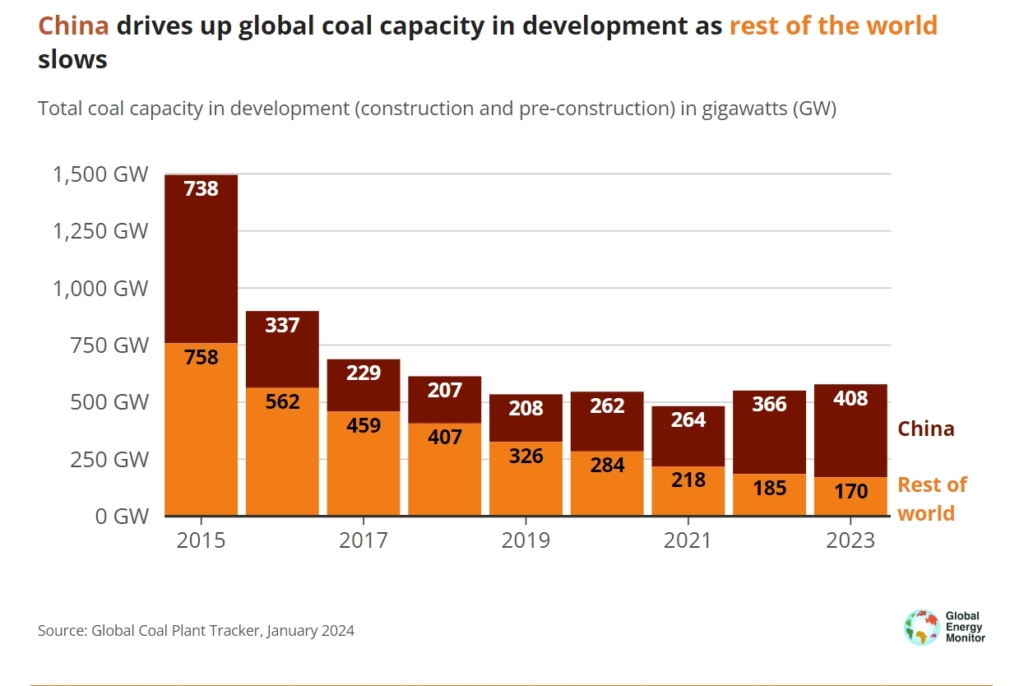

Global coal production capacity increased by 2% in 2023, with China responsible for two-thirds of new additions, while the rest of the world also experienced a slight increase for the first time since 2019.

