Global oil prices have been steadily climbing throughout the year, currently hovering around $90 per barrel, marking an 18.8 per cent increase since the beginning of the year.

This current surge represents the highest price per barrel since September 28 ($98 per barrel), further fueled by supply cuts from key OPEC+ members like Saudi Arabia and Russia.

Their decision in March to extend oil output cuts into the second quarter of 2024, coupled with geopolitical tensions such as the Israel-Hamas conflict, has contributed to the ongoing rise in oil prices.

For Ghana, a country heavily reliant on oil imports despite being an oil producer, the implications of these rising prices are significant.

President Akufo-Addo has highlighted that Ghana imports about 97 per cent of its petroleum products from foreign sources.

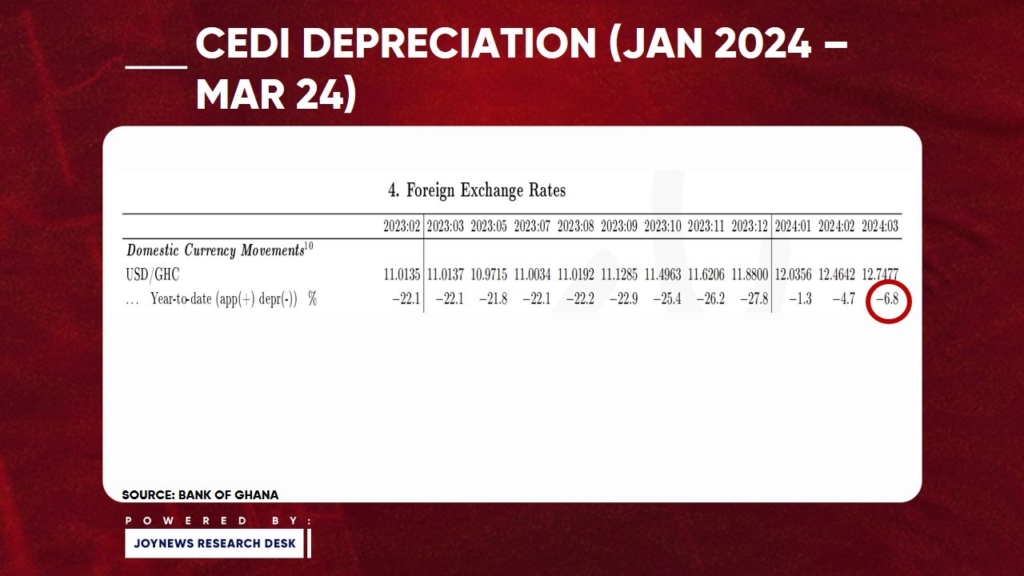

This dependency, combined with the recent depreciation of the cedi by 6.8 per cent against the US dollar from January to March, has led to increased costs for importing petroleum products.

As of April 8, 2024, gasoline and diesel prices at the state-owned fuel station, GOIL, have risen to GHS 13.9 and GHS 14.6 respectively, up from the beginning of the year.

The impact of these rising fuel prices is felt across the economy, with inflation remaining high at 23.2 per cent, putting strain on Ghanaian consumers.

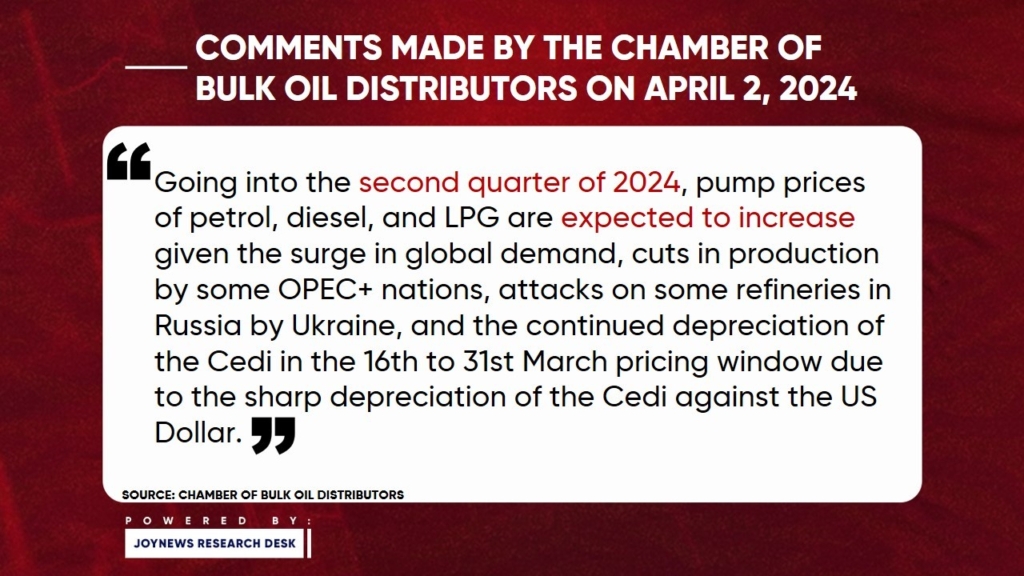

The Chamber of Bulk Oil Distributors has issued a warning of impending fuel price increases at the pumps, further exacerbating the economic challenges faced by the country.

While the government's Gold for Oil program aims to mitigate currency depreciation by purchasing petroleum products directly with gold, its impact remains limited, addressing only 30 per cent of the country's fuel demand (2024 budget).

In response to these challenges, the Bank of Ghana's intervention in ensuring the availability of dollars to bulk distribution companies becomes crucial.

This measure could help alleviate some of the pressure on fuel prices and mitigate the effects of currency depreciation in the coming weeks.

Latest Stories

-

Paris 2024: Opening ceremony showcases grandiose celebration of French culture and diversity

3 hours -

How decline of Indian vultures led to 500,000 human deaths

4 hours -

Paris 2024: Ghana rocks ‘fabulous fugu’ at olympics opening ceremony

4 hours -

Trust Hospital faces financial strain with rising debt levels – Auditor-General’s report

5 hours -

Electrochem lease: Allocate portions of land to Songor people – Resident demand

5 hours -

82 widows receive financial aid from Chayil Foundation

5 hours -

The silent struggles: Female journalists grapple with Ghana’s high cost of living

5 hours -

BoG yet to make any payment to Service Ghana Auto Group

5 hours -

‘Crushed Young’: The Multimedia Group, JL Properties surprise accident victim’s family with fully-furnished apartment

6 hours -

Asante Kotoko needs structure that would outlive any administration – Opoku Nti

6 hours -

JoyNews exposé on Customs officials demanding bribes airs on July 29

7 hours -

JoyNews Impact Maker Awardee ships first consignment of honey from Kwahu Afram Plains

8 hours -

Joint committee under fire over report on salt mining lease granted Electrochem

8 hours -

Life Lounge with Edem Knight-Tay: Don’t be beaten the third time

8 hours -

Pro-NPP group launched to help ‘Break the 8’

8 hours