Audio By Carbonatix

The Bank of Ghana (BoG) has admitted that the Domestic Gold Purchase Programme delivered economic stability at a high financial cost, insisting the losses were a deliberate national choice.

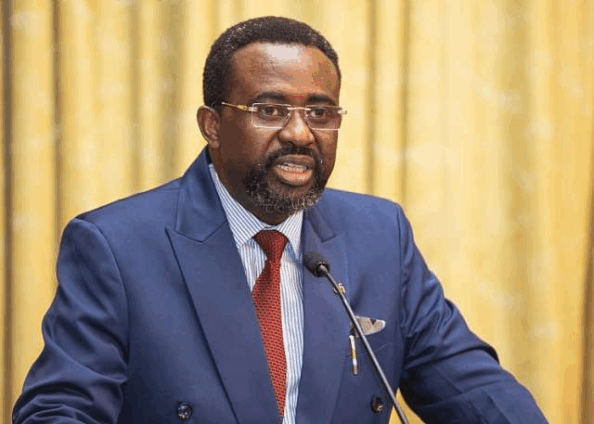

Appearing before Parliament’s Public Accounts Committee on Monday, January 12, Governor Dr Johnson Pandit Asiama said the programme was introduced at a time when Ghana’s foreign exchange buffers were dangerously low and confidence in the economy was fragile.

“Its purpose was clear: to strengthen reserves, stabilise the currency, and create space for macroeconomic recovery by leveraging Ghana’s own natural endowment,” he said.

Dr Asiama told the Committee that while the programme achieved its stabilisation objectives, it came with unavoidable financial consequences.

“But frankly, this stability came at a cost,” he said.

He explained that the Bank of Ghana consciously absorbed the burden of a national strategic policy in the wider public interest.

“Since the inception of the DGPP, the Bank of Ghana carried the financial burden of a national strategic policy – deliberately, and in the national interest,” the Governor said.

Dr Asiama rejected claims that the programme was designed as a profit-making venture or a speculative trading scheme.

“The programme was never conceived as a speculative trading operation, but as a stabilisation tool designed to protect the wider economy,” he said.

Audited figures presented to the Committee showed that losses were recorded between 2022 and 2024. The Governor said these outcomes must be understood within the context of extreme market stress and policy trade-offs.

“These losses were primarily driven by timing and foreign exchange conversion effects,” he said, citing differences between local gold market transactions and the exchange rate used to convert offshore dollar proceeds into cedis.

He also pushed back against public claims that the Bank bought gold at high prices only to sell at lower prices.

“To be clear, the narrative that the Bank ‘buys gold at high prices and sells at low prices’ is incorrect,” Dr Asiama told Parliament.

“Transactions are conducted at prevailing market prices,” he said.

According to him, outcomes were shaped by settlement timelines, structural transaction costs and the stabilisation mandate under which the programme operated.

Despite the losses, Dr Asiama said the programme played a key role in strengthening reserves, improving market liquidity and reducing exchange rate pass-through to inflation.

He said the policy should be judged in its historical context rather than reduced to partisan debate.

“Programmes of this nature should not be reduced to partisan debate,” he said.

Latest Stories

-

South Tongu MP inspects GH₵500,000 surgical equipment, supports District Court with logistics

33 minutes -

Kpasec 2003 Year Group hosts garden party to rekindle bonds and inspire legacy giving

2 hours -

Financing barriers slowing microgrid expansion in Ghana -Energy Minister

2 hours -

Ghana’s Ambassador to Italy Mona Quartey presents Letters of Credence to Pres. Mattarella

3 hours -

KOSA 2003 Year Group unveils GH¢10m classroom project at fundraising event

3 hours -

Woman found dead at Dzodze

5 hours -

Bridging Blight and Opportunity: Mark Tettey Ayumu’s role in Baltimore’s vacant property revival and workforce innovation

5 hours -

Court blocks Blue Gold move as investors fight alleged plot to strip shareholder rights

5 hours -

Nana Aba Anamoah rates Mahama’s performance

5 hours -

Ghana selects Bryant University as World Cup base camp

6 hours -

Nana Aba Anamoah names Doreen Andoh and Kwasi Twum as her dream interviewees

6 hours -

Religious Affairs Minister urges Christians to embrace charity and humility as Lent begins

8 hours -

Religious Affairs Minister calls for unity as Ramadan begins

8 hours -

Willie Colón, trombonist who pioneered salsa music, dies aged 75

8 hours -

Ga Mantse discharged from UGMC following Oti Region accident

9 hours