Audio By Carbonatix

In October 2025, Ghana’s Minister of Finance announced an approximately 12% increase in the nominal cocoa producer price, raising it from GHS 51,660 to GHS 58,000 per tonne for the 2025/2026 season.

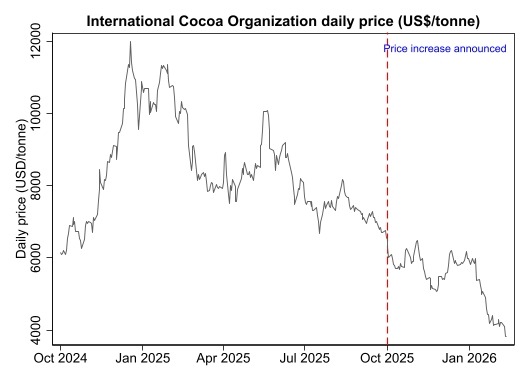

The decision was taken at a time when international cocoa prices were still elevated following a period of sharp increases.

However, global cocoa prices began declining soon after October, as shown in the International Cocoa Organization daily price series.

This created a mismatch between the fixed domestic producer price and falling world market prices.

The result was predictable: licensed buyers struggled to purchase at the official price, some cocoa already offtaken remained unpaid, and market activity slowed significantly.

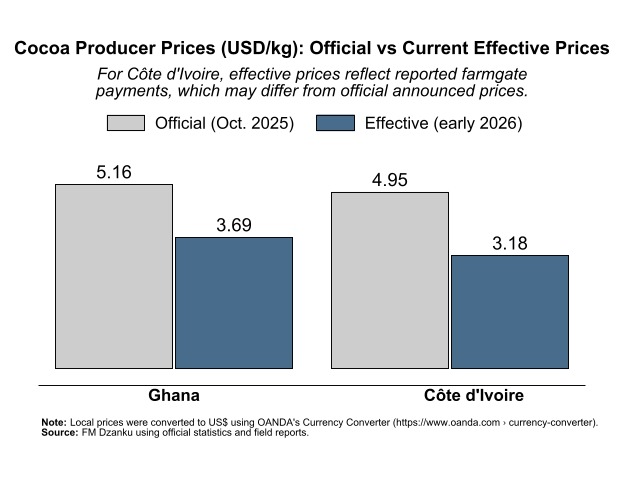

The recent decision to reduce the producer price by about 29% has therefore triggered concerns about increased smuggling of cocoa beans to Côte d’Ivoire, where the official producer price remains higher.

On the surface, this concern appears reasonable. Following Ghana’s adjustment, the official Ivorian producer price is now roughly 27% higher than Ghana’s.

But official prices alone do not determine incentives. Market reality matters more. Evidence from buyers indicates that, despite Côte d’Ivoire’s unchanged official price, transactions are occurring below the announced level, with farmers reportedly receiving between US$2.72 and US$3.63 per kilogram, averaging about US$3.17/kg.

At these effective market prices, Ghana’s revised producer price is still approximately 16% higher.

This implies that the immediate incentive for smuggling into Côte d’Ivoire is weak. If anything, the opposite pressure could emerge.

The episode highlights a broader lesson: when domestic producer prices become disconnected from world prices, market distortions arise quickly.

Aligning producer prices more closely with market fundamentals may be painful in the short run, but it reduces payment delays, restores liquidity in the supply chain, and stabilizes incentives for both farmers and buyers.

The current debate should therefore move beyond headline comparisons of official prices and focus instead on effective prices actually received by farmers. In commodity markets, incentives follow reality, not announcements.

Latest Stories

-

‘I wanted to be an architect but ended up as a nurse’ – Diana Hamilton reveals

20 minutes -

From wards to worship: Diana Hamilton reveals how nursing school shaped her destiny

37 minutes -

Mahama demands binding deadlines for African reparations

1 hour -

This is not the time to settle political scores – Bawumia to government

2 hours -

5 definitive Valentine’s Day gifts to win your lover’s heart in Ghana

3 hours -

37% of SHS students exposed to drugs – Opare-Addo

3 hours -

NLC secures court injunction against striking tertiary unions

3 hours -

Waiting in the Ring: life inside Bukom’s halted boxing scene

4 hours -

Red Notice cancellation: OSP official fires back at Ofori-Atta’s lawyers

4 hours -

Ofori-Atta saga: Red Notice ends after arrest – OSP official clarifies

5 hours -

AAG raises alarm over billboard demolitions, calls for presidential intervention

5 hours -

Health Minister to chair probe into ‘No Bed Syndrome’ death; promises system overhaul

5 hours -

Prime Insight to tackle ‘galamsey tax’ debate, cocoa reforms and Ayawaso East fallout this Saturday

6 hours -

Cocoa crisis, galamsey complicity and election credibility to dominate this Saturday’s Newsfile

6 hours -

INTERPOL deletes Red Notice for Ofori-Atta as extradition process continues — OSP confirms

7 hours