Audio By Carbonatix

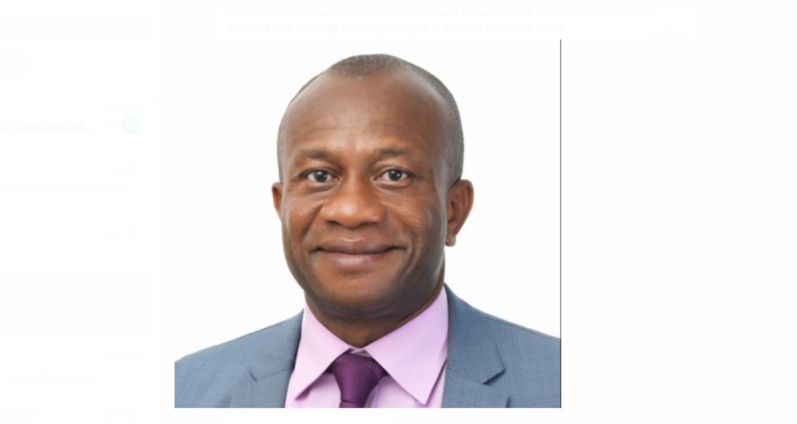

The Chief Executive Officer of the National Pensions Regulatory Authority (NPRA), Christopher Boadi-Mensah, has underscored the importance of a robust and inclusive pension system that caters to both the formal and informal sectors of the economy.

He emphasised the need for innovative micro-pension schemes and digital solutions to expand coverage and ensure financial security for all Ghanaians.

"We need a robust and effective pension system that will be responsible for the welfare of all employees. It is usually targeted at the formal sector, and this is the time to have the self-employed individuals as part of the pensions. We need to increase the coverage through digital solutions to ensure financial security," he said.

He was addressing a pivotal stakeholder engagement that brought together pension managers, fund managers, and custodians to discuss the future of Ghana’s pension sector and ways of restoring confidence in the system.

Mr Boadi-Mensah further acknowledged the challenges posed by economic fluctuations, including inflation and debt restructuring, and called for stronger governance and transparency in fund management.

He stressed the urgency of addressing delays in the payment of benefits and improving employer compliance, noting that trust in the pension system is crucial for its sustainability.

"It is obvious that the economic situation of the country, such as inflation and debt restructuring, has been a challenge for this sector. This has resulted in delays in the payment of benefits, which has reduced trust and employer compliance," Mr Boadi-Mensah stated.

He reaffirmed the Authority’s commitment to a hands-on, collaborative approach to policy implementation and regulatory oversight. Nonetheless, Mr Boadi assured stakeholders that the NPRA would not be a passive regulator but an active partner in driving reforms that benefit both industry players and pension contributors.

"This is not just about policies; it’s about people’s lives. We as stakeholders must work together in building a pension system that guarantees financial dignity in retirement. We must take steps toward a more resilient and inclusive pension framework for Ghana," he said.

Latest Stories

-

See the areas that will be affected by ECG’s planned maintenance this week (Feb 22-28)

11 minutes -

All injured students stable after Swedru clash —GES

24 minutes -

GPL 2025/26: Karela United beat Eleven Wonders 2-0 to maintain unbeaten run

32 minutes -

Crime trends in schools will worsen if preventive systems aren’t modernised —Kofi Tonto

1 hour -

Ghanaian Ismail Akwei named to the Alumni Leadership Council of McCain Global Leaders

1 hour -

Today’s front pages: Monday, February 23, 2025

1 hour -

MTN Group CEO Ralph Mupita ends 3-day tour of Ghana

2 hours -

24-hour economy is doable, but must be premised on effective demand – Oppong Nkrumah

2 hours -

NIB injects GH¢1m into Military Housing Project, plans Burma Camp branch

2 hours -

Police probe violence at Agona Swedru Schools Athletics Games

2 hours -

Funeral of Togbega Kwaku Ayim IV: Ho pays homage to the late Paramount Chief of Ziavi (Photos)

3 hours -

NPP Sweden branch congratulates Bawumia on flagbearer victory for election 2028

3 hours -

CDM demands emergency education fund and transparent deployment framework

3 hours -

Student injured in clash at Agona Swedru District Schools Athletics Games

3 hours -

A Rocha Ghana demands stronger action against galamsey

3 hours