Audio By Carbonatix

The Chief Executive of the Ghana National Chamber of Commerce (GNCCI) says government must not overburden the private sector in its bid to secure an International Monetary Fund (IMF) bailout.

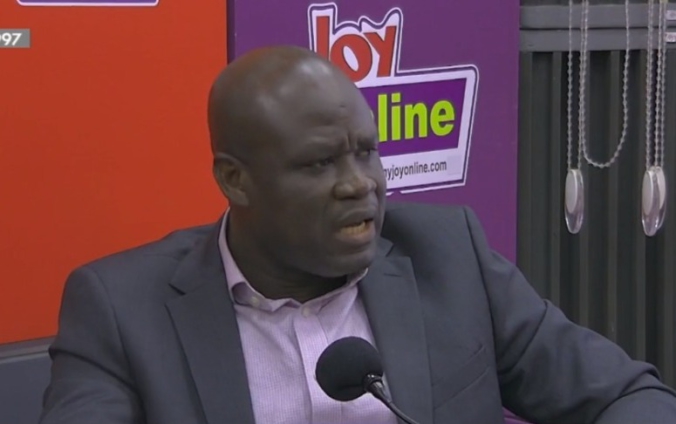

Speaking in an interview on Joy FMs Top Story on Tuesday, Mr Mark Badu-Aboakye suggested that government reduces its expenditure instead of introducing new taxes.

He added that “when you [government] help the businesses to grow and you don’t overburden them at the production level and they grow and excel and they make a lot of revenue, you will get a lot of money from corporate tax.”

“You [Government] don’t have to overburden the private sector to get your revenue and ask us to tighten our belt,” he said.

The CEO of GNCCI stated that the International Monetary Fund will not be pleased if, after giving Ghana the fund, the country's businesses collapse.

He, therefore, urged the government to build and empower the private sector.

His comments come in the wake of Parliament's passing of new revenue measures after reports indicating that the country cannot make progress with the IMF without the revenue measures.

Reacting to this, he said the IMF did not specifically make such a comment but recommended for the revenue measures be enhanced.

According to him, in enhancing the revenue stream, government ought to improve the efficiency of the collection of taxes and ensure compliance.

This, according to him will rake in more revenue than the projected GHȼ4 billion to be accrued from the new revenue measures.

“In Ghana, research has shown that those who are supposed to pay taxes are about 13 million people and less than 5 million are paying. If we rope in all those who are supposed to pay and everyone will be paying, we will get the money that the government is looking for, instead of piling taxes day in and out on the few businesses and individuals they can identify.”

According to him, the approach of pilling taxes on businesses is “a lazy way of getting the revenue.”

Mr Badu urged government to abolish tax exemptions, adding that a lot of revenue will come from that action.

He also called on the government to engage taxpayers on the revenue measures for consensus building.

Latest Stories

-

Bawumia calls for NPP unity ahead of 2028 elections

3 minutes -

Fifi Kwetey brands calls for Mahama third term as ‘sycophancy’

14 minutes -

‘Ghana’s democracy must never be sacrificed for short-term politics’ – Bawumia

18 minutes -

Bawumia congratulates Mahama but warns he “cannot afford to fail Ghanaians”

19 minutes -

Ebo Noah arrested over failed Christmas apocalypse and public panic

1 hour -

CICM backs BoG’s microfinance sector reform programme; New Year Debt Recovery School comes off January-February 2026

1 hour -

GIPC Boss urges diaspora to invest remittances into productive ventures

2 hours -

Cedi ends 2025 as 4th best performing currency in Africa

2 hours -

Obaapa Fatimah Amoadu Foundation launches in Mankessim as 55 artisans graduate

2 hours -

Behold Thy Mother Foundation celebrates Christmas with aged mothers in Assin Manso

3 hours -

GHIMA reaffirms commitment to secured healthcare data

3 hours -

John Boadu pays courtesy call on former President Kufuor, seeks guidance on NPP revival

3 hours -

Emissions Levy had no impact on air pollution, research reveals

4 hours -

DSTV enhanced packages stay in force as subscriptions rise following price adjustments

4 hours -

Financial Stability Advisory Council holds final meeting for 2025

4 hours