Audio By Carbonatix

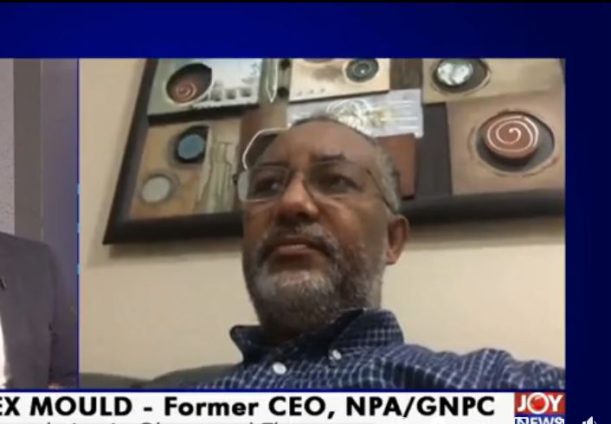

Former Chief Executive of the Ghana National Petroleum Corporation (GNPC), Alex Mould has called for the removal of Special Petroleum Taxes on fuel products.

Speaking on the Business Edition of PM Express, he explained that the reason for the tax implementation does not exist anymore hence the push to get it removed.

He said certain taxes of petroleum cannot be removed due to the binding force against bonds that have been issued from the Esla but special tax does not fall in that category.

He indicated that although “government has reduced the price stabilization levy; he believes that Ghanaians are being taxed too much.”

“…. the question is, are we taxed too much and the answer is yes. I know that government has reduced the price stabilization levy which was 16 pesewas since November but we still have a special tax of about 46 pesewas which is still lingering on the price build-up,” he said on Thursday.

He added that if the government indeed wants the consumer to benefit from a reduction in petroleum then it should consider has to forgo some of these imposed taxes.

He, however, mentioned that he does not see the reduction anytime soon because “there are revenue challenges” therefore government is not going to remove the special petroleum tax.

Mr Mould also called for the specialization of forex regime for imports and distributors in the country.

This, he said, was because “Bank of Ghana is supposed to ensure that we have dollars for petroleum imports which is a mandate for Bank of Ghana.”

“Bank of Ghana when you go on their rate now it’s about 6.10 whereas the price buildup, they are using something close to 6.45 and that is a lot of money that we can save the consumer and people will say that, that is going to the oil marketing company. But the oil marketing company will also complain that when they go to their banks, their banks give them rates that are close to 6.4 or something like that.

"That means that the Bank of Ghana is actually lying to us about what the exchange rate is in the market… because the exchange rate at the market now is about 6.35 against 6.1 that Bank of Ghana is showing,” he stressed.

Latest Stories

-

MTN FA Cup: Defending champions Kotoko knocked out by Aduana

1 hour -

S Korean crypto firm accidentally pays out $40bn in bitcoin

1 hour -

Washington Post chief executive steps down after mass lay-offs

2 hours -

Iranian Nobel laureate handed further prison sentence, lawyer says

2 hours -

U20 WWCQ: South Africa come from behind to draw against Black Princesses in Accra

2 hours -

Why Prince William’s Saudi Arabia visit is a diplomatic maze

2 hours -

France murder trial complicated by twin brothers with same DNA

2 hours -

PM’s chief aide McSweeney quits over Mandelson row

2 hours -

Ayawaso East primary: OSP has no mandate to probe alleged vote buying – Haruna Mohammed

3 hours -

Recall of Baba Jamal as Nigeria High Commissioner ‘unnecessary populism’ – Haruna Mohammed

3 hours -

Presidency, NDC bigwigs unhappy over Baba Jamal’s victory in Ayawaso East – Haruna Mohammed

3 hours -

Africa Editors Congress 2026 set for Nairobi with focus on media sustainability and trust

3 hours -

We are tired of waiting- Cocoa farmers protest payment delays

4 hours -

Share of microfinance sector to overall banking sector declined to 8.0% – BoG

5 hours -

Ukraine, global conflict, and emerging security uuestions in the Sahel

5 hours