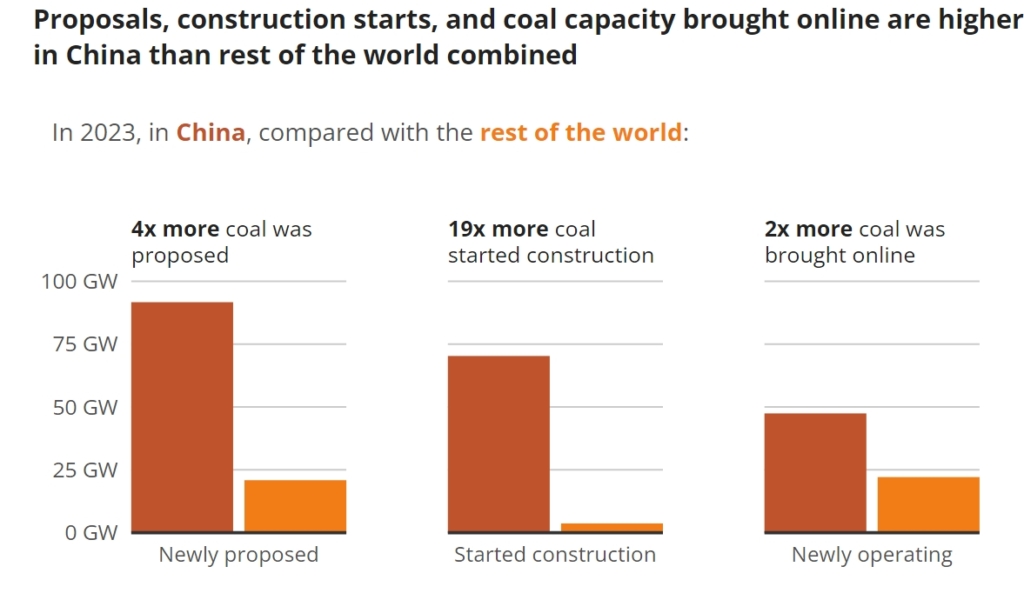

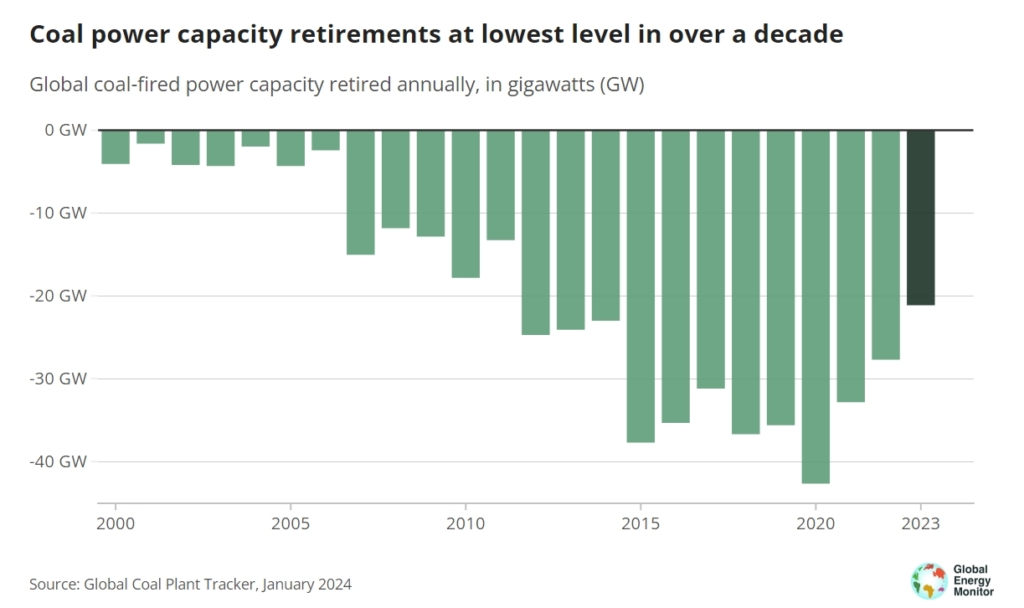

The Global Coal Plant Tracker data reveals that in 2023, 69.5 gigawatts (GW) of coal power capacity was started, and 21.1 GW was shut down. This led to a net increase of 48.4 GW over the year, bringing the worldwide total to 2,130 GW. This marks the largest yearly gain in coal power capacity since 2016, as reported by the Global Energy Monitor.

