Audio By Carbonatix

The Ghana National Chamber of Commerce and Industry (GNCCI) is warning businesses will be forced to flee the country due to the unbearable tax environment.

This warning follows the passage of three controversial taxes into law by parliament last Friday.

The taxes namely; the Income Tax Amendment Bill, the Excise Duty Amendment Bill, and the Growth and Sustainability Amendment Bill are expected to generate about GH¢4 billion annually.

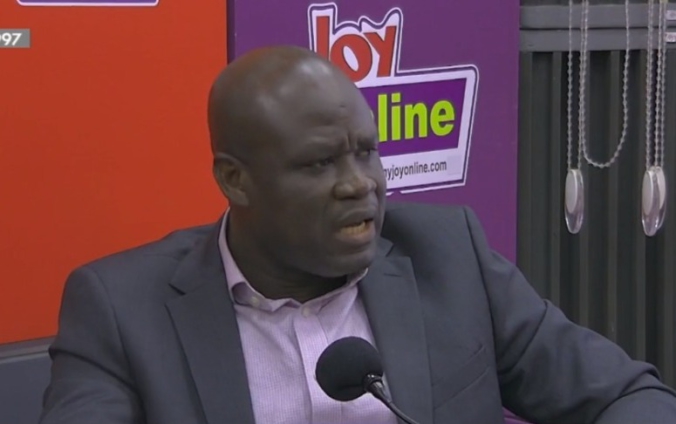

Speaking on JoyNews’ AM Show on Monday, Chief Executive of GNCCI, Mark Badu-Aboagye said businesses will leave the country due to the continuously growing tax burden.

According to him, the businesses will settle in countries that have a conducive environment for their businesses to thrive.

He stated that the passage of the taxes will result in the collapse of businesses and downsizing in some cases.

“Businesses that will not be able to survive here [Ghana] will relocate to other countries and we have seen some of them relocating. Some of them are closing down and going to the neighbouring countries because the business environment is conducive. You are losing taxes on those people that you want to get revenue from,” he pointed out.

Mr Badu-Aboagye also doubted the government's capability to realise the earmarked four billion cedis from these taxes, arguing that there will also be a high incidence of tax avoidance.

“The incidence of these taxes is on businesses and the incidence of these taxes is on consumers of products of the businesses. Now, while the taxes that they have passed, businesses are supposed to pay and as I have said earlier, you can only tax me when I make profit … if I don’t make profit how do you tax me?” he questioned.

In a related development, the Ghana Union of Traders Association (GUTA) has also reacted furiously to the passage of the taxes, insisting Parliament has failed Ghanaians.

This the PRO of GUTA, Joseph Padi explained, is because the timing for the passage of the three taxes is bad.

“In fact, Parliament has failed us, we thought they were working for us rather they were working for themselves,” he said.

According to him, the money sought by the country from the International Monetary Fund was obtained during the Covid period, and if the requested fund is the only way and must be generated internally, there are other options.

He proposed that “the leakages in the system should be closed” rather than introducing new taxes.

Latest Stories

-

JUSAG declares strike on January 19 over unpaid salary arrears

45 minutes -

Anderlecht and QPR join race for Jalal Abdullai after impressive Molde loan spell

47 minutes -

I am confident there won’t be a rerun in Kpandai—Haruna Mohammed

51 minutes -

NPP should’ve invited Prof Frimpong-Boateng for a chat over ‘fake party’ comment – Nyaho-Tamakloe

1 hour -

Ghana Publishing Company in strong financial shape after 10 months – Managing Director

1 hour -

Many NPP members share Frimpong-Boateng’s views; NPP should prepare to expel them too – Dr Nyaho-Tamekloe

1 hour -

I’m not leaving – Prof. Frimpong-Boateng defies NPP expulsion threats

1 hour -

If you know you have misused public funds, be prepared to return it – Asiedu Nketia

1 hour -

Police arrest three over taxi phone-snatching syndicate

1 hour -

NPP’s move against Frimpong-Boateng raises fairness concerns – Asah-Asante

2 hours -

I’m not leaving NPP; the fake people should rather go – Prof. Frimpong-Boateng

2 hours -

‘We have met Pontius Pilate’ – Judge declines state’s bid to drop Abu Trica co-accused charges

2 hours -

Who said Ofori-Atta was picked up from an ICU bed? – Frank Davies questions ‘medically fit’ claim

2 hours -

We’ll win the Kpandai re-run—Tanko-Computer

2 hours -

Ghana facing acute teacher shortage as 30,000 classrooms left without teachers – Eduwatch

2 hours