Audio By Carbonatix

The Government of Ghana would require between US$600.0 million and US$800.0 million for external debt service in 2024.

Out of this, an estimated US$477.0 million would be used for Eurobond debt service.

According to IC Africa Research, the estimated cash flow on the restructured Eurobonds envisages the resumption of debt service on the restructured Eurobonds from July 2024.

“Accounting for the ongoing multilateral debt service (given that these debts were outside the perimeter of debt restructuring), we think the authorities would require between US$600.0 million – US$800.0 million for external debt service in 2024. These estimates exclude the US$1.6 billionn legacy arrears owed to the Independent Power Producers, out of which only US$400.0 million has been paid, and other commercial creditors”.

“Extending the outlook, the cash flow forecast shows intensified debt service obligation from 2026 – 2030, from peak US$1.4bn to US$1.1 billion on the Eurobonds alone”, it added.

However, Ghana’s forex reserves (excluding oil funds and encumbered assets) stood at US$4.3 billion in April 2024 (2.0 months of import).

This, IC Africa Research said emphasises its longstanding view that the government have been in reserves accumulation mode in anticipation of external debt service resumption rather than sufficient foreign exchange market support.

Consequently, it stressed that it remained less bullish on the outlook for the Ghanaian cedi as it sees limited sources of sizable foreign exchange (FX) inflow to the market.

Limited upside risks for secondary market pricing

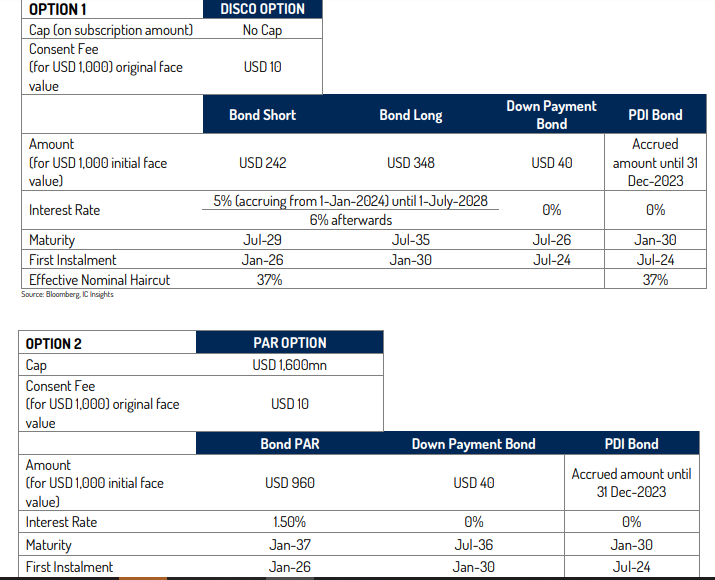

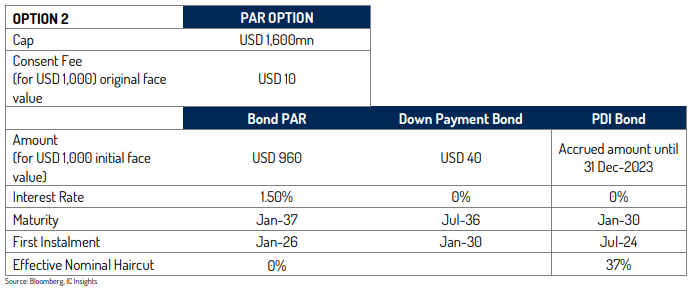

Following the significant move in restructuring the Eurobonds, IC Africa Research added that it envisages limited upside for secondary market pricing due to the deeper haircut and slashed coupon.

“Following our early May 2024 update note on the initial proposal in which we anticipated upside of between 10.0% and 20.0%, Ghanaian Eurobonds have posted an average price gain of 3.8% as of mid-day 24 June 2024. However, we opine that the new terms impose deeper losses on investors via the effective haircuts on principal and PDI, as well as the 50 basis points reduction in the stepped-up coupon rate (6.0%) while the lower coupon of 5.0% is extended for one extra year.”

“In view of this, we now see limited upside scope from the current average market cash price of US$53.4 per US$100.0 face value, with upside potential of between 5.0% – 7.0%.

Latest Stories

-

Trump threatens strong force if Iran continues to retaliate

7 minutes -

Lekzy DeComic gears up for Easter comedy special ‘A Fool in April’

2 hours -

Iran declares 40 days of national mourning after Ayatollah Ali Khamenei’s death

2 hours -

Family of Maamobi shooting victim makes desperate plea for Presidential intervention

3 hours -

Middle East turmoil threatens to derail Ghana’s single-digit gains

4 hours -

Free-scoring Semenyo takes burden off Haaland

4 hours -

Explainer: Why did the US attack Iran?

5 hours -

Peaky Blinders to The Bride!: 10 of the best films to watch in March

6 hours -

Crude oil price crosses $91 as Strait of Hormuz blockade chokes 22% of global supply

6 hours -

Dr. Hilla Limann Technical University records 17% admission surge; launches region’s first cosmetology laboratory

7 hours -

Over 50 students hospitalised after horror crash ends sports tournament

7 hours -

Accra–Dubai flights cancelled as Middle East tensions deepen

8 hours -

See the areas that will be affected by ECG’s planned maintenance from March 1-5

8 hours -

Kane scores twice as Bayern beat rivals Dortmund

9 hours -

Lamine Yamal hits first hat-trick in Barcelona win

9 hours