Audio By Carbonatix

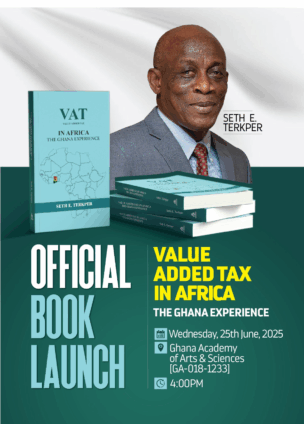

Former Finance Minister and current Presidential Adviser on the Economy, Seth E. Terkper, is set to launch his latest book, VAT in Africa: The Ghanaian Experience, on 25th June 2025.

This is Terkper’s second publication focused on VAT (Value Added Tax), and it offers a detailed and reflective account of Ghana’s complex journey in adopting VAT as a major fiscal policy tool.

The book recounts the turbulent path from the introduction of VAT in the 1990s to its evolution under the VAT Act 2013 (Act 870), chronicling both technical refinements and the political, economic, and institutional hurdles along the way.

Terkper explores the challenges that accompanied the policy’s initial rollout in 1995, which was met with fierce public resistance and mass demonstrations—famously the “Kumepreko” protests—that forced the government to suspend the tax just months after its launch.

However, the book emphasizes that the setback was temporary. A revised version of the VAT was introduced successfully in 1998, following a robust national education campaign, stakeholder consultations, and political negotiations.

This marked a turning point in Ghana’s revenue mobilisation efforts and fiscal self-reliance.

Blending legislative analysis with historical and administrative context, Terkper reflects on how VAT transformed from a failed policy into a core pillar of Ghana’s public finance system.

He also examines how subsequent policy missteps and loopholes have weakened VAT’s effectiveness—leading to overburdened taxpayers and increasing evasion and avoidance.

Through rich case studies, the book reveals how policy adaptability and institutional strength can turn an unpopular tax measure into a dependable revenue stream.

It also offers cautionary lessons for African and developing countries implementing or reforming VAT systems in their own jurisdictions.

With VAT in Africa: The Ghanaian Experience, Terkper contributes not only to Ghana’s policy literature but to the broader discourse on sustainable taxation and economic governance in Africa.

Seth Terkper to Launch Book on Ghana’s VAT Journey and Lessons for Africa.

Former Finance Minister and current Presidential Adviser on the Economy, Seth E. Terkper, is set to launch his latest book, VAT in Africa: The Ghanaian Experience, on 25th June 2025.

This is Terkper’s second publication focused on VAT (Value Added Tax), and it offers a detailed and reflective account of Ghana’s complex journey in adopting VAT as a major fiscal policy tool.

The book recounts the turbulent path from the introduction of VAT in the 1990s to its evolution under the VAT Act 2013 (Act 870), chronicling both technical refinements and the political, economic, and institutional hurdles along the way.

Terkper explores the challenges that accompanied the policy’s initial rollout in 1995, which was met with fierce public resistance and mass demonstrations—famously the “Kumepreko” protests—that forced the government to suspend the tax just months after its launch.

However, the book emphasises that the setback was temporary. A revised version of the VAT was introduced successfully in 1998, following a robust national education campaign, stakeholder consultations, and political negotiations.

This marked a turning point in Ghana’s revenue mobilisation efforts and fiscal self-reliance.

Blending legislative analysis with historical and administrative context, Terkper reflects on how VAT transformed from a failed policy into a core pillar of Ghana’s public finance system.

He also examines how subsequent policy missteps and loopholes have weakened VAT’s effectiveness—leading to overburdened taxpayers and increasing evasion and avoidance.

Through rich case studies, the book reveals how policy adaptability and institutional strength can turn an unpopular tax measure into a dependable revenue stream.

It also offers cautionary lessons for African and developing countries implementing or reforming VAT systems in their own jurisdictions.

With VAT in Africa: The Ghanaian Experience, Terkper contributes not only to Ghana’s policy literature but to the broader discourse on sustainable taxation and economic governance in Africa.

Latest Stories

-

Russia killed opposition leader Alexei Navalny using dart frog toxin, UK says

2 hours -

Obama addresses racist video shared by Trump depicting him as an ape

2 hours -

Frank Davies slams Special Prosecutor as INTERPOL deletes Ofori-Atta Red Notice

3 hours -

Controller issues March 15 ultimatum for Ghana Card verification

5 hours -

Cocoa Crisis: Current challenges are self-inflicted — Oforikrom MP

6 hours -

Fuel prices set to surge as Cedi slides and global markets tighten

6 hours -

President Mahama honours August 6 helicopter crash widows with Valentine’s Day tribute

7 hours -

Vice President Naana Jane Opoku-Agyemang champions made-in-Ghana chocolates on Valentine’s Day

7 hours -

Six critically injured in gruesome head-on collision near Akrade

9 hours -

Gov’t to extradite foreign national who secretly filmed Ghanaian women to face prosecution – Sam George

9 hours -

U20 WWC: Black Princesses to play Uganda in final round of qualifiers

10 hours -

Burundi takes the helm as African Union declares ‘war’ on water scarcity

10 hours -

‘I will never forget you’ – Kennedy Agyapong thanks supporters, NPP delegates after primaries

11 hours -

Woman found dead in boyfriend’s room at Somanya

13 hours -

Woman feared dead after being swept away in Nima drain amid heavy rain

13 hours