Audio By Carbonatix

In October 2025, Ghana’s Minister of Finance announced an approximately 12% increase in the nominal cocoa producer price, raising it from GHS 51,660 to GHS 58,000 per tonne for the 2025/2026 season.

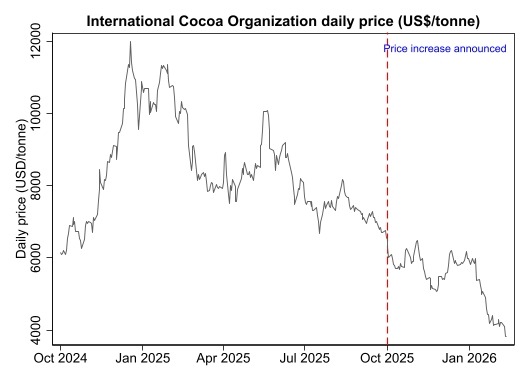

The decision was taken at a time when international cocoa prices were still elevated following a period of sharp increases.

However, global cocoa prices began declining soon after October, as shown in the International Cocoa Organization daily price series.

This created a mismatch between the fixed domestic producer price and falling world market prices.

The result was predictable: licensed buyers struggled to purchase at the official price, some cocoa already offtaken remained unpaid, and market activity slowed significantly.

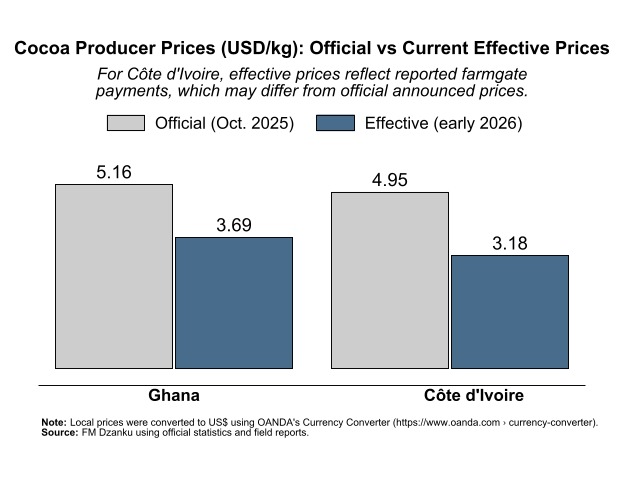

The recent decision to reduce the producer price by about 29% has therefore triggered concerns about increased smuggling of cocoa beans to Côte d’Ivoire, where the official producer price remains higher.

On the surface, this concern appears reasonable. Following Ghana’s adjustment, the official Ivorian producer price is now roughly 27% higher than Ghana’s.

But official prices alone do not determine incentives. Market reality matters more. Evidence from buyers indicates that, despite Côte d’Ivoire’s unchanged official price, transactions are occurring below the announced level, with farmers reportedly receiving between US$2.72 and US$3.63 per kilogram, averaging about US$3.17/kg.

At these effective market prices, Ghana’s revised producer price is still approximately 16% higher.

This implies that the immediate incentive for smuggling into Côte d’Ivoire is weak. If anything, the opposite pressure could emerge.

The episode highlights a broader lesson: when domestic producer prices become disconnected from world prices, market distortions arise quickly.

Aligning producer prices more closely with market fundamentals may be painful in the short run, but it reduces payment delays, restores liquidity in the supply chain, and stabilizes incentives for both farmers and buyers.

The current debate should therefore move beyond headline comparisons of official prices and focus instead on effective prices actually received by farmers. In commodity markets, incentives follow reality, not announcements.

Latest Stories

-

Breaking borders, building futures: How African-led AI is rewriting the rules of global innovation

46 minutes -

Guinea orders dissolution of 40 political parties, including three main opposition groups

52 minutes -

Iran Embassy in Ghana opens Book of condolence after death of Supreme leader in US-Israel attacks

3 hours -

GPL 2025/26: Vision FC cruise past Berekum Chelsea with emphatic 3–1 win

3 hours -

GPL 2025/26: Samartex held by Dreams FC as winless run extends to five

3 hours -

New Juaben North MP challenges gov’t to provide evidence of jobs created and cheap loans

4 hours -

Nadowli-Kaleo District marks 69th Independence Day with cultural exhibition, academic awards

4 hours -

Confusion, tension rock NPP polling station registration exercise in Tarkwa-Nsuaem

5 hours -

Burger King opens first Kumasi branch in Ahodwo

5 hours -

Burma Camp Tennis Club hosts successful 12th Ghana–Nigeria Independence Day Tennis Tournament

5 hours -

Rights, justice and action for all women and girls must include women and girls with disabilities

5 hours -

The Lover and the Fighter: China, the west, and Africa’s geopolitical awakening

6 hours -

UCC student dies in tragic road accident on campus

6 hours -

Health Ministry establishes committee to probe death of hit-and-run victim

6 hours -

RTI Commission, NACOC explore collaboration to promote transparency and accountability

6 hours