Audio By Carbonatix

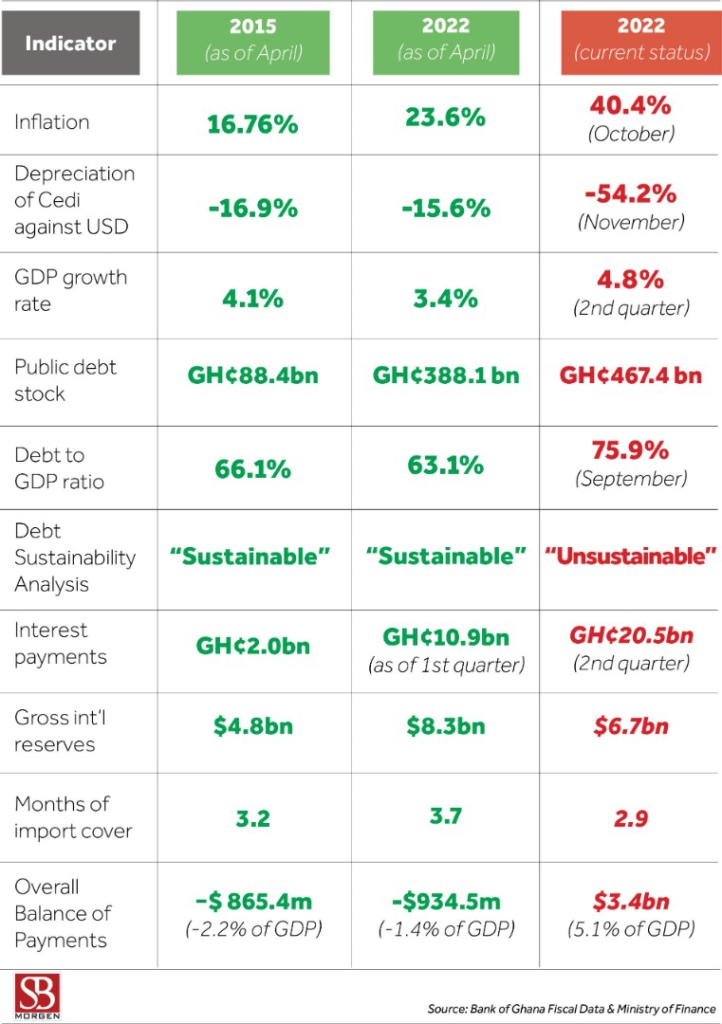

While delivering the much anticipated 2023 budget, Ghana’s Finance Minister, Ken Ofori-Atta, unmasked the nature of Ghana’s debt portfolio, saying the country is finding it difficult to carry a debt burden worth $48.9 billion as of September 2022.

Debt restructuring is the only gateway to access the projected $3 billion IMF bailout package. Barely five days after Ofori-Atta confirmed the debt operation exercise, international credit rating agency Moody’s dropped Ghana’s long-term sovereign bonds ratings.

On 4 December 2022, the government finally announced a debt operation exercise called “Domestic Debt Exchange”, which outlined the nature of debt restructuring for domestic creditors. The Finance Minister indicated that domestic bondholders would be asked to exchange their instruments for new ones under the programme. However, the impact of the domestic debt exchange on investors holding government bonds, particularly small investors, individuals, and other vulnerable groups, will be minimised; hence treasury bill holders will be paid the full value of their investments on maturity.

20 years after Ghana received a total relief of approximately US$3.7 billion, equivalent to US$ 2.2 billion in Net Present Value terms, from all its creditors, it is back in the IMF ‘programmes market’ hoping to shop for another bailout packet worth $3 billion. According to the fund, “in cases where a country’s debt is assessed as unsustainable, the IMF is precluded from providing financing unless the member takes steps to restore debt sustainability, including by seeking a debt restructuring from its creditors.” Like the country’s 16th IMF programme in 2015, the government has decided to freeze public-sector employment next year to reduce expenditure. The monetary policy rate has also been hiked from 24.5% to a record 27% to deal with the over 40% inflation rate.

As Ghana walks the path to its 17th IMF bailout, precipitated by a debt sustainability problem, the country will experience the immediate impact, such as losses to investors, shaking of the financial industry, potential bank collapses and stifling of production due to how expensive it will be to procure financing. Added to these is the long-term effect of losing confidence in the Ghanaian government’s security. It will be hard for a government that has defaulted on domestic debt in the currency it prints to convince investors to buy its securities in international currencies that it does not control. This will take at least a decade to restore.

Latest Stories

-

Minority raises alarm over commodity dependence and cocoa sector crisis

30 seconds -

MPs trade blame over Burkina Faso terrorist attack that killed 8 Ghanaian traders

43 seconds -

Minority warns against ‘artificial stability’ in assessment of Mahama administration

5 minutes -

Daily Insight for CEOs: Leading with Consistency and Credibility

12 minutes -

An injury to one is an injury to all – TUC Chairman slams COCOBOD pay cuts

20 minutes -

A Modern Blueprint to end Ghana’s “No Bed Syndrome”: A Systems Approach for a new era of emergency care

29 minutes -

Minority questions 24-hour economy and job creation claims

34 minutes -

US Supreme Court rules that Trump’s sweeping emergency tariffs are illegal

37 minutes -

Symphonic Music releases ‘King of Kings’ EP

39 minutes -

Developing Ghana’s steel base will power infrastructure and jobs – Mahama

49 minutes -

Trump directs US government to prepare release of files on aliens and UFOs

53 minutes -

Apam-Mankessim Highway blocked after fuel tanker accident

54 minutes -

24-Hour Economy, a major boost for private sector—GUTA President

60 minutes -

Ghana’s housing challenge: A Historical, structural, and policy perspective

1 hour -

GIPC CEO calls for strategic investment in coconut value chain

1 hour