Audio By Carbonatix

Ghana has mined gold since colonial times, yet the long-promised transformation from gold to diamonds and then to oil has not delivered the kind of structural economic shift many expected.

A recurring question is what Ghana has truly gained from its mineral wealth and why those resources have not been leveraged to accelerate development.

Other resource rich economies such as Canada, Australia, Botswana and South Africa appear to have extracted more tangible and lasting benefits from their natural resources than Ghana has.

Paradoxically, Ghana’s mining fiscal regime is among the most elaborate globally.

The state captures a significant share of mining profits through a combination of royalties, corporate income tax and other levies.

In the gold sector, Ghana’s average effective after-tax rate exceeds 50% of company profits. In the stalled lithium project, the Natural Resource Governance Institute (NGRI) projected an effective rate of about 58%.

This places Ghana among countries with a relatively high government take from mining.

Royalties themselves appear modest on the surface because they are charged on revenue rather than profits.

Large scale gold mining companies typically pay a royalty rate of 5% of total revenue. Three major gold mining firms operate under development agreements, with royalty rates ranging from 3% to 5%, to reflect their investment commitments.

However, once other taxes are included, the state’s total take rises sharply.

These include a 35% corporate income tax, a 3% growth and sustainability levy, as well as import duties, withholding taxes, surface rent, mineral rights fees and Pay As You Earn (PAYE) contributions.

Combined, these push Ghana’s effective tax take from mining companies above 50%.

Unlike the oil sector, where revenues are ringfenced and overseen by the Public Interest Accountability Committee (PIAC), majority of revenues from gold and other minerals flow directly into the consolidated fund.

There are no dedicated accounts for mineral revenues outside oil. Once funds enter the consolidated fund, tracking their specific use becomes extremely difficult. This weakens transparency and accountability in the sector.

One of the few components that can be tracked consistently is mineral royalties. These are the 3 to 5% payments on revenue made by large scale mining companies. Mineral royalties cover gold, bauxite, manganese and other minerals but exclude oil.

Gold accounts for the largest share.

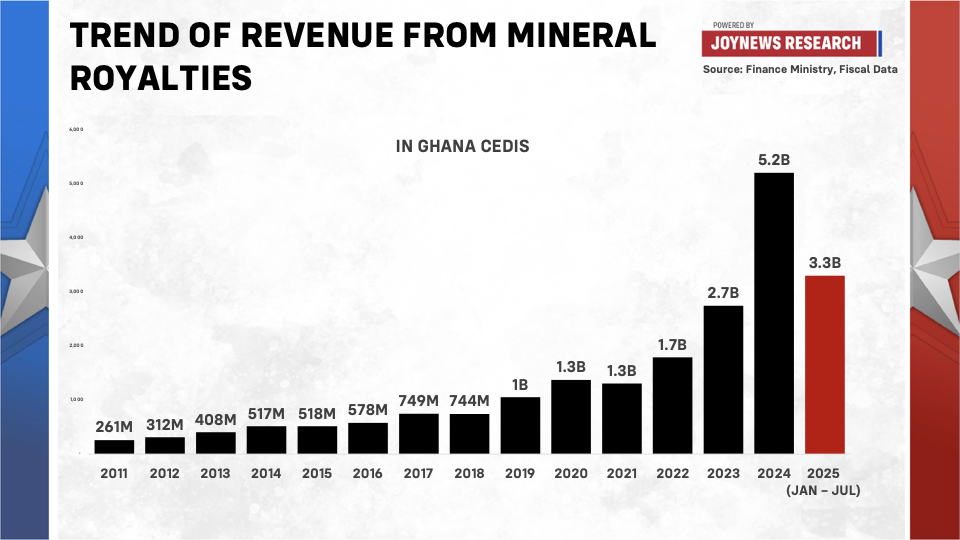

Finance Ministry data shows that from 2011 to the first seven months of 2025, Ghana received more than GHS 20 billion in mineral royalties alone.

This figure excludes corporate income tax, levies and other mining related payments, which means the total fiscal contribution from mining is significantly higher but harder to isolate from government accounts.

Since 2011, mineral royalties have consistently contributed about 6 to 7% of Ghana’s total tax on income and property.

Yet how this GHS 20 billion has been used is difficult to trace.

Under the current mining regime, mineral royalties are paid into the Minerals Income Holding Account.

From there, 78% is transferred to the Consolidated Fund, 2% goes to the Minerals Income Investment Fund, while 20% is transferred to the Minerals Development Fund, which then shares the money between stools and district assemblies in mining areas and regulatory bodies.

The bulk of royalties therefore ends up in the consolidated fund.

For stronger accountability in the mining sector, Ghana should begin separately accounting for all revenues generated from mining companies.

These revenues should be ringfenced and allocated to clearly defined projects or sectors, allowing citizens to track how mineral wealth is used.

Oil revenues are treated this way, yet even there the promised transformation has been limited.

In fact, gold royalty payments and broader fiscal contributions from mining companies are larger than those from the oil sector.

Extending similar ringfencing and reporting standards to non-oil minerals would therefore improve transparency and strengthen public confidence.

Parliament should consider streamlining the treatment of both oil and non-oil mineral revenues and enhance reporting and tracking mechanisms to ensure Ghanaians derive maximum long-term benefit from their natural resources.

Latest Stories

-

Russian hits Ukraine energy sites in ‘most powerful blow’ so far this year

5 minutes -

2nd edition of Canada-Africa Agribusiness Summit set for July 15–16

5 minutes -

Kwadaso MCE warns artisans against burning refuse following mechanic shop fire

6 minutes -

Banks courting firms with cheaper loans as interest rates ease – Majority Leader

7 minutes -

Constitutional reform is about people, not law

7 minutes -

FirstBank opens two new branches at Dzorwulu and North Industrial Area to deepen SME and Retail Banking Services

21 minutes -

2 banks remain undercapitalised as of December 2025 – BoG

23 minutes -

Joint bank accounts can spark conflict in marriages – Kweku Frimpong

26 minutes -

Scheduled exit from IMF programme, others could influence capital flows, exchange rate dynamics – BoG Governor

27 minutes -

Kwame Sowu Jnr urges focus on commercial interests over social interests for wealth creation

29 minutes -

Paris prosecutors raid France offices of Elon Musk’s X

32 minutes -

Senior Staff Association begins nationwide university strike over adjustments to conditions of service

33 minutes -

Rape trial begins for son of Norway’s crown princess in tense moment for royal family

37 minutes -

Ghana’s total petroleum receipts for 2025 decline sharply to $769m

38 minutes -

Early flagbearer process has deepened divisions – Dr. Arthur Kennedy

45 minutes