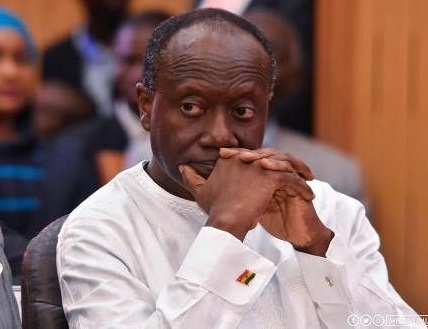

Ghana’s Finance Minister, Ken Ofori-Atta, successfully completed his 2-year tenure as the Chairman of the Development Committee (DC) of the World Bank and International Monetary Fund (IMF) after chairing his 4th DC plenary meeting.

The Committee discussed a build-back strategy for the global economy in view of the unprecedented ravages brought on by the Covid-19 pandemic. The pandemic has resulted in the largest global economic contraction of the last eight decades.

It has also overwhelmed health systems, disrupted productivity, exacerbated job losses, reduced incomes, and threatened global food security particularly for the most vulnerable.

The plenary considered two main topics: “Leaning Forward to Save Lives, Scale-up Impact and Get Back on Track: World Bank Group Covid-19 Crisis Response Update” and the “Joint IMF-WBG Staff Note on the Implementation and Extension of the Debt Service Suspension Initiative”.

Opening the plenary, the Minister indicated that “the crisis is threatening to reverse years of development gains and throw hundreds of millions of people back into poverty.”

In stressing the importance of the G20 Debt Service Suspension Initiative (DSSI) in giving fiscal space to economies, he stated that “since its endorsement, many of the poorest countries have worked closely with official bilateral creditors.

The moratorium has been a critical liquidity intervention to save much needed resources to tackle the crisis before us.” He suggested a 2-year extension and re-examination of the DSSI.

On the DSSI, the World Bank President, Mr. David Malpass asserted that there was the need for a new approach for a fair and balanced relationship between creditors and debtors. He also mentioned that he looked forward to the new framework to lead to the reduction of debts.

On the issue of vaccine finance, Mr. Malpass informed the Committee that the Bank’s Board of Directors had approved additional financing of up to $12 billion to help countries purchase and distribute vaccines which will ensure that initial vaccine doses are available to those who need them first in IDA and IBRD countries with limited access.

He stressed that “financing will be available immediately.” The Minister suggested that, as a ‘Global good’, we need to be more innovative about providing free access to everyone.

The IMF Managing Director in her remarks highlighted the uneven fiscal response deployed by Developed Countries, in stark comparison to Developing Economies. She stated that, Developed Economies have averagely deployed fiscal stimulus of about 20 percent of GDP, emerging markets up to six percent of GDP, while Low Income and Developing Countries have deployed, on average, two percent.

The International Community should therefore not prematurely withdraw fiscal support to developing economies as they remain the most vulnerable. She stated, “LIDCs need strong support from the international community to overcome the crisis and embark on a sustained recovery.”

In his concluding remarks, the Minister stated that the Covid-19 Pandemic has brought us to this precipice, a tipping point where critical action must be taken to avert imminent disaster. A lot has been said within the last 8 months about what is upon us and what needs to be done to ensure a just and inclusive recovery for all; but a lot more needs to be done.

He stated that the DSSI needs to be debt reductive and emphasised the need for the US and Europe to facilitate the issuance of new and unused SDRs.

Also, in the spirit of comparable treatment of all creditors and to ensure universal participation, China and private sector creditors should specifically engage Africa in particular for a debt restructuring programme and finally, there should be debt forgiveness and cancellation for vulnerable and debt distressed countries.

He called for a special Secretariat to work towards establishing a ‘fit for purpose’ and new global financial architecture as was done in Bretton woods. He proceeded to acknowledge the incredible leadership and passion that the Fund and Bank had shown over the period under the leadership of Madam Georgieva and Mr. Malpass.

He reminded them of his farewell note “A Call To Righteous Action” circulated to the Members of the Committee and Executive Directors of the World Bank Group in which he shared with them, a collection of artwork and symbolism that has over the years, been life-changing tools of reflection for him - at Achimota High School in Ghana, Columbia College and Yale University in the US, on Wall Street, as a Henry Crown Fellow of the Aspen Institute, during his life as an Entrepreneur in Ghana and in his Christian Faith.

The Minister summed up his reflections with the words of Martin Luther King, “In the end, we will remember not the words of our enemies, but the silence of our friends” and charged them to the effect that “the burden of responsibility we feel today should stir us to righteous action; and if we seek His righteousness to guide us, I am confident that together we will be victorious!”

He handed over to Ms. Mia Amor Mottley, Prime Minister and Minister of Finance of Barbados, and Ms. Azucena Arbeleche, Minister of Economy and Finance of Uruguay, who have been selected as sequential DC Chairs starting November 2020 to October 2022.

The 2020 Development Committee plenary was held virtually on Friday, 16th October 2020.The Committee is an inter-ministerial Committee of Finance and/or Development Ministers who represent the full membership of the Bank and Fund.

Latest Stories

-

FIFA Club World Cup 2025: Sundowns, Esperance join Al Ahly and Wydad as CAF representatives

4 mins -

CAFCL: Al Ahly set up historic final with ES Tunis

21 mins -

We didn’t sneak out 10 BVDs; they were auctioned as obsolete equipment – EC

4 hours -

King Charles to resume public duties after progress in cancer treatment

5 hours -

Arda Guler scores on first start in La Liga as Madrid beat Real Sociedad

5 hours -

Fatawu Issahaku’s Leicester City secures Premier League promotion after Leeds defeat

5 hours -

Anticipation builds as Junior Speller hosts nationwide auditions

6 hours -

Etse Sikanku: The driver’s mate conundrum

6 hours -

IMF Deputy Chief worried large chunk of Eurobonds is used to service debt

6 hours -

Otumfuo Osei Tutu II celebrates 25 years of peaceful rule on golden stool

6 hours -

We have enough funds to pay accruing benefits; we’ve never missed pension payments since 1991 – SSNIT

7 hours -

Let’s embrace shared vision and propel National Banking College – First Deputy Governor

7 hours -

Liverpool agree compensation deal with Feyenoord for Slot

8 hours -

Ejisu by-election: There’s no evidence of NPP engaging in vote-buying – Ahiagbah

8 hours -

Ejisu by-election: Independent ex-NPP MP’s campaign team warns party against dubious tactics

8 hours