Audio By Carbonatix

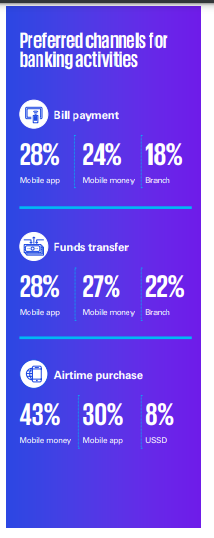

Mobile money stands out as the predominant channel in Ghana’s payment landscape, with 66% of respondents reporting weekly usage, the 2023 KPMG West Africa Banking Industry Customer Survey has disclosed.

Despite a substantial move towards digital channels, the country remains predominantly a cash-based economy.

The ease of transferring money between accounts and mobile wallets, the report said, emerged as the most important experience metric for retail customers.

Notably, certain banks refrain from imposing fees on their customers for transferring funds between their mobile money wallet and bank account, fostering convenience. Additionally, there was an uptick in customers utilising financial technology platforms.

Sixteen percent of respondents indicated using fintech platforms weekly, up from 10.0% in 2022.

Fifty three percent of respondents reported using their bank’s mobile app at least once a week, a 3-percentage point increase from last year.

The USSD platform’s penetration also continued its upward trajectory, evidenced by a growth in weekly customer usage. Presently, 28% of respondents use their bank’s USSD platform weekly.

Despite a substantial move towards digital channels, Ghana remains predominantly a cash-based economy.

A significant 32.0% of respondents indicated weekly Automated Teller Machine (ATM) usage, emphasising the importance of 24/7 cash availability at these machines which ranks as the second most crucial metric for retail respondents.

The report also stated that with 36% of respondents favouring the ATM for cash withdrawals and 22% preferring mobile money, the cultural preference for cash persists due to its perceived security and widespread acceptance, particularly in traditional markets and informal sectors.

“Despite advancements in digital security, there persists a prevailing mistrust and reluctance toward the security of digital platforms”, it added.

In summary, the report said the ongoing journey of digital adoption is gaining momentum, albeit moderately. Thus, the Ghanaian payment sphere presents a fertile ground, ripe with opportunities for substantial disruption and transformative change.

Latest Stories

-

Securing children’s tomorrow today: Ghana launches revised ECCD policy

2 hours -

Protestors picket Interior Ministry, demand crackdown on galamsey networks

2 hours -

Labour Minister highlights Zoomlion’s role in gov’t’s 24-hour economy drive

2 hours -

Interior Minister receives Gbenyiri Mediation report to resolve Lobi-Gonja conflict

2 hours -

GTA, UNESCO deepen ties to leverage culture and AI for tourism growth

2 hours -

ECG completes construction of 8 high-tension towers following pylon theft in 2024

3 hours -

Newsfile to discuss 2026 SONA and present reality this Saturday

3 hours -

Dr Hilla Limann Technical University records 17% admission surge

3 hours -

Meetings Africa 2026 closes on a high, Celebrating 20 years of purposeful African connections

3 hours -

Fuel prices to increase marginally from March 1, driven by crude price surge

3 hours -

Drum artiste Aduberks holds maiden concert in Ghana

4 hours -

UCC to honour Vice President with distinguished fellow award

4 hours -

Full text: Mahama’s State of the Nation Address

4 hours -

Accra Mayor halts Makola No. 2 rent increment pending negotiations with facility managers

4 hours -

SoulGroup Spirit Sound drops Ghana medley to honour gospel legends

4 hours