Audio By Carbonatix

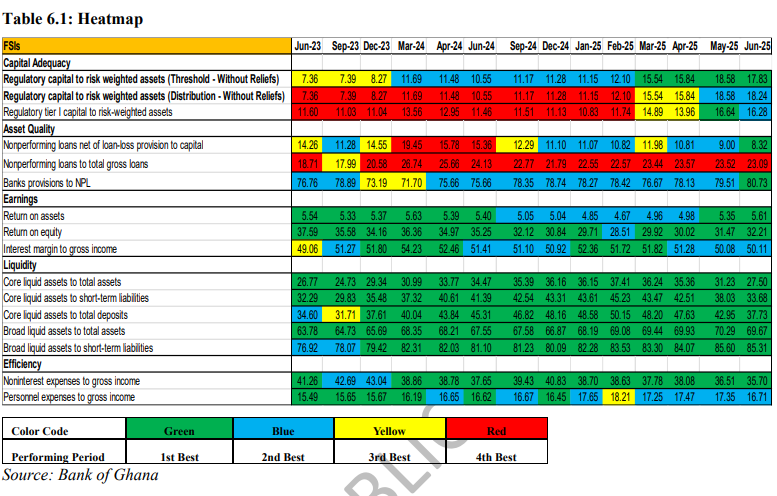

The stress tests conducted by the Bank of Ghana on banks in the first-half of the year indicated that the banking sector appears resilient to adverse macroeconomic developments

This is given the current strong capital positions of the banks which increased by 48.5% to GH¢48.0 billion in the first-half of 2025

The stress tests assessed the implications of macroeconomic developments in the outlook for the solvency conditions of the banking sector.

The report pointed out that a deterioration in macroeconomic conditions could negatively impact asset quality and increase operational costs, but these would be offset by gains from net interest income.

It alluded that the macro-prudential assessment of the banking sector suggests positive macroeconomic developments have supported the banking sector’s performance and moderated systemic risk in half-year 2025.

“The Bank’s [BoG’s] stress test results suggest that the banking sector’s resilience to shocks has improved due to profit retention, capital injections, adequate liquidity, and moderation in the build-up of new non-performing loans”.

However, the report warned that debt servicing remains a challenge for both the corporate and household sectors.

“It is expected that the ongoing macroeconomic recovery, restructuring of loans to eligible borrowers, and implementation of measures outlined in the Bank of Ghana’s Regulatory Notice to banks on reducing NPLs [Non-Performing Loans] will help address this challenge.

In the near term, the report mentioned that sustaining the macroeconomic gains would provide the impetus for a stronger recovery in the banking sector’s intermediation capacity.

Latest Stories

-

Transport Minister defends plan to rename Kotoka Airport, says move is not political

10 seconds -

ECG engineers avert major revenue loss, restore power after Asawinso downtime threat

9 minutes -

Ghana’s Sports Minister to address 8th AIPS Africa Congress in Banjul, The Gambia

10 minutes -

Over 100 drivers arrested for charging excess fares ,vows to continue – GPRTU

11 minutes -

Daily Insight for CEOs: Creating execution accountability

23 minutes -

Ken Agyapong: I’m not bitter because I lost, I’m bitter because I’ve been betrayed

25 minutes -

Boko Haram, Banditry: US military says some forces have been dispatched to Nigeria

52 minutes -

Commuters grapple with increasing transport difficulties in Accra

57 minutes -

Parliamentary recess delayed appointment of substantive Defence Minister – NDC Communicator

1 hour -

Collision with Greek coast guard boat leaves 15 migrants dead

1 hour -

Afanyi Dadzie Writes: Why writing off Bawumia ahead of 2028 is politically reckless

2 hours -

President Mahama begins three-day State Visit to Zambia

2 hours -

Ghana’s inflation drops to 3.8% in January 2026, lowest since 2021 rebasing

2 hours -

Ghana Medical Trust Fund to train 100 specialist pharmacists to strengthen care for chronic diseases

2 hours -

Ghana midfielder Musah Mohammed signs for Turkish top-flight club Goztepe

2 hours