Audio By Carbonatix

The Electricity Company of Ghana (ECG) has failed to comply with the Cash Waterfall Mechanism (CWM) again after briefly adhering to it earlier this year, further exacerbating the energy sector’s mounting debt.

Following a two-month delay in the release of the Cash Waterfall validation reports by the Public Utilities Regulatory Commission (PURC), the reports for May, June, and July 2024 have finally been published.

The May and June reports reveal that ECG made only partial payments to three of the six Independent Power Producers (IPPs) and the West African Gas Pipeline Company (WAPCo). However, three key IPPs—Karpower, Cenit, and Asogli—did not confirm the amounts they received for these months, leaving significant questions unanswered.

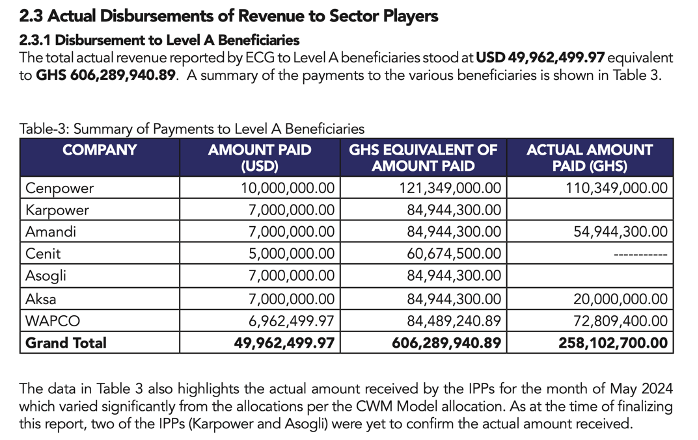

May 2024: Partial Payments, Major Shortfall

In May, ECG was obligated to pay GHS 606 million to the six IPPs and WAPCo. However, only GHS 258 million was paid, leaving a staggering shortfall of over GHS 348 million. Notably, Karpower and Asogli failed to confirm the amounts received.

“The Commission has validated payments and receipts from some stakeholders along the energy value chain and wishes to state that ECG did not comply with the approved payment to Level A,” the PURC stated.

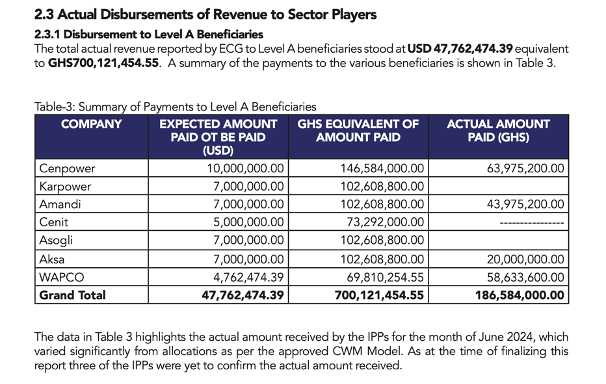

June 2024: Worsening Situation

The situation deteriorated in June, with ECG’s shortfall growing even larger. While partial payments were made again to three IPPs and WAPCo, the deficit ballooned to GHS 513 million.

“The Commission has validated payments and receipts from some stakeholders along the energy value chain and wishes to state that ECG did not comply with the approved payment to Level A,” PURC reiterated.

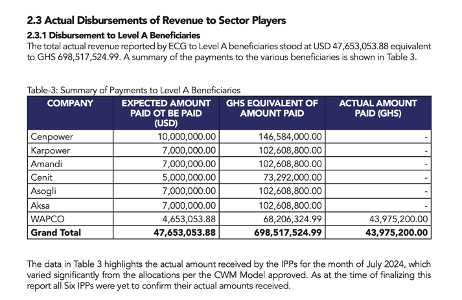

July 2024: No Confirmation from IPPs

In July, none of the IPPs confirmed receipt of any payments, while WAPCo reported receiving GHS 25 million less than what was due. The absence of confirmation from the IPPs casts doubt over ECG’s compliance with the CWM for that month.

Despite the lack of confirmation from the IPPs for July, it is clear that ECG did not meet its obligations for May and June, deepening the energy sector’s financial challenges.

Latest Stories

-

MTN FA Cup: Defending champions Kotoko knocked out by Aduana

2 hours -

S Korean crypto firm accidentally pays out $40bn in bitcoin

2 hours -

Washington Post chief executive steps down after mass lay-offs

2 hours -

Iranian Nobel laureate handed further prison sentence, lawyer says

3 hours -

U20 WWCQ: South Africa come from behind to draw against Black Princesses in Accra

3 hours -

Why Prince William’s Saudi Arabia visit is a diplomatic maze

3 hours -

France murder trial complicated by twin brothers with same DNA

3 hours -

PM’s chief aide McSweeney quits over Mandelson row

3 hours -

Ayawaso East primary: OSP has no mandate to probe alleged vote buying – Haruna Mohammed

4 hours -

Recall of Baba Jamal as Nigeria High Commissioner ‘unnecessary populism’ – Haruna Mohammed

4 hours -

Presidency, NDC bigwigs unhappy over Baba Jamal’s victory in Ayawaso East – Haruna Mohammed

4 hours -

Africa Editors Congress 2026 set for Nairobi with focus on media sustainability and trust

4 hours -

We are tired of waiting- Cocoa farmers protest payment delays

5 hours -

Share of microfinance sector to overall banking sector declined to 8.0% – BoG

5 hours -

Ukraine, global conflict, and emerging security uuestions in the Sahel

6 hours