Audio By Carbonatix

Some commercial banks are raising concerns about the Bank of Ghana’s directive regarding the abolishment of the Over-the-Counter withdrawal charge.

The Central Bank recently issued a notice to banks and specialized deposit-taking institutions to abolish what it calls unfair fees, charges and other practices in the banking sector.

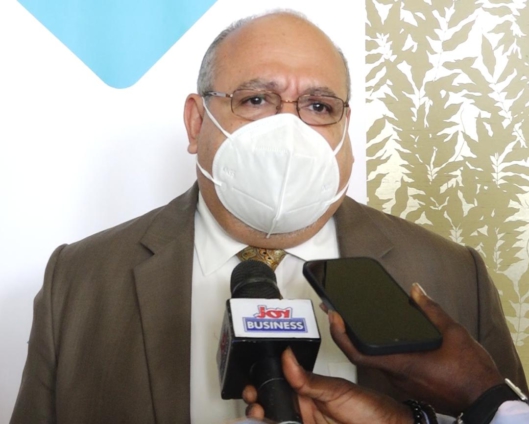

But in an interview with Joy Business at a Digital Conference organised by his outfit, Managing Director of Republic Bank Ghana, Farid Antar said the over the counter withdrawal charge was meant to serve as disincentive for customers to use the ATMs.

“The one that may be a little bit problematic for the banks is that we charge a fee for customers coming into the bank to withdraw cash when they have an avenue external to the bank so it’s not so much of a fee but a disincentive to change your behavior to use electronic which is the ultimate goal” said Mr. Antar.

History

The over-the-counter withdrawal fee is one of seven charges the central bank has warned commercial banks to do away with.

The Bank of Ghana noted that some banks and specialized deposit-taking institutions impose penal charges on customers who withdraw their own funds from banking halls and the reason the Republic Bank MD attributed to the practice was to encourage customers to use digital platforms provided to reduce congestion at the banking halls.

Digital Conference

The digital conference jointly organized by the bank and the Business and Financial Times was themed: digitization, artificial intelligence and the future of things; the impact and immense opportunities for Ghanaian Businesses.

Mr. Antar has underscored the need for Ghanaian businesses to take advantage of the opportunities provided by the African Continental Free Trade Area (AfCFTA) through the adoption of technology to expand their operations.

According to him, local businesses must begin to look beyond the country and network with other countries across the continent to reach a larger market.

The conference offered insight into how stakeholders, particularly business owners and their financiers could harness the recent gains from increased digitisation.

Latest Stories

-

Keta Municipal Assembly intensifies community clean-up exercise with strong public participation

11 seconds -

Voting in The Hague: Chemical weapons and principles

7 minutes -

Ghana AIDS Commission to distribute condoms nationwide on February 13 ahead of Val’s Day

11 minutes -

MOFFA shuts down Winneba, Cape Coast and Abura-Dunkwa Hospital morgues over safety breaches

17 minutes -

95% of family businesses fail before the third generation – IFC urges governance reforms

20 minutes -

Foreign Affairs Ministry, Nuclear Power Ghana deepen cooperation on energy diplomacy

28 minutes -

Ashanti RCC tightens rules on mining area levies following ‘galamsey tax’ exposé

42 minutes -

GES marks International Day for Women and Girls in Science with call to close gender gap

45 minutes -

Diplomatic community applauds Ghana’s economic turnaround

1 hour -

UG graduates 153 PhDs as over 15,000 students receive degrees

1 hour -

Africa’s mineral wealth must no longer be a paradox without prosperity , says Prof. Denton as UN body releases new Report

1 hour -

Woman killed on church premises at Twifo Denyase

1 hour -

2 arrested over alleged gang rape of Osino SHS student – Dept. Education Minister

2 hours -

Haruna Iddrisu, Mohammed Sukparu survive road crash on Bolgatanga-Tumu Road

2 hours -

#RoadOfPeril: Residents, commuters demand gov’t action on Kwabenya-Berekuso-Kitase road

2 hours