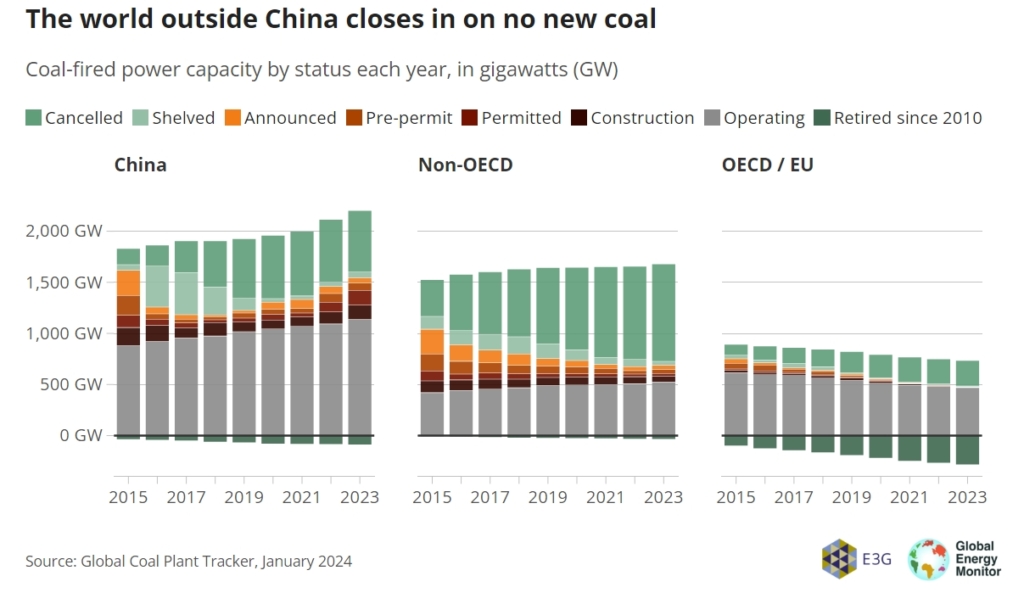

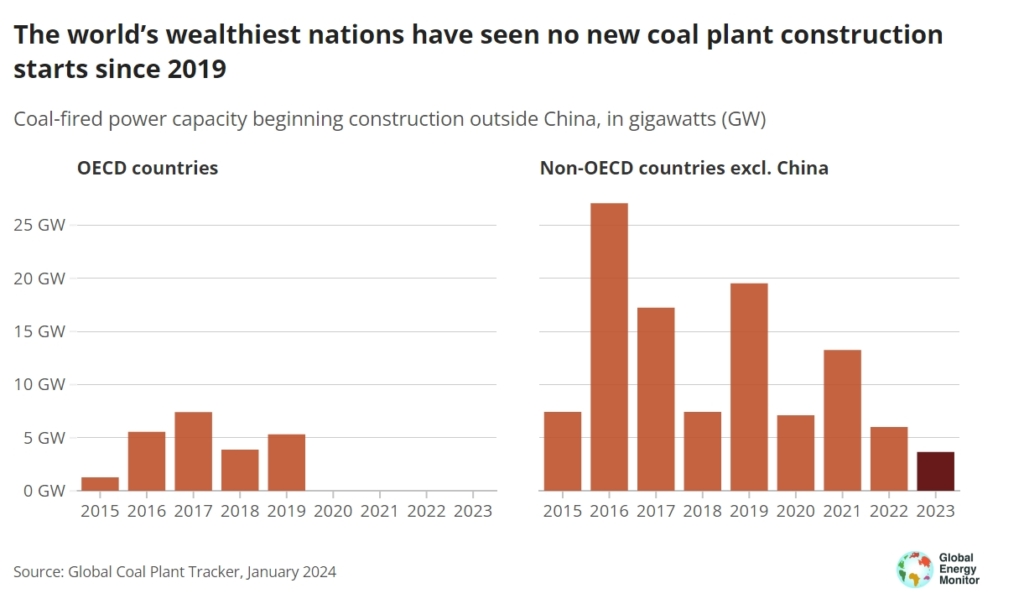

Since the 2015 Paris Climate Agreement, data from the Global Energy Monitor indicates that nearly all countries have cut or halted the expansion of coal-fired power plants.

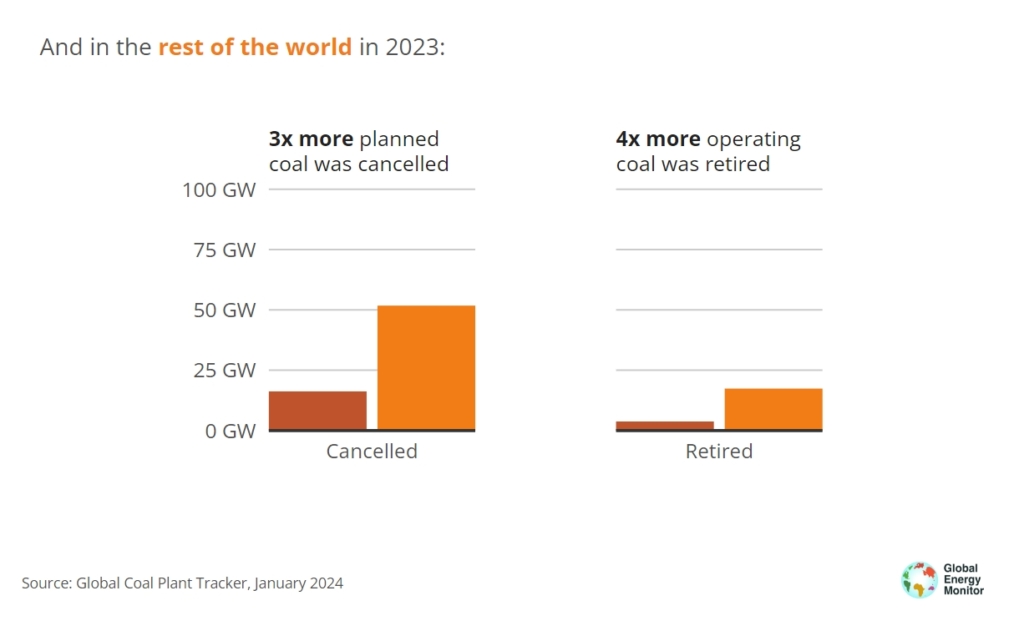

Over half of the countries with existing coal plants have not increased or have reduced their coal power capacity. The reasons include environmental concerns, poor economic returns, and public resistance, which have led to the cancellation of many planned coal plants and the closure of existing ones.

