Audio By Carbonatix

Banks in the country have begun releasing their 2022 Financial Statement ahead of the April 30, 2023 deadline by the Bank of Ghana.

But the Domestic Debt Exchange Programme (DDEP) has impacted negatively on their profitability position.

According to the 2022 Audited Financial Statements sighted by Joy Business, almost all the banks that have published their statements recorded losses.

Standard Chartered Bank is one of them, as it recorded a loss of ¢66.4 million in 2022, compared to a profit of ¢410.8 million in 2021.

This is despite recording a staggering ¢807.7 million interest income in 2022.

As a result of the effect of the DDEP, the tier one bank made an impairment of ¢1.18 billion in 2022.

Similarly, Republic Bank registered a loss of ¢66.8 million in 2022.

It posted a net interest income of ¢370.6 million, but a ¢237 million loss on financial assets and other costs triggered the loss.

Again, GCB Bank lost ¢568 million in 2022, despite recording net interest income of ¢2.09 billion.

FNB, Stanbic, Zenith heavily impacted by DDEP

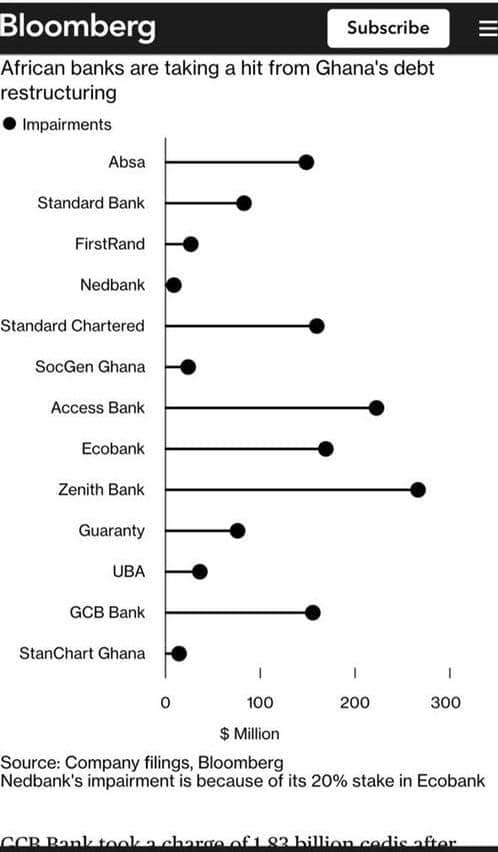

Parent companies of First National Bank, Stanbic, Zenith and Guaranty Trust Bank have already hinted of significant losses by their Ghana subsidiaries due to the impact of the DDEP on their operations. This will therefore require additional capital injection to turn things around.

For instance, Standard Bank said it was ready to re-capitalise its Ghanaian unit after making provisions to cover more than half of its holdings in the nation’s debt.

FirstRand Limited, Africa’s biggest bank by market capitalization, also hinted of writting off more than half the value of its holdings of Ghanaian bonds as the country grapples with a restructuring of its sovereign debt.

The banks had also indicated of slowing down lending until the Ghanaian economy improves.

The loss position of the banks means shareholders may not enjoy dividend for the 2022 financial year.

Societe Generale records ¢110.6m

Meanwhile, Societe Generale Bank is one of the few banks that recorded a profit in 2022.

The bank which was less exposed to the Government of Ghana bonds registered a profit of ¢110.6 million, lower than the ¢183.8 million recorded in 2021.

Joy Business had earlier reported that banks in Ghana lost about ¢15 billion in 2023 due to the DDEP

Latest Stories

-

GoldBod warns licence holders over failure to file monthly gold transaction reports

16 minutes -

NAPO’s guidance key to my 2012 victory – Afenyo-Markin

35 minutes -

Police arrest 7 over fake traffic fine scam targeting mobile money users

40 minutes -

NDPC, DTI rally stakeholders to drive 2026 human capital development agenda

45 minutes -

GNAPS welcomes government’s declaration of Wednesdays as Fugu Day

50 minutes -

CHRAJ Director laments delay in implementation of Disability Act

55 minutes -

Secure customs system critical to Ghana’s competitiveness – Trade Minister

60 minutes -

Stakeholders push for more women’s participation in governance

1 hour -

Media key to national security – GAF

1 hour -

North Tongu: Residents expect SONA to focus on stalled projects, roads…

1 hour -

Corruption is like adultery – Sophia Akuffo dismisses claims of rot in judiciary

1 hour -

Sophia Akuffo warns against locking Ghana into costly agreements

2 hours -

Father demands justice through the government for the alleged murder of his son at Oyarifa

2 hours -

Fifty-eight abuse, protection cases handled by DSW in Adaklu in 2025

2 hours -

Sophia Akuffo questions government debt trust after DDEP haircut

2 hours