Audio By Carbonatix

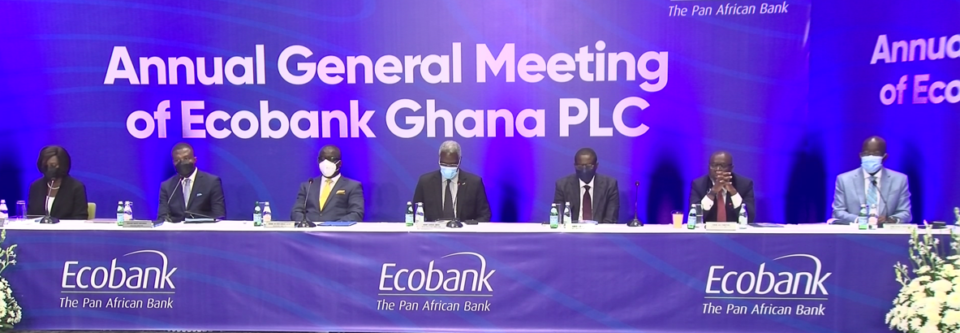

Shareholders of Ecobank Ghana have approved GH¢0.62 per share dividend for the 2021 financial year, at the bank’s Annual General Meeting [AGM]today [6/10/2022].

The bank recorded a profit before tax of GH¢894 million, representing a growth of 14 percent. Total revenue also went up by 10 percent to GH¢2 billion.

Speaking at the AGM through a virtual platform, the outgoing Board Chair of the bank, Terence Darko attributed the good financial performance of the bank to its primary role of focusing on customer service.

He stated that the foresight of the board, management and staff of the bank reflected in its financial performance for 2021.

“The growth was mainly driven by 13 a percent increase in Net Interest Income and 24 percent rise in Net fees and Commission”, he said, adding that “Net trading income was down by 18 percent due to margin compressions”.

Mr. Darko explained that the Net interest income contributed 75 percent of the bank’s total revenue with Non-interstet income accounting for the remaining 25 percent.

“Our cost to income ratio of 46.2 percent was a reduction from the previous year’s of 47.9 percent” he added.

Looking ahead, Managing Director the bank, Dan Sackey stated that Ecobank’s execution momentum will see more acceleration in 2022.

According to him, the bank will leverage the momentum built in 2021 and continue to deliver on its mandate in 2022.

“We started 2022 well, with the same hope, fortitude and drive that we usually muster to usher in a New Year. We have clearly formulated our goals and have the means and capacity to meet them”, he assured.

He however stressed that the bank will not lose sight of the current global happenings to avert any shocks on its operations.

“It is important that our plans be set in the proper context of a global economy which has entered a period of profound uncertainty and fragility as the Bank of Ghana puts it”, he maintained.

Latest Stories

-

ICE confirmed Ken Ofori-Atta was medically fit for detention – Victor Smith

2 hours -

‘He shut the door in our faces’ – Ghana’s envoy reacts to Ken Ofori-Atta decision

2 hours -

FBI involvement raises stakes in Ken Ofori-Atta detention – Ghana’s US Envoy

5 hours -

‘Miracle baby’ born in a tree above Mozambique floodwaters dies aged 25

5 hours -

After years of losses, BoG tightens controls and slashes fees in Gold Programme overhaul

6 hours -

Minnesota sues Trump administration to block surge of ICE agents

6 hours -

Trump to meet Venezuelan opposition leader Machado at the White House

6 hours -

Trump announces 25% tariff on countries doing business with Iran

6 hours -

How BoG’s gold strategy quietly pulled in $17bn and held the economy together

7 hours -

Ghana Water targets the end of January 2026 to resolve Teshie water crises

7 hours -

All UG students who overpaid fees will be refunded – Deputy Education Minister

7 hours -

Majeed Ashimeru set for La Louvière loan switch from Anderlecht

8 hours -

NPP flagbearer race: Any coercion in primaries will be resisted – Bryan Acheampong campaign team

8 hours -

‘Infection spread’ feared: Teshie water crisis triggers healthcare emergency

8 hours -

AratheJay turns ‘Nimo Live’ into defining homecoming moment

9 hours