Audio By Carbonatix

Commercial banks have expressed concerns about rising Treasury bill rates and its impact on cost of credit and loan recovery.

According to them, the development could have serious implications on borrowers struggling to pay back loans.

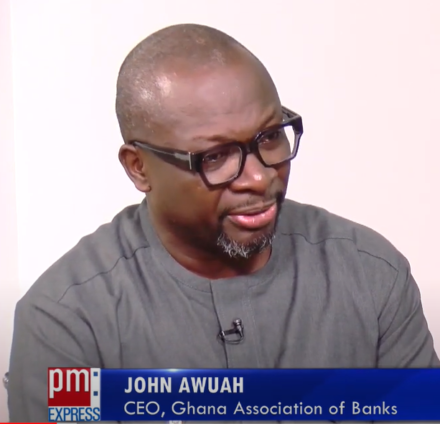

“If the market rate moves into the 30 and 40s which company or household will be able to borrow at the rate and make good on the re-payment”the Chief Executive Officer of the Ghana Association Banks John Awuahsaid on PM Express Business Edition with host George Wiafe on September 7, 2023.

“We should not forget that if you give 10 loans and one goes bad it wipes off the benefits of the other nine”, he added.

The Treasury bills rate challenge

Government, earlier used the conclusion of the first round of the Domestic Debt Exchange Programme to reduce interest rates to about 15 percent.

However, due to government’s heavy borrowing through the Treasury bills market, the rates jumped to around 30 percent.

Some market analysts have blamed the development on the fact that the Treasury bills market has become the only source of raising funds locally by government to support its operations.

Currently Ghana is unable to go to the international capital market to raise funds due to unfavorable credit ratings and high debt levels.

Interest Rate dynamics

Mr. Awuah complained that high interest rates is not helping banks to make good returns on credit.

He refuted assertions that banks have been benefiting from high interest rates.

On the contrary, Mr. Awuah explained that high interest rates increases the cost of operations of banks and affect their ability to offer new loans.

“When these rates are going up, depositors are also pushing for high rates on their funds and that is not good for the banks” Mr. Awuah added.

He also rejected arguments that banks have contributed to high Treasury bills rate currently on the market.

Making some recommendations, Mr. Awuah called for a relook at how market players are quick to adjust rates when they go up.

Domestic Debt Exchange Programme and concerns of Banks

Touching on the successful completion of the domestic debt exchange programme, he pointed out that banks must be given credit for the role played in the exercise.

He added banks did not meet the expectations of the exercise in relation to interest payments, principals and regulatory reliefs.

On the first payment coupons for debts issued under the Domestic Debt Exchange Programme , Mr. Awuah noted that it is a good move which will aid market confidence.

Banking Sector outlook and expectations

Commercial banks ended the first half of this year with some strong profits despite the Domestic Debt Exchange Programme.

Responding to this, Mr. Awuah said it is too early make conclusions.

He stated that there is the need for expectations to be measured, adding that a pickup for banks will largely depend on the stability of the economy.

Latest Stories

-

Speaker directs business committee to schedule anti-LGBTQ bill for parliamentary consideration

4 minutes -

Inflation drop doesn’t mean prices have fallen – Oppong Nkrumah clarifies

8 minutes -

Kenya to confront Russia over ‘unacceptable’ use of its nationals in combat

11 minutes -

Running Ghana by elections, not by plans: Galamsey as the consequence

14 minutes -

Israeli theatre scholar Prof Roy Horovitz brings cultural exchange to Ghana

18 minutes -

Awula Serwaa slams Amansie Central Assembly over ‘Galamsey Tax’ defence

31 minutes -

High airport infrastructure charges making Ghana’s aviation sector uncompetitive – stakeholders

33 minutes -

Mining Indaba: African integration requires collective will – Armah-Kofi Buah

36 minutes -

Drowning in hunger: Nawuni farmers struggle to survive amidst floods and climate change

37 minutes -

15 women arrested in New Juaben South over human trafficking, sex work charges

38 minutes -

Arrest officials issuing illegal mining licences, Ashigbey demands

39 minutes -

Nyasabga’s women farmers bear the brunt of climate change and land degradation, others turn to smart agriculture

55 minutes -

‘A Tax for Galamsey’: JoyNews petitions President Mahama to take action on investigative documentary

60 minutes -

From Ballot Lines to Academic Laurels: Multimedia’s Akwasi Agyeman earns PhD at University of Ghana

1 hour -

Ghana’s gold refining deal could reduce commodity vulnerability – EM Advisory

1 hour