Standard Chartered Wealth Management Chief Investment Office (CIO) has released its Outlook 2024 report, outlining its investment strategy for the year ahead.

The US and other major economies are likely to witness sharply slower growth and sliding inflation in 2024.

Equity and bond markets are expected to start 2024 positively, supported by hopes of a soft landing and central bank policy shifting towards supporting growth, but it remains on watch should macro winds shift towards a harder landing.

Against this backdrop, the CIO believes that investing in 2024 is likely to be about balancing the development of the macro scenario and spotting where asset class risk/reward appears attractive.

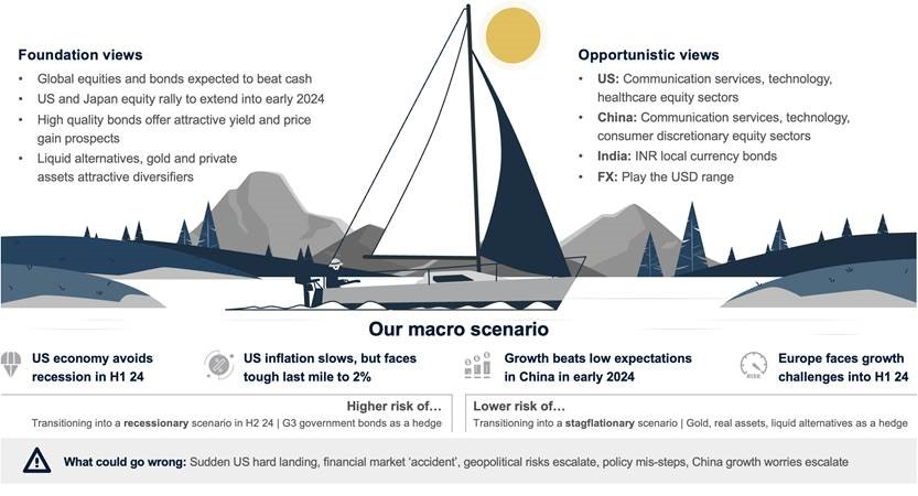

For Foundation allocations – a model that can be used as a starting point for building a diversified investment portfolio – its highest convictions are in (i) high-quality Developed Market government bonds, particularly with longer maturities, (ii) global equities heading into early 2024, led by the US and Japan, and more broadly (iii) global equities and global bonds, which are likely to deliver cash-beating performance.

The team’s Opportunistic allocations look to take advantage of stock and sector dispersion to capture short-term opportunities, with a view to (i) buy communication services, technology and healthcare equity sectors in the US, (ii) buy consumer discretionary, communication services and technology sectors in China, and (iii) play the USD range.

Steve Brice, Global Chief Investment Officer, said that investors should consider their investment objectives, time horizon and most importantly, the ability to weather drawdowns in their portfolio.

“The key to successful investing discipline: don’t be a forced seller, whether it be due to emotional or financial needs, and avoid excessive, permanent losses.

"We hope that our latest outlook report offers investors some important questions to consider, and our take on how they can optimally position their asset allocation as they navigate 2024 amid a high level of uncertainty.”

Latest Stories

-

Paris 2024: Opening ceremony showcases grandiose celebration of French culture and diversity

3 hours -

Spectacular photos from the Paris 2024 opening ceremony

4 hours -

How decline of Indian vultures led to 500,000 human deaths

4 hours -

Paris 2024: Ghana rocks ‘fabulous fugu’ at olympics opening ceremony

4 hours -

Trust Hospital faces financial strain with rising debt levels – Auditor-General’s report

5 hours -

Electrochem lease: Allocate portions of land to Songor people – Resident demand

5 hours -

82 widows receive financial aid from Chayil Foundation

5 hours -

The silent struggles: Female journalists grapple with Ghana’s high cost of living

5 hours -

BoG yet to make any payment to Service Ghana Auto Group

5 hours -

‘Crushed Young’: The Multimedia Group, JL Properties surprise accident victim’s family with fully-furnished apartment

6 hours -

Asante Kotoko needs structure that would outlive any administration – Opoku Nti

6 hours -

JoyNews exposé on Customs officials demanding bribes airs on July 29

7 hours -

JoyNews Impact Maker Awardee ships first consignment of honey from Kwahu Afram Plains

8 hours -

Joint committee under fire over report on salt mining lease granted Electrochem

8 hours -

Life Lounge with Edem Knight-Tay: Don’t be beaten the third time

8 hours