Audio By Carbonatix

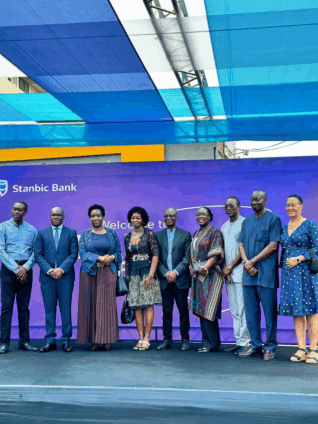

Stanbic Bank Ghana has officially opened its newest branch in Labone, a strategic move aimed at enhancing access to financial services for customers in the area and surrounding communities.

Speaking at the launch event, Chief Executive Officer of Stanbic Bank, Kwamina Asomaning, described the new branch as a key component of the bank’s broader strategy to deepen customer engagement and reinforce its commitment to blending digital innovation with personal service.

“The needs of our customers have evolved. Today’s clients expect digital solutions, interfaces, and platforms, and we’ve provided that. But there’s still a place for physical branches,” Mr. Asomaning said.

“We see our physical and digital platforms as complementary. Branches won’t go out of fashion completely, but what they represent is certainly evolving. That’s why we’ve created modern spaces here with meeting rooms and private areas where we can have meaningful, value-enriching conversations with our clients.”

He also expressed optimism about Ghana’s macroeconomic outlook, noting that the current trajectory could offer some short-term relief in interest rates for consumers and businesses.

Also speaking at the event, Margaret Obimpeh, Head of Affluent Banking at Stanbic, emphasized the branch’s role in serving the growing entrepreneurial and high-net-worth population within the Labone enclave.

“We have a well-defined strategy to attract more high-net-worth individuals in this area, which aligns with our broader vision. Additionally, we’ve seen a rise in SMEs, especially women-led enterprises, and we have tailor-made solutions for entrepreneurs operating here,” she explained.

Over the past two decades, Ghana’s financial services industry has experienced a remarkable transformation with a greater focus on customer-centric innovations and digital expansion.

Stanbic Bank has played a leading role in that shift, continuously investing in infrastructure and services that reflect the dynamic needs of its diverse clientele.

The Labone branch is expected to serve as both a financial hub and a relationship center, reinforcing Stanbic Bank’s reputation as a forward-thinking, customer-focused institution that values both human connection and technological advancement.

Latest Stories

-

Ghana risks dropping to top 10 most expensive countries for air passenger charges

2 seconds -

Ghana and Nigeria unite to tackle Out-of-School Children challenges

39 seconds -

‘NDC has become a clearing agent’ – Haruna Mohammed on party retaining Baba Jamal

13 minutes -

MTN Ghana signs landmark MOU with Thrive & Shine to boost AI literacy and empower youth

26 minutes -

From blurred vision to digital health innovation: Audrey Agbeve builds AI chatbot for hypertension care

37 minutes -

The prodigal artiste: Why Ghanaian musicians need to lawyer up

54 minutes -

Our politics is corrupt; rule by the rich is not democracy

1 hour -

Sesi Technologies launches AI-Powered soil testing services for smallholder farmers

1 hour -

Ghana Chamber of Shipping calls for a 3-month grace period on cargo insurance directive

1 hour -

NACOC to begin licensing for medicinal and industrial cannabis cultivation

2 hours -

It’s easier to move from GH₵100k to GH₵1m than from zero to GH₵100k- Ecobank Development Corporation MD

2 hours -

Between faith and rights: A nuanced strategic view on the debate over an Islamic widow’s political ambition

2 hours -

At least Baba Jamal should have been fined – Vitus Azeem

2 hours -

Gender Minister visits the 31st December Women’s Day Care Centre and the Makola clinic

2 hours -

Ayawaso East NDC primary: Why feed people for votes? Are they your children? – Kofi Kapito

2 hours