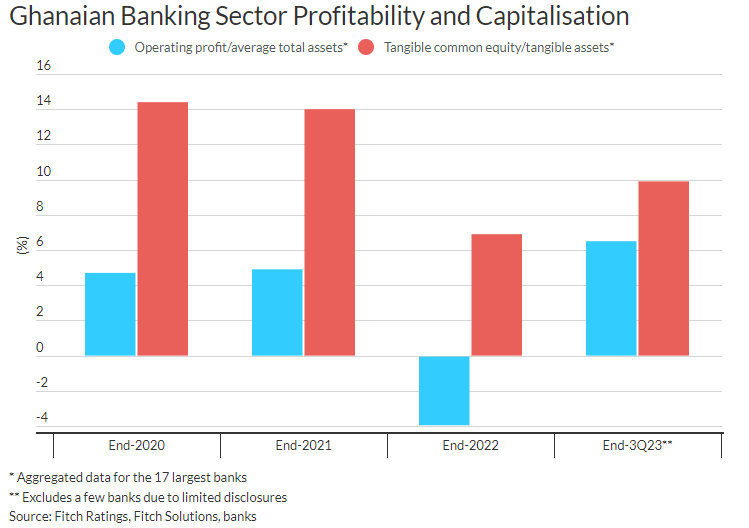

A significant growth in profitability of banks in 2023 driven by exceptionally high yields on treasury bills is helping the financial intermediaries recover in capitalization from the large losses recorded in 2022 due to the Domestic Debt Exchange programme.

According to Fitch Ratings, it expects profitability to remain strong in 2024 as treasury bill yields stay high despite decreasing from their peak.

It added that together with the capital-raising initiatives encouraged by the Bank of Ghana (BoG), this will continue to support the recovery in capitalisation.

“The restructuring of several domestically issued debt instruments in 2023 inflicted large net present value losses on sovereign domestic creditors and significantly weakened the banking sector’s capitalisation. Most of the accounting losses were incurred in December 2022, when the initial proposals for the restructuring were announced. We believe the true capital impact is masked by two factors”.

“Firstly, the discount rate that banks used to determine the fair value of the new bonds was low, reducing the impairment charges they were required to incur. Secondly, banks have been permitted by the BoG to phase in the impact of the impairment charges on regulatory capital over four years”.

Fitch however said the banking sector reported extremely strong profitability in 2023 driven by net interest margins benefitting from the exceptionally high treasury bill yields since the debt exchange was launched.

This was despite incremental impairment charges from the sovereign debt exchange and higher loan impairment charges due to an increasing non-performing loans (NPLs) ratio, adding, “With dividend payouts likely to be limited, the strong earnings should support a significant capital improvement”.

Strong profitability to complement capital-raising initiatives

Fitch added that strong profitability will complement the capital-raising initiatives encouraged by the Bank of Ghana, which instructed undercapitalised banks to present credible recapitalisation plans last year.

“We expect several banks to raise core capital from shareholders and to seek capital support from Ghana Financial Stability Fund. The government has committed the local-currency equivalent of $500 million to the fund and the World Bank’s International Development Association has committed $250 million”, it continued.

Furthermore, it said foreign-owned banks are generally best placed to deal with the difficult operating environment in Ghana as they can call on extraordinary support from their large shareholders.

Fitch rated two Ghanaian banks: Guaranty Trust Bank (Ghana) Limited and United Bank for Africa (Ghana) Limited, both with Long-Term IDRs of ‘B-’/Stable and Viability Ratings of ‘ccc’. The Long-Term IDRs are driven by the likelihood of support from their Nigerian parents.

Latest Stories

-

Paris 2024: Opening ceremony showcases grandiose celebration of French culture and diversity

2 hours -

How decline of Indian vultures led to 500,000 human deaths

3 hours -

Paris 2024: Ghana rocks ‘fabulous fugu’ at olympics opening ceremony

4 hours -

Trust Hospital faces financial strain with rising debt levels – Auditor-General’s report

4 hours -

Electrochem lease: Allocate portions of land to Songor people – Resident demand

4 hours -

82 widows receive financial aid from Chayil Foundation

5 hours -

The silent struggles: Female journalists grapple with Ghana’s high cost of living

5 hours -

BoG yet to make any payment to Service Ghana Auto Group

5 hours -

‘Crushed Young’: The Multimedia Group, JL Properties surprise accident victim’s family with fully-furnished apartment

5 hours -

Asante Kotoko needs structure that would outlive any administration – Opoku Nti

6 hours -

JoyNews exposé on Customs officials demanding bribes airs on July 29

6 hours -

JoyNews Impact Maker Awardee ships first consignment of honey from Kwahu Afram Plains

7 hours -

Joint committee under fire over report on salt mining lease granted Electrochem

7 hours -

Life Lounge with Edem Knight-Tay: Don’t be beaten the third time

8 hours -

Pro-NPP group launched to help ‘Break the 8’

8 hours