Despite positive trends, global operating coal power capacity has increased by 11% since the 2015 Paris Climate Agreement, with a record high in coal use and capacity in 2023.

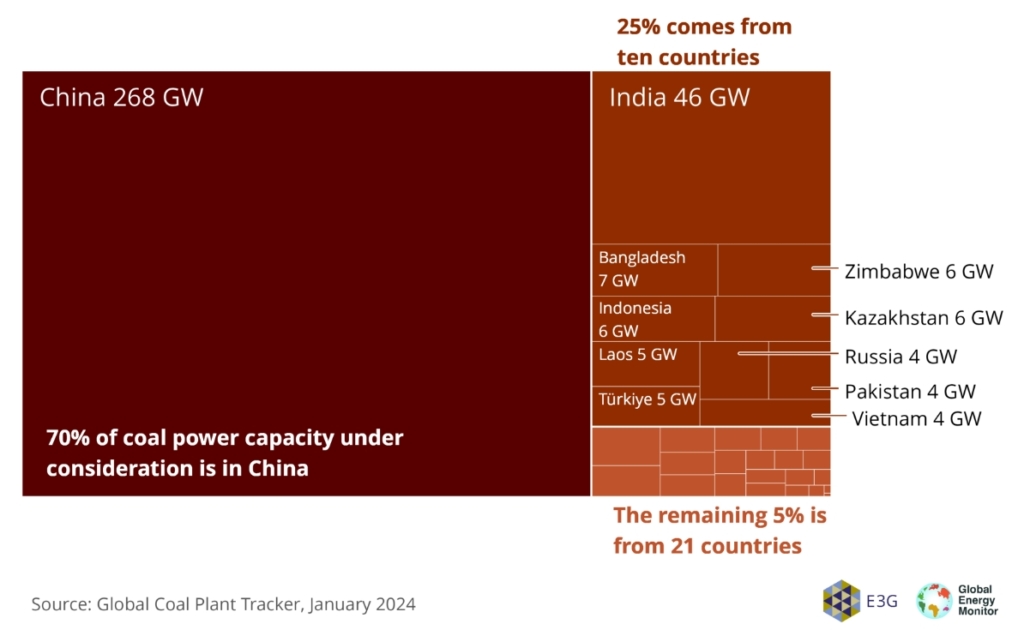

“In China, the exact opposite happened, with new construction starts increasing for the fourth year in a row and hitting an eight-year high, which is out of line with President Xi’s 2021 pledge to “strictly control” coal projects. Outside of China, 113 GW of coal is still under consideration, only slightly up from 110 GW in 2022, due to a surge in proposals in India, and, in China, 268 GW is under consideration, up from 249 GW in 2022. This global pre-construction capacity, up 6% since last year, crystallizes the importance of calls to stop proposing and breaking ground on new coal plants,” the report said.

The report emphasizes that countries need to improve their commitments to phasing out coal and turn these commitments into specific plans for shutting down individual plants. Currently, only 15% (317 gigawatts) of the world’s coal power capacity is set to be retired in a manner that aligns with the Paris Agreement’s goal to limit global warming to 1.5 degrees Celsius. To phase out existing coal power by 2040, the report indicated that, it would be necessary to retire an average of 126 gigawatts each year for the next 17 years, which is equivalent to closing two coal plants every week. This challenge is compounded by the additional 578 gigawatts of coal power that is either under construction or in the planning stages, which would require even more aggressive reductions.

The report indicates that 2023 experienced the largest rise in operational coal capacity since 2016, mainly due to a significant number of new coal plants starting up in China, which added 47.4 gigawatts. There were fewer closures of coal plants in the United States and Europe, with retirements totaling 9.7 gigawatts and 5 gigawatts respectively, which is less compared to previous significant years.

“About half of the United States operating coal capacity is planned to be decommissioned or converted to another fuel by 2035. Momentum away from coal needs to accelerate to meet national energy and climate goals. In the European Union, 27 and the United Kingdom, the region’s coal retirement plans and commitments go halfway towards Paris Agreement climate targets and must continue to become more ambitious too.”

