Audio By Carbonatix

Pakistani ministers can no longer fly business class or stay in five-star hotels abroad. And the government thanks them for taking salary cuts.

The South Asian nation fighting to stay solvent and avoid a debt default has unveiled $764 million of cost-cutting measures needed to help revive a $6.5 billion of International Monetary Fund bailout.

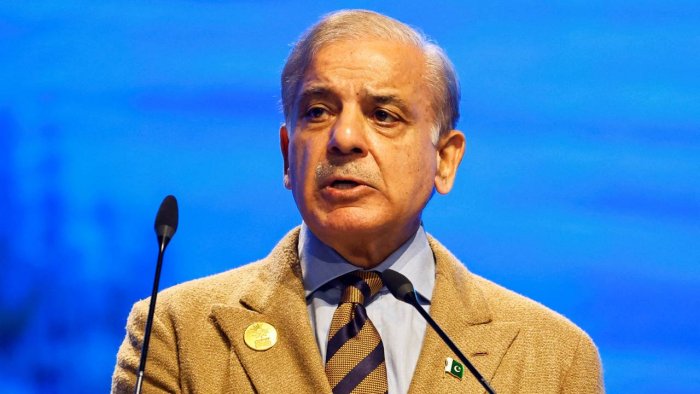

The government will follow up with further austerity measures in the next budget in July, Prime Minister Shehbaz Sharif said Wednesday.

"This is need of the hour," he said after a cabinet meeting in Islamabad. "We have to show what the time demands from us and that's austerity, simplicity and sacrifice."

The world's fifth most populous country has descended dangerously close to a debt default in recent months.

The $350-billion economy, with just $3 billion of foreign-exchange reserves by one estimate, also faces a dollar squeeze that tests its external stability.

Supply disruptions caused by flooding, food shortages and steps the government took to meet IMF's preconditions for the rescue may push inflation above 30% for the first time on record, according to Bloomberg Economics.

As common people come out on streets to protest crippling conditions, the government is trying to show austerity begins at the highest levels.

Several federal and state ministers besides high-ranking government officials have volunteered to forgo salaries and perks, Sharif said. The government has also banned the purchase of luxury items and cars until next year, he added.

Parliament this week voted to roll out tax increases including higher levies on luxury imports. The government had raised energy prices and let the currency weaken after the IMF called on the nation to scrap subsidies and enable a market-determined exchange rate.

Meanwhile, the State Bank of Pakistan has raised the benchmark rate by 725 basis points since the start of 2022 and signaled more monetary tightening is coming. SBP will hold its next policy review on March 16.

Pakistan faces $542.5 million of coupon repayments this year, according to data compiled by Bloomberg. In all, the country has $8 billion in dollar bonds debt due by 2051 with the next payment of $1 billion due in April next year. Most of the nation's external debt of about $100 billion is sourced from concessional multilateral and bilateral sources.

Latest Stories

-

GH¢30bn Big Push Programme to strengthen Ghana’s infrastructure in 2026 – EM Advisory

25 seconds -

Services sector to drive Ghana’s baseline 4.8% growth in 2026 – EM Advisory

1 minute -

Education Minister appeals for end to university staff strike, confirms partial payment of arrears

4 minutes -

British International Investment reinforces commitment to Ghana’s private sector with high‑level leadership visit

7 minutes -

Major General Joseph Narh Adinkrah

17 minutes -

Ghana eyes 4.8% GDP growth in 2026 amid commodity gains and fiscal discipline – EM Advisory

20 minutes -

GRIDCO serves notice of a load redistribution exercise in parts of Volta region

22 minutes -

Tourism and Creative Arts could boost Ghana’s 2026 growth – EM Advisory projects

23 minutes -

Food insecurity rises to 38.1%; 12.5m Ghanaians struggle to access food—GSS

26 minutes -

Mahama opens 66th WACS Conference, calls for stronger surgical capacity in West Africa

26 minutes -

ECG steps up infrastructure investment to deliver reliable power nationwide

27 minutes -

Daily Insight for CEOs: Setting clear performance expectations

30 minutes -

Mothers wrap cleft-lipped babies in polythene to avoid stigma – National Cleft care

42 minutes -

No drumming or dancing at airports without approval – GACL warns

45 minutes -

Tema Central NDC executives lock up NHIS office over alleged exclusionary appointments

54 minutes