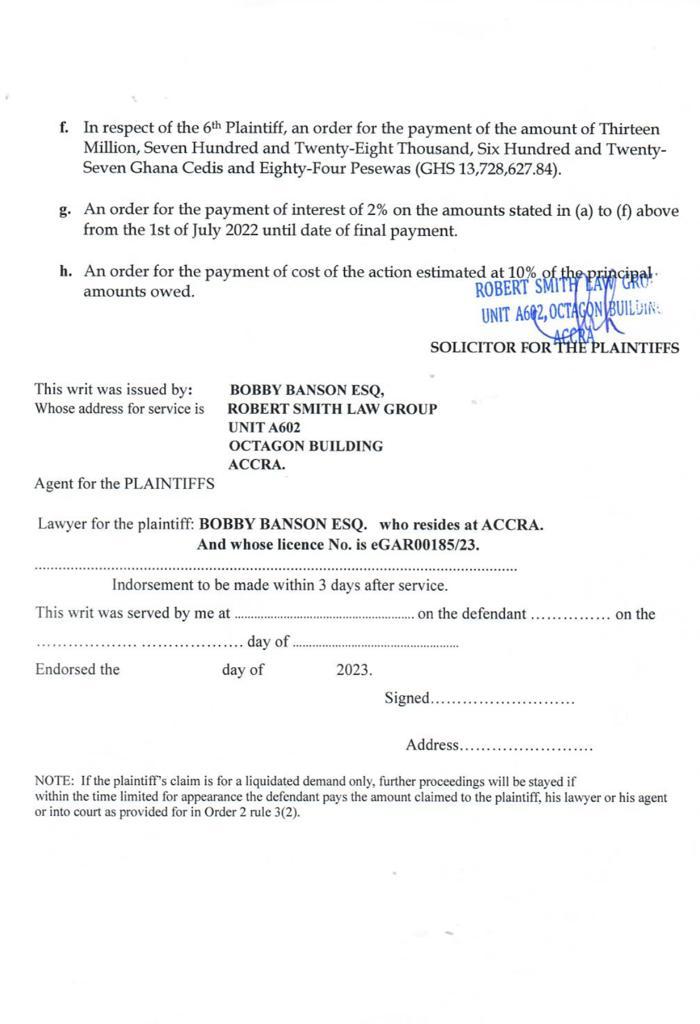

In respect of the 1st Plaintiff (ADB Bank), the licensed buying cocoa company is expected to pay GH¢49.257 million. PBC is also expected to pay GH¢11.219 million, GH¢71.049 million, GH¢108.469 million, GH¢42.295 million and GH¢13.728 million to Bank of Africa Ghana, CalBank, GCB Bank, UMB and UBA Bank respectively.

The attachment order was issued by the Chief Justice, Gertrude Torkonoo, to have the company honour its debt obligations to the six banks.

PBC struggles to secure funding from banks

Since last year, PBC, has been struggling to secure funds for the purchase of cocoa beans.

Sources say this was due to the company’s current debt position, which made it difficult to carry out any financial transaction through the commercial banks.

Joy Business understands that PBC accounts with some of these banks have been frozen due to the company's failure to settle debt to the banks. This situation has made it difficult for the licensed buying cocoa company to undertake some financial transactions through the commercial banks.

Joy Business also understands that the salaries of staff have been in arrears for some time now due to this challenge.

Latest Stories

-

FIFA Club World Cup 2025: Sundowns, Esperance join Al Ahly and Wydad as CAF representatives

2 hours -

CAFCL: Al Ahly set up historic final with ES Tunis

2 hours -

We didn’t sneak out 10 BVDs; they were auctioned as obsolete equipment – EC

6 hours -

King Charles to resume public duties after progress in cancer treatment

7 hours -

Arda Guler scores on first start in La Liga as Madrid beat Real Sociedad

7 hours -

Fatawu Issahaku’s Leicester City secures Premier League promotion after Leeds defeat

7 hours -

Anticipation builds as Junior Speller hosts nationwide auditions

8 hours -

Etse Sikanku: The driver’s mate conundrum

8 hours -

IMF Deputy Chief worried large chunk of Eurobonds is used to service debt

9 hours -

Otumfuo Osei Tutu II celebrates 25 years of peaceful rule on golden stool

9 hours -

We have enough funds to pay accruing benefits; we’ve never missed pension payments since 1991 – SSNIT

9 hours -

Let’s embrace shared vision and propel National Banking College – First Deputy Governor

10 hours -

Liverpool agree compensation deal with Feyenoord for Slot

10 hours -

Ejisu by-election: There’s no evidence of NPP engaging in vote-buying – Ahiagbah

10 hours -

Ejisu by-election: Independent ex-NPP MP’s campaign team warns party against dubious tactics

10 hours