Audio By Carbonatix

The Ghana Cocoa Board (COCOBOD) has settled coupon payments worth GH¢2 billion to investors of its restructured cocoa bills.

Joy Business understands that the payments were made on Monday, September 1, 2025, to investors holding these instruments.

Following the Domestic Debt Exchange Programme, the restructured bills are now classified as bonds.

The restructuring, which mainly affected commercial banks, saw the cocoa bills converted into bonds.

Sources indicate that COCOBOD has assured investors it will honour coupon payments of about GH¢1.9 billion due in 2026 and 2027, as well as the principal, on schedule.

This new arrangement for COCOBOD was facilitated by some local banks acting as transaction advisors.

In recent months, COCOBOD has been implementing measures to clean its books, settle outstanding debts, and strengthen its financial position to support cocoa purchases.

Sources say the steps are already having a positive impact, particularly on debt settlement with some suppliers.

Market analysts argue that the restructuring could position COCOBOD strongly to secure fresh funding at more affordable rates.

This would enhance its capacity to purchase cocoa beans for the next crop season while improving the institution’s credit rating.

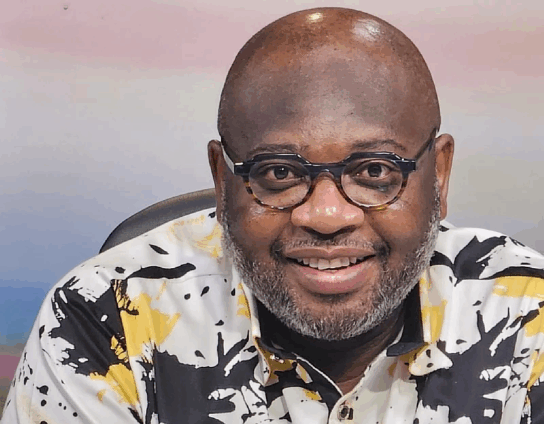

The Chief Executive of COCOBOD, Dr Randy Abbey, told Joy Business he is committed to placing the institution on a solid financial footing by the end of the administration’s first term.

Bank of Ghana Governor, Dr. Johnson Asiama, also revealed to Joy Business that COCOBOD is expecting over $4 billion in inflows from buyers under a new pre-financing deal.

This is expected to support cocoa purchases for the upcoming crop season and could strengthen Ghana’s international reserves as well as the stability of the cedi.

Latest Stories

-

Kim Jong Un chooses teen daughter as heir, says Seoul

40 minutes -

Morocco to spend $330m on flood relief plan

50 minutes -

Samini’s ORIGIN8A storms Apple Music Ghana charts at No. 7

3 hours -

Ghana’s gold output hits record 6 million ounces in 2025, industry group says

4 hours -

‘I’m a lover boy, not womaniser’ – 2Baba on fatherhood, marriage to Natasha

4 hours -

Tems becomes first African female artist to have 7 entries on Billboard Hot 100

4 hours -

Police arrest three for the alleged possession of firearm without license

4 hours -

Suspected robber shot dead by police while fleeing with officer’s vehicle

4 hours -

Head porter charged over mobile phone theft

5 hours -

Tuchel extended England stay for ‘amazing players’

5 hours -

Gender Ministry holds stakeholders’ meeting to strengthen Ghana’s adoption system

5 hours -

Atletico Madrid put four past Barcelona in Copa del Rey semi-final

5 hours -

Tottenham are ‘not a big club’ – Postecoglou

5 hours -

Nottingham Forest close in on Pereira appointment

5 hours -

England to face Spain and Croatia in Nations League

5 hours