Audio By Carbonatix

Governor of the Bank of Ghana (BoG), Dr Johnson Asiama Pandit, says recent pressures on the foreign exchange market were triggered by large energy sector payments and investor exits, not by direct market intervention from the Central Bank.

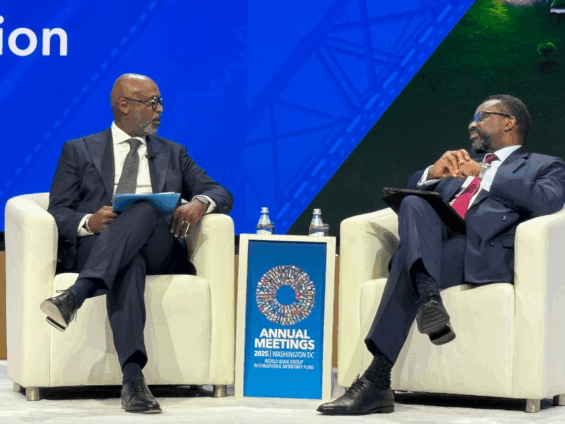

Speaking in an interview with the International Monetary Fund (IMF) at the ongoing IMF/World Bank Spring Meetings in Washington, D.C., on October 16, he said the Bank of Ghana had to undertake a series of “lumpy” foreign exchange payments between July and August to clear long-standing energy debts and other domestic obligations.

“Yes, there were allegations about whether we were intervening in the market. But that was not exactly the case,” he explained.

The Governor’s remarks come amid renewed public scrutiny of the Bank of Ghana’s foreign exchange management practices and growing interest in the country’s energy sector debt, which continues to weigh heavily on fiscal stability.

“Between the second and third quarter, we had to do a number of lumpy payments. There were all these large arrears in payments to some of the IPPs. These were billions of US dollars.”

He revealed that the Central Bank also faced additional outflows from some domestic bondholders who decided to liquidate their investments after the cedi appreciated.

“We also had some of the domestic debt-affected bondholders who wanted to exit. They felt that because the currency had appreciated, it was the right time to take up their investment. We had to allow them to go,” he said.

The Bank of Ghana Governor said those combined pressures temporarily tightened liquidity in the foreign exchange market.

“We did a lot of lumpy payments between July and August, and you might have seen some bit of that,” he noted.

Dr. Pandit further disclosed that the situation coincided with a decline in remittance inflows, which typically provide over US$6 billion in annual FX injections.

“Because all these inflows accrue to the central bank, and it was happening at a time when we saw some decline in remittance inflows, the central bank needed to step in to meet all those lumpy payments,” he said.

According to him, the interbank foreign exchange market “had dried up” during that period, forcing the Bank of Ghana to provide temporary support.

“The central bank needed to provide that support. But I’m happy to say that the interbank FX market has come back,” Dr Pandit said.

He explained that the Central Bank has since written to mining firms to route their inflows through commercial banks to improve liquidity in the FX market.

“We are beginning to see some pick-up in interbank FX market activity,” he said, clarifying that the directive covers all commodities except gold.

Dr Pandit stressed that with improved market conditions, the Central Bank no longer needs to be heavily involved in supplying dollars.

“As of yesterday, we had committed to make available $150 million. This morning, when I checked, the market had picked up only $90 million, so $60 million automatically goes into our reserves,” he said.

“Same thing Tuesday — we made available $150 million, and the markets picked up less than half that. So automatically, it goes into our reserves.”

He dismissed claims that the Bank was over-supporting the market.

“We do not over-support the markets at all. All we seek to do is to limit volatility and ensure smooth market dynamics. That’s the framework we will maintain going forward,” Dr Pandit emphasised.

Latest Stories

-

GSTEP Consortium charts sustainable future for STEM education

10 minutes -

Tano North MP begins paving project at Bomaa Market to improve sanitation

43 minutes -

Gov’t hopes to clear cocoa farmer arrears within 2–3 weeks – Otokunor

47 minutes -

Ghanaian defender Oscar Naasei shines for Granada in victory over Deportivo

49 minutes -

Bitter times for cocoa farmers as chocolate market slumps

1 hour -

Australians must prove they are over 18 to access porn under new laws

1 hour -

Ghana not immediately threatened by fuel shortages – Energy Ministry

1 hour -

Ghana records eight deaths, over 1,000 mpox cases since May 2025 – Health Minister

1 hour -

X probes offensive Grok chatbot posts as AI safety concerns intensify

1 hour -

Planet One announces TVET projects worth $327m in three West African countries

1 hour -

UN Chief condemns attack on Ghanaian peacekeepers in Lebanon, demands accountability

2 hours -

US-Israeli air campaign hits hundreds of military targets in new wave of Iran strikes

2 hours -

Ghana must lead Africa in criminalising environmental destruction – Annoh-Dompreh

2 hours -

US-Israeli war against Iran enters new phase with rise of hardline successor Mojtaba Khamenei

2 hours -

Kofi Adu Domfeh honoured with Excellence in Climate Journalism and Advocacy Award

2 hours