Audio By Carbonatix

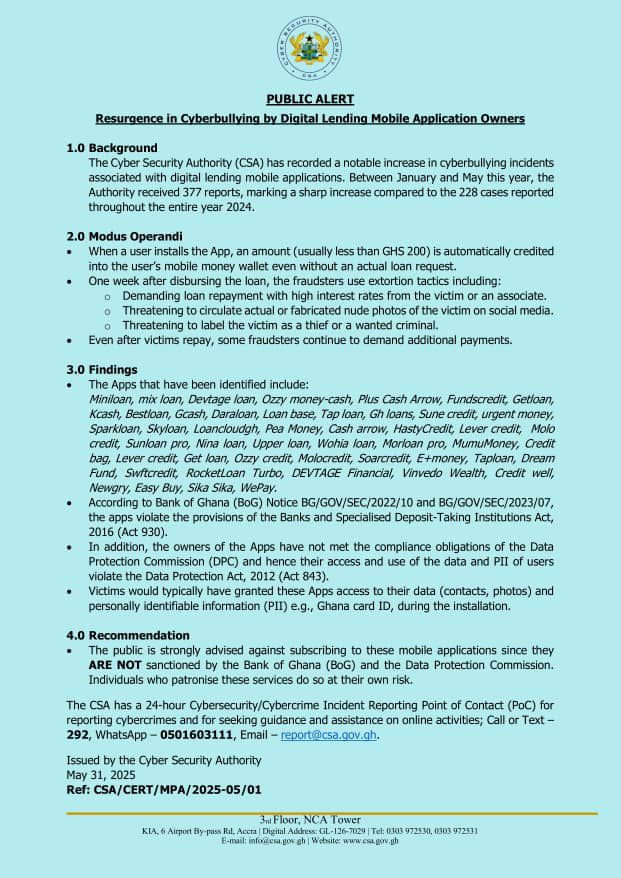

The Cyber Security Authority (CSA) has issued a strong warning to the public following a rise in cyberbullying, harassment, and blackmail linked to unlicensed mobile loan applications operating in Ghana.

The Authority revealed that from January to May 2025, it received 377 complaints relating to such digital lending platforms—a significant jump from 228 cases reported in all of 2024.

The CSA attributes the increase to the aggressive recovery methods used by these unauthorised loan apps, which frequently flout data protection regulations and consumer rights.

Many of these platforms operate outside Ghana’s legal and regulatory frameworks and are not under the supervision of the Bank of Ghana or relevant financial authorities.

According to the CSA, users are often offered unsolicited loans, and when they are unable to repay on time, the apps resort to harassment.

Victims report receiving threats of defamation, blackmail, and intimidation.

In several instances, private information—including photos, contact lists, and messages—has been extracted from users’ devices and shared with third parties, friends, or family members as a form of coercion.

“These apps operate without legal backing and often disregard consumer protection laws. Engaging with them exposes users to serious risks, including data breaches, harassment, and financial loss,” the CSA warned in an official statement.

The Authority has so far identified 48 of these so-called “rogue loan apps”, many of which are still active in the Ghanaian digital space. Some of the blacklisted platforms include Miniloan, Devtage Loan, Mix Loan, Ozzy Money-Cash, Plus Cash Arrow, Cash Arrow, FundsCredit, Lever Credit, GetLoan, Upper Loan, Kcash, BestLoan, Gcash, DaraLoan, Loanbase, TapLoan, Gh Loans, Sune Loans, Urgent Money, SparkLoan, SkyLoan, Loancloudgh, and Pea Money, among others.

The CSA is advising users to exercise caution and verify the legitimacy of any loan service before engaging with it. Users are also encouraged to read app permissions carefully before installation, especially when granting access to contacts, media, and other personal data.

As part of its public protection measures, the Authority has activated its 24-hour cyber incident response platform, through which victims or concerned users can report suspicious digital activity.

Ghanaians are urged to remain vigilant and avoid interacting with loan apps not regulated by the Bank of Ghana or listed under approved financial service providers. The CSA says it is working with other relevant institutions to remove these apps and hold developers accountable.

For support or to report abuse, users can contact the CSA’s incident reporting lines or visit their official website.

Latest Stories

-

Make Accra Beautiful Again (MABA)

3 minutes -

Love Beyond Roses: Olive Tower ignites hearts at ‘Time with Mama Portia’ Valentine seminar

8 minutes -

Gov’t warns against non-essential travel to high-risk areas after Burkina Faso attack

9 minutes -

DoorMaster launches SECURE+, Ghana’s first security doors with built-in insurance protection

22 minutes -

GAUA warns against use of court processes to halt university strikes

33 minutes -

Learning to stand alone: Love, loss, and the quiet strength of faith

40 minutes -

Mahama orders air evacuation of injured Ghanaians from Burkina Faso

45 minutes -

Ghanaians death toll in Burkina Faso terror attack now 8

1 hour -

Ken Ashigbey demands probe into 14 containers of changfang machines

1 hour -

The NDC doesn’t need a southerner or northerner

1 hour -

NSA assures service personnel of allowance payments by week’s end

1 hour -

Why COCOBOD’s pay cut is a band-aid on a gaping national wound

1 hour -

We cannot stop cross-border trade but must protect our traders – Dumelo

1 hour -

Port security lapses exposed in importation of illegal mining machines – Ashigbey

1 hour -

One-week observance in honour of Yaw Sarpong slated for February 19

1 hour