Audio By Carbonatix

Five Ghanaian Small Medium Enterprises (SME) have received GH₵1 million in financial support as beneficiaries from a pilot phase of SME Growth and Opportunity (GO) programme.

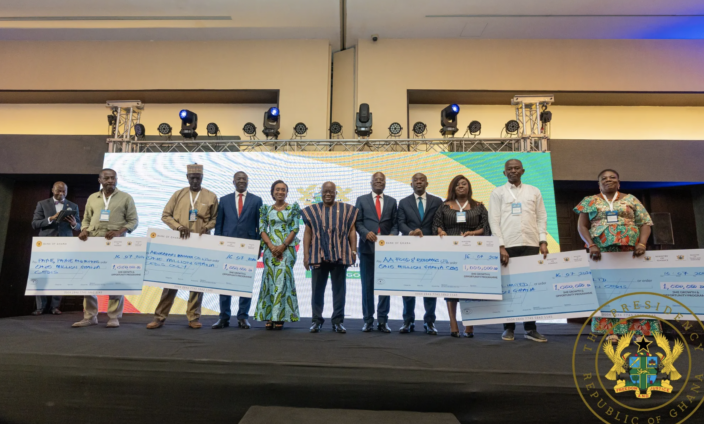

President Nana Addo Dankwa Akufo-Addo presented a dummy cheque to the beneficiaries at the launch of the 8.2 billion intervention programme for SMEs.

They include Tevonwa Limited, a rice processing firm; Tilaa Limited, a honey producer; Abubakar Mahama Limited, a Sheanut processing firm; Payne Payne and Hopkins, a fish processing and packaging firm and AA Food and Beverages Limited, a liquor producer.

The Government, through the Ministry of Finance and the Ministry of Trade and Industry developed the programme with the objective of providing targeted financing solutions and technical assistance to support SME to expand and create jobs.

Speaking during the SME GO summit, which was held under the theme, “Breaking Barriers to SME Growth”, Dr Mohammed Amin Adam, the Minster of Finance, said supporting SMEs was crucial to achieving the growth and development ambition of the country.

He explained that harnessing the potential of homegrown SMEs was a stable way of building a prosperous and competitive economy.

“We must be intentional about providing access to financial resources, expertise, and capacity building programmes that empower them to drive innovation, create jobs, and stimulate economic growth,” he said.

Mr Kobina Tahir Hammond, the Minister of Trade and Industry, commended the Ghana Enterprises Agency (GEA) for providing targeted support to specific demographics through interventions such as the “Business in a Box” project which seeks to equip aspiring entrepreneurs with the requisite tools for their enterprises, YouStart Jobs and Skills, and Cocoa Life Youth.

He said the GEA also facilitated the establishment of over 56,000 new businesses and more than 100,000 new jobs within the SME space from 2017 to 2023.

“From the modest number of 170 when your government assumed the reins of power, the GEA has expanded its Business Advisory Centres (BACs) and Business Resource Centres (BRCs) to 224 which are all placed at the service of the SME sector,” he said.

Dr Ernest Addison, Governor of the Central Bank of Ghana, said the Bank was working to keep inflation in check to allow SMEs to have access to loans with lower interest rates.

“When inflation declines to comfortable levels and interest rates begin to decline, demand and supply for SME loans will pick up and be a key driving force supporting growth,” he said.

He also disclosed that the Bank had commissioned a study in collaboration with the Development Bank of Ghana and the University of Ghana Business School to better understand the constraints of SMEs to formulate targeted policies to ensure growth.

“The objective of the study is among others, to ascertain the economy’s SME credit demand needs, the supply of liquidity by these SME and how fintech can be leveraged to scale up lending by the SMEs,” he said.

The implementing agencies for the SME GO programme are the GEA, Ghana Exim Bank and the Development Bank Ghana/International Finance Corporation.

Latest Stories

-

ECG completes construction of 8 high-tension towers following pylon theft in 2024

14 minutes -

Newsfile to discuss 2026 SONA and present reality this Saturday

22 minutes -

Dr Hilla Limann Technical University records 17% admission surge

29 minutes -

Meetings Africa 2026 closes on a high, Celebrating 20 years of purposeful African connections

34 minutes -

Fuel prices to increase marginally from March 1, driven by crude price surge

46 minutes -

Drum artiste Aduberks holds maiden concert in Ghana

1 hour -

UCC to honour Vice President with distinguished fellow award

1 hour -

Full text: Mahama’s State of the Nation Address

2 hours -

Accra Mayor halts Makola No. 2 rent increment pending negotiations with facility managers

2 hours -

SoulGroup Spirit Sound drops Ghana medley to honour gospel legends

2 hours -

ECG reinforces ‘Operation Keep Light On’ in Ashanti Region

2 hours -

UK remains preferred study destination for Ghanaians – British Council

2 hours -

Ghana Medical Trust Fund: Maame Samma Peprah ignites chain of giving through ‘Kyerɛ Wo Dɔ Drive’

2 hours -

A new children’s book celebrates Ghanaian culture and early literacy through food storytelling

2 hours -

Right To Play deepens fight against child labour through MLMR and MRMF projects

2 hours