Audio By Carbonatix

Standard Chartered Wealth Management Chief Investment Office (CIO) has released its Outlook 2024 report, outlining its investment strategy for the year ahead.

The US and other major economies are likely to witness sharply slower growth and sliding inflation in 2024.

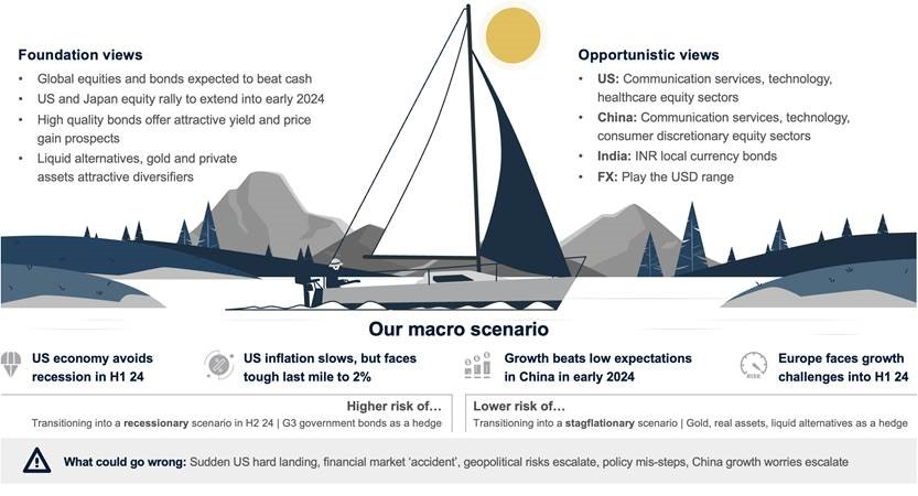

Equity and bond markets are expected to start 2024 positively, supported by hopes of a soft landing and central bank policy shifting towards supporting growth, but it remains on watch should macro winds shift towards a harder landing.

Against this backdrop, the CIO believes that investing in 2024 is likely to be about balancing the development of the macro scenario and spotting where asset class risk/reward appears attractive.

For Foundation allocations – a model that can be used as a starting point for building a diversified investment portfolio – its highest convictions are in (i) high-quality Developed Market government bonds, particularly with longer maturities, (ii) global equities heading into early 2024, led by the US and Japan, and more broadly (iii) global equities and global bonds, which are likely to deliver cash-beating performance.

The team’s Opportunistic allocations look to take advantage of stock and sector dispersion to capture short-term opportunities, with a view to (i) buy communication services, technology and healthcare equity sectors in the US, (ii) buy consumer discretionary, communication services and technology sectors in China, and (iii) play the USD range.

Steve Brice, Global Chief Investment Officer, said that investors should consider their investment objectives, time horizon and most importantly, the ability to weather drawdowns in their portfolio.

“The key to successful investing discipline: don’t be a forced seller, whether it be due to emotional or financial needs, and avoid excessive, permanent losses.

"We hope that our latest outlook report offers investors some important questions to consider, and our take on how they can optimally position their asset allocation as they navigate 2024 amid a high level of uncertainty.”

Latest Stories

-

ECG to cut power in parts of Accra West on February 11 for planned maintenance

31 minutes -

BoG announces guidelines to govern foreign exchange spot interventions

55 minutes -

Intelligence report uncovers weapons transfers under Sudanese Army oversight to South Kordofan

1 hour -

119 people died during mediation efforts in Bawku conflict – Mahama

1 hour -

Trade Ministry to lead raw material expansion for 24-hour production, youth jobs & exports

1 hour -

Migration induced by coastal erosion: The Shama experience

1 hour -

Ghana’s economy to expand by 5.67% in 2026

1 hour -

A/R: ECG surcharges over 2,200 customers for illegal connections, recovers over GH¢4.3bn in 2025

2 hours -

With galamsey still ongoing, who is buying the gold? – Oppong Nkrumah questions gov’t

2 hours -

Avoiding Fiscal Risks in GCR’s deal with GoldBod

2 hours -

Suame Interchange won’t affect NPP votes in Ashanti – Asenso-Boakye

2 hours -

Mahama receives Transition Committee report on UGMC transfer to University of Ghana

2 hours -

Quiz Talk National STEM Programme instituted to boost innovation in basic schools

2 hours -

Unemployed graduates with disabilities engage Gender Minister on jobs and inclusion

2 hours -

Parliament approves GH¢2.9bn for Ghana Medical Trust Fund

2 hours