A Tax Consultant, Francis Timore Boi has urged government to use the 2023 Budget to pursue a policy that will centralize the collection of property tax and empower the Ghana Revenue Authority (GRA) to collect the levy on behalf of government.

He stated that property tax is one of the surest ways government can improve revenue collection without introducing new taxes.

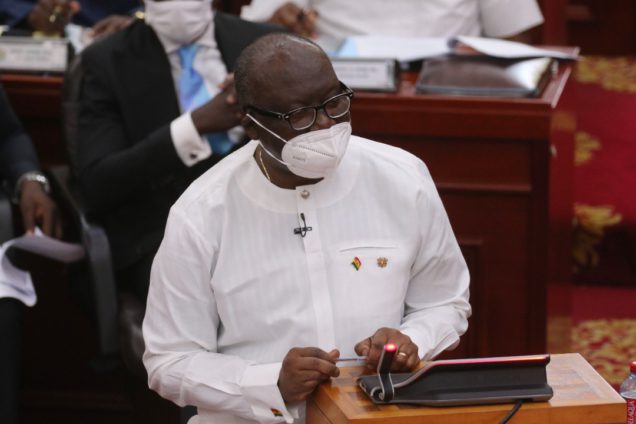

Speaking to Joy Business on his expectations ahead of the 2023 Budget Presentation, Timore Boi proposed that the collection of property tax should be handed over to the GRA since the assemblies have proved incapable of doing it.

“Property tax has been on the table for a very long time. When are we going to see proper measures put in place, possibly if we have to take the Property Taxation from the local assemblies and possibly centralize it and give it the GRA as another tax type, maybe the GRA will do better”, he expressed optimism.

Mr. Timore Boi is of the view that the GRA has the capacity to value properties and assign the right taxes to them to help increase revenue.

Citing developed countries as good examples, he pointed out that property owners should have the ability to pay the state since properties are expected to be protected by the state.

He added that such a policy will help government estimate proceeds from property tax accurately.

Mr. Timore Boi also maintained that such a tax handle will not be rejected by the populace since valuation will determine the rate.

Latest Stories

-

Trade Minister promotes Ghana’s industrialisation agenda to US investors

7 mins -

COCOBOD intensifies crackdown on cocoa smuggling syndicates

14 mins -

Ejisu By-election: Don’t condemn EC officials before content of ‘bribe’ envelope is established- Dr Serebour Quaicoe

44 mins -

Ghana’s first Kente Culture Story Documentary Film takes centre stage abroad

49 mins -

10 AI tools to enhance your school, personal or work life

1 hour -

WAEC reacts to private schools’ threat to boycott BECE, WASSCE over exorbitant charges

1 hour -

Reception given Bawumia in the Eastern region depicts victory – Jeff Konadu

1 hour -

GPL: ‘Going to Manhyia was good for the team’ – Ogum on Kotoko’s rejuvenated form

2 hours -

Ejisu by-election: NPP MP for Kwadaso, Kingsley Nyarko fingered in alleged electoral malpractice

2 hours -

Court instructs Anas to testify in person unmasked against Nyantakyi or case will be dismissed

2 hours -

Ghana takes on 7 other countries in a battle for best indigenous cuisine in Africa

2 hours -

Seidu Rafiwu finishes four-day walk-a-thon from Techiman to Accra

3 hours -

NPA increases price floor for petrol to GH¢13.63; diesel unchanged at GH¢13.07

3 hours -

How I lost my ring on my wedding day

3 hours -

Ejisu by-election: EC withdraws 2 temporary staff over suspected bribery caught on camera

3 hours