In 2023, twelve more countries also joined the Powering Past Coal Alliance, committing to the 'No New Coal' initiative. This brings the total to 101 countries that have either officially pledged not to build new coal plants or have scrapped plans for new coal projects over the past decade. China and the ten countries trailing it make up 95% of the world's coal capacity that is still in the planning stages. The other 5% is spread across 21 countries, with eleven of these countries having just one project left before they can reach the 'no new coal' goal.

As captured by the report, in 2023, while there was a decline in proposed coal projects outside of China, this was offset by 20.9 gigawatts (GW) of entirely new coal project proposals. Leading these were India with 11.4 GW, Kazakhstan with 4.6 GW, and Indonesia with 2.5 GW. Additionally, projects totaling 4.1 GW that had been previously shelved or canceled were re-proposed. A notable trend is the rise of “captive” coal power projects, which are not connected to the main energy grid but are used for industrial processes. For instance, Zimbabwe proposed 1.9 GW of new coal capacity for chrome smelters, and in Indonesia, coal projects are advancing to power the nickel smelting industry.

Meanwhile, the pace of financial institutions adopting new coal policies has slowed; 23 top private financial institutions introduced or updated coal policies in 2023, a decrease from the 57 in 2022. The Group of Seven (G7) major industrial nations, which together hold 15% (310 GW) of the world’s operating coal capacity, saw the completion of new coal units in Japan in 2023. Following these completions, the G7 now has no ongoing coal construction, although there remains one coal project proposal in Japan and two in the U.S.

“The proposals are linked to carbon capture and other “clean coal” technologies and are effectively uncertain and expensive distractions from the urgent need to phase out coal. The Group of Twenty (G20) is home to 92% of the world’s operating coal capacity (1,968 GW) and 88% (336 GW) of the pre-construction coal capacity. India’s 11.4 GW of entirely new coal proposals introduced—by both public and private sector actors—is more than in any year since 2016, and several long-stalled projects were also revived in the country.”

Brazil's pre-construction coal capacity has decreased, yet it still has two projects under consideration, marking the final coal projects in Latin America. In contrast, while most other regions are either stabilizing or reducing their coal project proposals, Central Asia is experiencing a significant increase. The proposed coal capacity in Central Asia now equals 45% of the region’s existing operational capacity, which is more than double what was proposed ten years ago.

GEM Coal Program Director, Flora Champenois, notes that the current rise in coal capacity is unusual, and indicators suggest a shift away from this trend. However, nations with existing coal plants earmarked for retirement should expedite these closures, while those considering new coal projects should abandon them altogether.

“Coal’s fortunes this year are an anomaly, as all signs point to reversing course from this accelerated expansion. But countries that have coal plants to retire need to do so more quickly, and countries that have plans for new coal plants must make sure these are never built. Otherwise we can forget about meeting our goals in the Paris Agreement and reaping the benefits that a swift transition to clean energy will bring,” Flora said.

Latest Stories

-

Paris 2024: Opening ceremony showcases grandiose celebration of French culture and diversity

3 hours -

Spectacular photos from the Paris 2024 opening ceremony

4 hours -

How decline of Indian vultures led to 500,000 human deaths

4 hours -

Paris 2024: Ghana rocks ‘fabulous fugu’ at olympics opening ceremony

4 hours -

Trust Hospital faces financial strain with rising debt levels – Auditor-General’s report

5 hours -

Electrochem lease: Allocate portions of land to Songor people – Resident demand

5 hours -

82 widows receive financial aid from Chayil Foundation

5 hours -

The silent struggles: Female journalists grapple with Ghana’s high cost of living

5 hours -

BoG yet to make any payment to Service Ghana Auto Group

5 hours -

‘Crushed Young’: The Multimedia Group, JL Properties surprise accident victim’s family with fully-furnished apartment

6 hours -

Asante Kotoko needs structure that would outlive any administration – Opoku Nti

6 hours -

JoyNews exposé on Customs officials demanding bribes airs on July 29

7 hours -

JoyNews Impact Maker Awardee ships first consignment of honey from Kwahu Afram Plains

8 hours -

Joint committee under fire over report on salt mining lease granted Electrochem

8 hours -

Life Lounge with Edem Knight-Tay: Don’t be beaten the third time

8 hours