Audio By Carbonatix

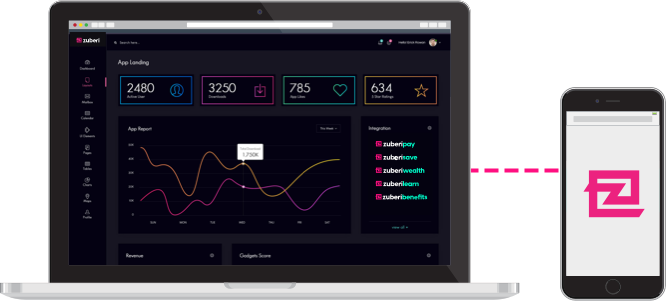

A London/Accra-based startup Zuberi is partnering with Ghanaian companies to offer all-in-one employee benefits through their app.

The app is set to go live in July 2020, after a successful private-beta test earlier in the year.

The app’s core product is a salary streaming feature which allows workers access to up to 50% of their salary on a daily basis after they have worked.

This provides an alternative option to quick high-interest loans which employees often are further burdened by given the often-disadvantageous terms and conditions that come with it.

The Founders shared their excitement having been able to build a sustainable model that has no interest rates or penalty fees for its users.

Zuberi, Co-Founded by Julian Owusu, has already signed on 9 companies ahead of their launch in Accra & Kumasi, Ghana targeting 4,000 employees.

She says, “Zuberi wants to establish a relationship between employers and financial wellness amongst workers in Africa. Employees we have tested the app with have seen an instant improvement in their financial wellness as they now have the ability to react quickly to unplanned events.

From a company’s perspective, there is no change to their internal payroll process, and it's free, so companies have been very warm to the concept.

So far, the average transaction value is around ¢300, but sometimes people take out between ¢50–¢500 because they need it for an emergency at that moment".

Julian Owusu added, “As African’s on and off the continent we are always talking about improving our economy and improving the lives of our people. This is primarily done in organisations/institutions, but we have noticed that it is rare for a company to have a financial wellness strategy for making sure that the people who are on the ground every day building their businesses are not suffering from anxiety or financial stress.

What we are building here at Zuberi is a suite of strong employee benefits that have an instant impact on workers' personal cash-flow. It’s something we will continue to iterate and improve over time as we understand people’s needs more”.

The team of five has already raised a pre-seed investment which has enabled them to build and test the product and is now raising further funds to scale the solution.

So far, organisations have seen the benefits of offering the app to their employees. Bennett Antwi, the Financial Director at Zuberi mentions in his interactions with companies:

During initial conversations, companies have struggled to believe that it is not a traditional loan. Zuberi is 6 times cheaper than most instant loans and Zuberi takes the risk off the employers".

Latest Stories

-

Police arrest suspect in murder of Officer at Zebilla

41 seconds -

SUSEC–Abesim and Adomako–Watchman roads set for upgrade in Sunyani

30 minutes -

CDD-Ghana calls for national debate on campaign financing

1 hour -

INTERPOL’s decision on Ofori-Atta: What it means for his U.S. bond hearing and the legal road ahead

1 hour -

Parties can use filing fees to cover delegates’ costs, end vote-buying – Barker-Vormawor

1 hour -

Boxing in Bukom: Five months without the bell

1 hour -

Political parties can end vote-buying by disqualifying offenders – Barker-Vormawor

2 hours -

Ministry of Gender investigates alleged sharing of intimate videos by foreign national

2 hours -

Cocoa must be treated as business, not politics- Nana Aduna II

2 hours -

Barker-Vormawor urges scrutiny of COCOBOD reforms, warns of continued debt burden

3 hours -

Prince Adu-Owusu: Beyond flowers and grand gestures — How do you want to be loved?

3 hours -

Multiple vehicles burnt as fuel tanker explodes on Nsawam-Accra highway

3 hours -

Former COCOBOD administration spent syndicated loans on themselves, not farmers – Inusah Fuseini

3 hours -

Mahama vows to end export of raw mineral ores by 2030, shifts focus to local processing

4 hours -

Mahama meets UN Chief, discusses African security & democracy.

4 hours