Audio By Carbonatix

Auditing firm, Deloitte is advising government to reduce its reliance on the international capital market and switch towards concessionary loans to reduce the countries growing debt stock.

Data from the Bank of Ghana puts the country’s total debt stock at ¢393.4 billion in June 2022.

Assessing the 2022 Mid-Year Budget in its latest report, Deloitte maintained that it is time for government to take some drastic measures to control the debt stock.

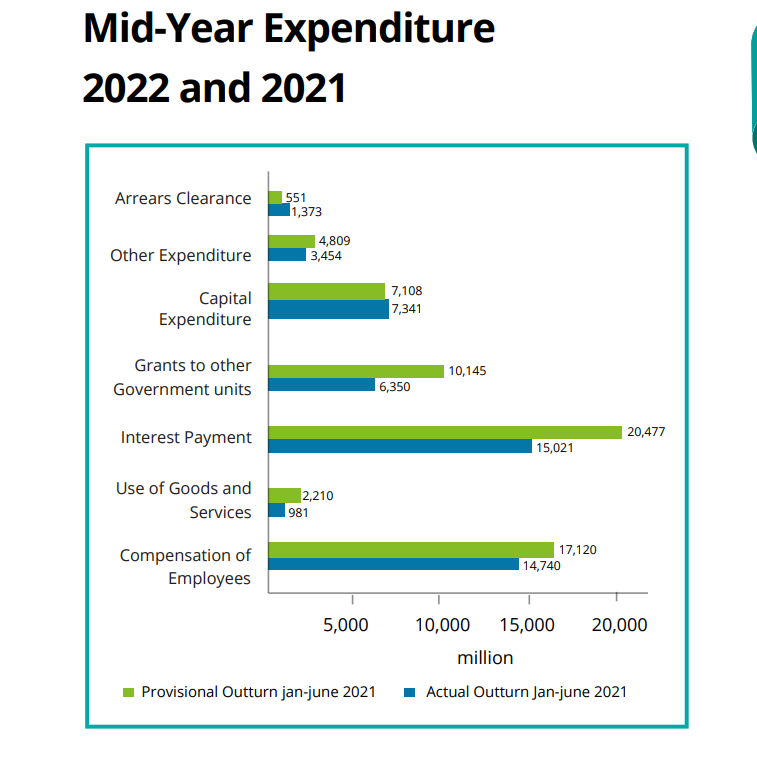

According to the report, even though government was able to maintain all expenditure items within the budget, government however paid high interest rates on Ghana’s loans due to the depreciation of the cedi against major trading currencies as well as higher cost of borrowing in the domestic market.

The report recommended that “government should consider reducing its reliance on the international capital markets and switch more towards concessionary loans in order to contain the rising interest expense”.

Additionally, the auditing firm proposed that “funds borrowed from the international capital markets should be invested more in capital projects with the ability to boost foreign exchange earnings and increase foreign exchange reserves”.

This, Deloitte says will help absorb some of the foreign exchange shocks accounting for the increase in interest expense.

The report also pointed out that the need for fiscal consolidation coupled with prudent spending is key to restoring macro-economic stability and growth prospects in the medium to long term, hence government must direct its expenditure the sectors of the economy that will help create jobs.

Latest Stories

-

Salah-Mane rivalry renewed in AFCON semi-finals

5 hours -

What does Trump’s foreign policy mean for World Cup?

5 hours -

Carrick confirmed as Man Utd caretaker head coach

5 hours -

CPS & JoyNews to hold public lecture on Ghana’s move to back currency with gold

6 hours -

Africa Education Watch supports calls for review of SHS teachers’ manual, curricula over gender controversy

6 hours -

Ntim Fordjour demands review of SHS teachers’ manual over gender controversy

6 hours -

GCB Bank hands over renovated dormitory to TAMASCO

6 hours -

Nkyinkyim Band to headline Ghana Independence celebration in London

6 hours -

NPP leadership has lost touch with grassroot – Dr Nyaho-Tamekloe

7 hours -

IGP’s Team nabs drug suspects in Tamale swoop; seizes cash, narcotics

7 hours -

NaCCA revises teacher manual, withdraws ‘gender definition’ content deemed contrary to Ghanaian values

7 hours -

Ntim Fordjour condemns gov’t over gender definition in curriculum

7 hours -

NPP must develop thick skin for criticism – Dr Asah-Asante

7 hours -

Auditor-General raises alarm over 2,000+ weapon interceptions at airports

8 hours -

Motorists lament years of faulty traffic lights at Poku Transport Junction

8 hours