Audio By Carbonatix

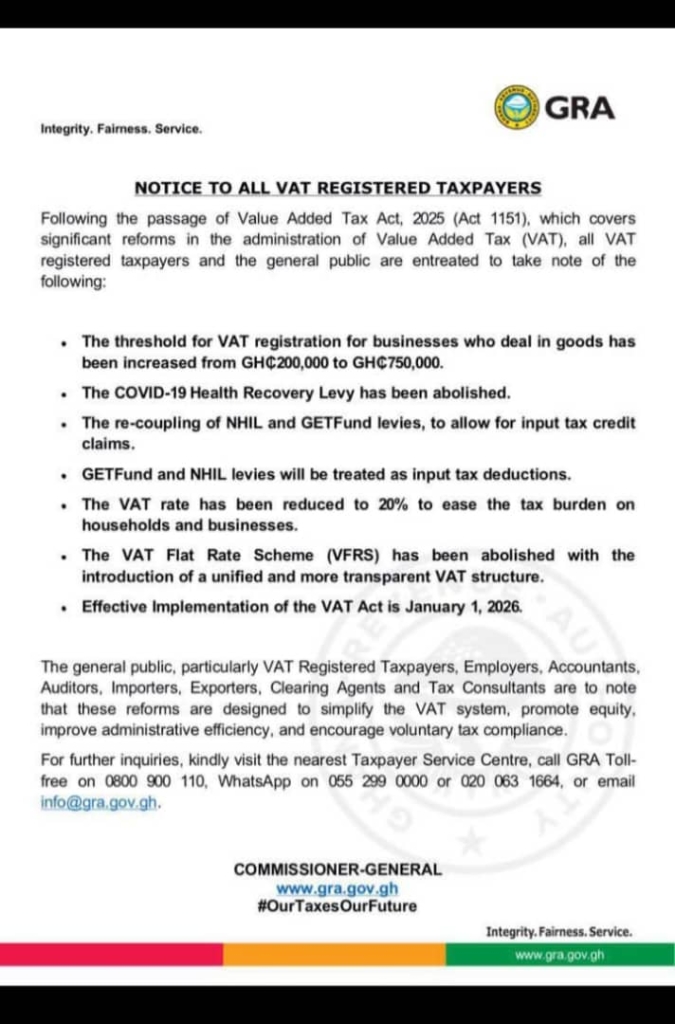

The Ghana Revenue Authority (GRA) has announced sweeping changes to the country’s Value Added Tax (VAT) regime following the passage of the Value Added Tax Act, 2025 (Act 1151), with the reforms set to take effect from January 1, 2026.

In a notice addressed to all VAT-registered taxpayers, the GRA stated that the new law introduces significant reforms aimed at simplifying VAT administration, enhancing compliance, and alleviating the tax burden on households and businesses.

One of the major changes is an increase in the VAT registration threshold for businesses dealing in goods. The threshold has been raised from GH¢200,000 to GH¢750,000, a move expected to reduce the number of small businesses required to register for VAT.

The Authority also announced the abolition of the COVID-19 Health Recovery Levy, which was introduced during the pandemic to support the government's expenditure.

Under the new VAT structure, the National Health Insurance Levy (NHIL) and the Ghana Education Trust Fund (GETFund) levies have been re-coupled, allowing businesses to claim input tax credits. Both levies will now be treated as input tax deductions.

In addition, the VAT rate has been reduced to 20 per cent, a measure the GRA says is intended to ease the tax burden on consumers and businesses.

The VAT Flat Rate Scheme (VFRS) has also been abolished, paving the way for a unified and more transparent VAT system.

The GRA explained that the reforms are designed to promote equity, improve administrative efficiency, and encourage voluntary tax compliance.

It urged VAT-registered taxpayers, employers, accountants, auditors, importers, exporters, clearing agents, and tax consultants to take note of the changes ahead of the implementation date.

The Authority further encouraged the public to seek clarification where necessary by visiting the nearest Taxpayer Service Centre or contacting the GRA through its toll-free line or official communication channels.

Read the full statement below

Latest Stories

-

Trump ‘does not care’ if Iran play at World Cup

36 minutes -

Burna Boy’s associate, Rahman Jago confirms singer converted to Islam

42 minutes -

Amazon says drones damaged three facilities in UAE and Bahrain

52 minutes -

NDC’s Baba Jamal wins Ayawaso East by-election

1 hour -

Integrity over individuals: Economic Fighters League maintains vote-buying stance in Ayawaso East

1 hour -

How to follow European football

2 hours -

A new dawn: Formula One charges into an unpredictable 2026

2 hours -

Trump threatens to halt trade with Spain over military base access

2 hours -

Trump says US Navy will protect ships in Middle East ‘if necessary’

2 hours -

Ghana shines in GSMA DNSI and DPRI 2025 report due to E-Levy repeal and tech neutrality

3 hours -

NJA College of Education inducts 379 students amidst infrastructure gains and calls for professional discipline

3 hours -

GJA President, executives join Sammy Gyamfi to observe One-Week memorial of father-in-law

3 hours -

FDA bans mixed alcoholic energy drinks: VAST-Ghana demands ‘Name and Shame’ list for public safety

3 hours -

Police probe deaths of teacher and farmer in Assin Fosu

4 hours -

Gov’t reaffirms commitment to safeguard Ghana’s energy supply amid Middle East crisis

4 hours