Audio By Carbonatix

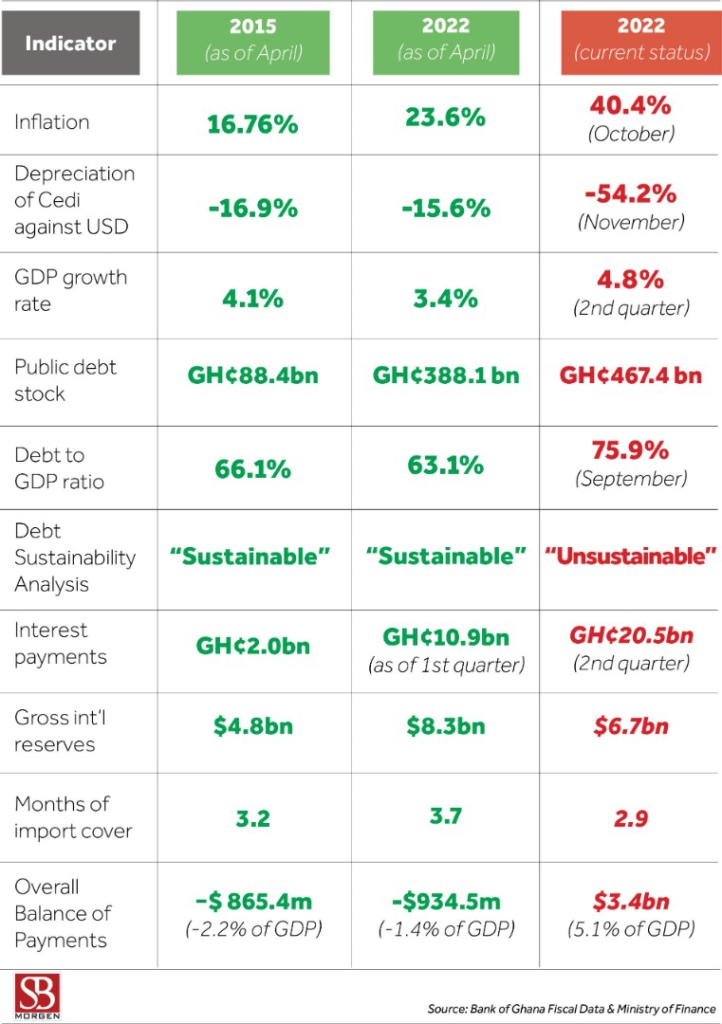

While delivering the much anticipated 2023 budget, Ghana’s Finance Minister, Ken Ofori-Atta, unmasked the nature of Ghana’s debt portfolio, saying the country is finding it difficult to carry a debt burden worth $48.9 billion as of September 2022.

Debt restructuring is the only gateway to access the projected $3 billion IMF bailout package. Barely five days after Ofori-Atta confirmed the debt operation exercise, international credit rating agency Moody’s dropped Ghana’s long-term sovereign bonds ratings.

On 4 December 2022, the government finally announced a debt operation exercise called “Domestic Debt Exchange”, which outlined the nature of debt restructuring for domestic creditors. The Finance Minister indicated that domestic bondholders would be asked to exchange their instruments for new ones under the programme. However, the impact of the domestic debt exchange on investors holding government bonds, particularly small investors, individuals, and other vulnerable groups, will be minimised; hence treasury bill holders will be paid the full value of their investments on maturity.

20 years after Ghana received a total relief of approximately US$3.7 billion, equivalent to US$ 2.2 billion in Net Present Value terms, from all its creditors, it is back in the IMF ‘programmes market’ hoping to shop for another bailout packet worth $3 billion. According to the fund, “in cases where a country’s debt is assessed as unsustainable, the IMF is precluded from providing financing unless the member takes steps to restore debt sustainability, including by seeking a debt restructuring from its creditors.” Like the country’s 16th IMF programme in 2015, the government has decided to freeze public-sector employment next year to reduce expenditure. The monetary policy rate has also been hiked from 24.5% to a record 27% to deal with the over 40% inflation rate.

As Ghana walks the path to its 17th IMF bailout, precipitated by a debt sustainability problem, the country will experience the immediate impact, such as losses to investors, shaking of the financial industry, potential bank collapses and stifling of production due to how expensive it will be to procure financing. Added to these is the long-term effect of losing confidence in the Ghanaian government’s security. It will be hard for a government that has defaulted on domestic debt in the currency it prints to convince investors to buy its securities in international currencies that it does not control. This will take at least a decade to restore.

Latest Stories

-

Open letter to Education Minister: Rising student deviance and the urgent need for national parental responsibility framework

2 minutes -

Mahama delivers State of the Nation Address on February 27

2 minutes -

Dr Kotia backs Ghana’s move to refer maritime boundary dispute with Togo to International arbitration

5 minutes -

When “substantive ” become a security strategy — Rev Ntim Fordjour’s nameplate doctrine

10 minutes -

No plan to pay cocoa farmers, yet ready to change NIB to BNI—Dr Ekua Amoakoh

12 minutes -

COCOBOD is not your cover story. It will not be your scapegoat

12 minutes -

BOST Energies welcomes Salifu Nat Acheampong as new Deputy Managing Director

19 minutes -

NIB or BNI: Will changing the name solve the problem? Asks Prof. Boadi

24 minutes -

Abidjan to host DRIF 2026 as global talks on digital rights and inclusion open for registration

28 minutes -

CEPI unveils new plan to protect the world from deadly disease outbreaks

32 minutes -

NVI survey aims to build trust in local vaccines across Ghana

38 minutes -

Kofi Asmah Writes: From seedlings to strategy: Can Ghana process 50%?

48 minutes -

Kofi Asmah Writes: The land we may never build on

50 minutes -

3, including woman, arrested in Obuasi anti-robbery operation

57 minutes -

How the Liberator Became the Strongman: Museveni’s long slide from revolutionary promise to entrenched power

58 minutes