Audio By Carbonatix

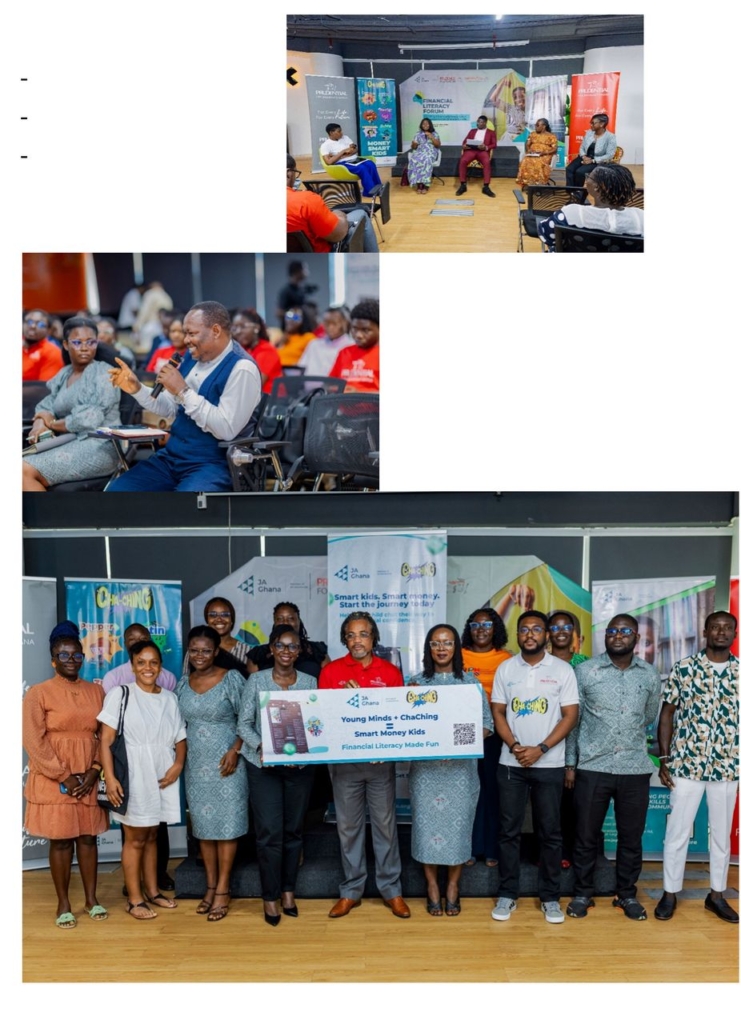

Prudential Life Insurance Ghana, in partnership with Junior Achievement (JA) Ghana have hosted a stakeholder forum in Accra, Ghana’s capital to celebrate the impact of the Cha-Ching Financial Literacy Programme and explore ways to integrate financial literacy into Ghana’s basic education curriculum.

The Cha-Ching program, funded by Prudence Foundation; the community investment and outreach arm of Prudential PLC is designed to teach children essential money management skills using the Earn, Save, Spend, and Donate framework. The initiative is active in Ghana and six other countries, Uganda, Nigeria, Vietnam, Indonesia, Malaysia, and the Philippines.

The forum brought together key stakeholders in Ghana’s education sector, including officials from the Ghana Education Service, school heads, teachers, proprietors, and other partners whose institutions have benefited from the program.

The forum was also used to launch a WhatsApp chatbot to expand the reach of Cha-Ching and financial education to all Ghanaians.

In his remarks, Edem Amesu-Addor, Executive Director of JA Ghana, highlighted the strength of the partnership in promoting financial empowerment among young people.

He said, “Our collaboration with Prudential Life Insurance Ghana continues to empower the next generation of leaders with the financial skills they need to thrive.”

Over the past five years, the Cha-Ching programme has made a remarkable impact in Ghana, reaching over 400 schools, training more than 900 educators and volunteers, and touching the lives of over 36,000 students across six regions.

During a panel discussion, Gloria Henrietta Yamson, Acting Chief Commercial Officer of Prudential Life Insurance Ghana, reaffirmed the company’s commitment to community empowerment.

She said, “Empowering communities to thrive economically and socially is at the heart of what we do. We encourage parents and educators to nurture financial responsibility in children from an early age.”

The panel featured experts from the public and private education sectors, finance, and civil society. All participants unanimously agreed that integrating financial literacy into Ghana’s basic education curriculum is essential for securing the financial wellbeing of future generations and the county.

This vision aligns with Prudential Life Insurance Ghana’s mission; “to be the most trusted partner and protector for this generation and the next, by providing simple, accessible financial solutions.” The company remains committed to fostering financial empowerment across Ghana—one child, one classroom, and one community at a time.

Latest Stories

-

Iranian Embassy in Ghana responds to the remarks of the Israeli Ambassador to Ghana

3 seconds -

GNFS confirms six deaths, seven injured in Accra-Nsawam highway petrol tanker fire

20 minutes -

President Mahama commissions new Ghana embassy chancery in Addis Ababa

28 minutes -

Kyei-Mensah-Bonsu questions timing of OSP investigation into alleged vote buying in NPP Presidential Primary

31 minutes -

Photos: Dreams FC suffer 1-0 defeat at home to Karela

36 minutes -

Ghana needs clear policy to tackle galamsey, our past methods fell short – Kyei-Mensah-Bonsu

41 minutes -

Mahama pushes urgent rollout of Pan-African payment system at AU Summit

46 minutes -

AGA Obuasi Mine and partners inspire girls at Asare Bediako SHS to pursue careers in STEM

47 minutes -

Ashanti Regional Minister inaugurates Spatial Planning Committees, unveils plan to restore Kumasi’s green glory

56 minutes -

AI-driven technology set to boost farmers’ productivity and cut seed losses in Ghana

57 minutes -

Early polls are misleading – Kyei-Mensah-Bonsu on Ghana’s 2028 elections

1 hour -

Black Princesses arrive in Ghana after victory over South Africa

1 hour -

NPP primaries: Gideon Boako reconciles opposing camps in Tano North

1 hour -

‘We will prepare ourselves to outweigh Uganda’ – Black Princesses coach Charles Sampson

1 hour -

Dr Bawumia can bounce back to win Ghana’s 2028 presidency – Kyei-Mensah-Bonsu

1 hour