Audio By Carbonatix

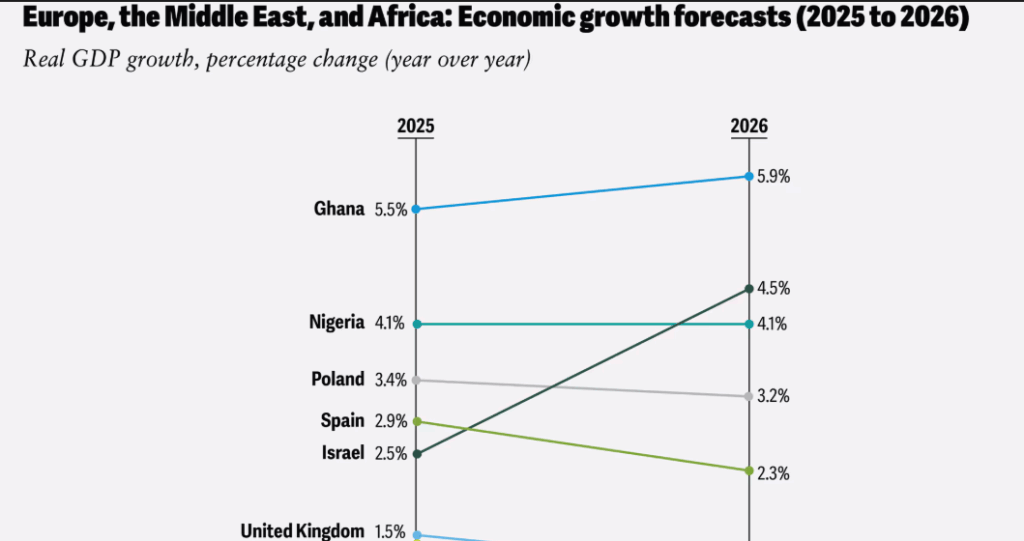

Deloitte is predicting a 5.9% Gross Domestic Product (GDP) for Ghana’s economy in 2026, higher than the 5.5% recorded in 2025.

At the same time, it is forecasting an unchanged growth rate of 4.1% for Nigeria in 2026.

In its Global Economic Outlook 2026, the professional services firm said the expansion in the Ghanaian economy will be driven by improved exports from the development of the Bibiani gold mine in western Ghana and ongoing government initiatives such as the 24-hour Economy Programme and the Accelerated Export Development Programme.

However, it warned that several factors including fluctuations in cocoa production due to climate events, the spread of the swollen shoot virus, smuggling activities, and volatility in commodity prices could impede these forecasts.

The Ghanaian economy recorded a real economic growth of 6.3% in the second quarter of 2025, mainly driven by Fishing, which grew 16.4%, followed by Information, Communication and Technology at 13.1%, and Finance and Insurance at 9.3%.

Ghana achieved a single-digit inflation rate of 6.3% as of November 2025, after about four years in double digits, driven by a strong cedi, falling nonfood prices, and reduced supply-side pressures.

Deloitte said, “Potential risks to Ghana’s inflation outlook include higher tariffs on utilities such as electricity and water, and persistently high domestic food prices.”

BoG and Interest Rates

The Bank of Ghana (BoG) resumed adjusting interest rates, implementing a 1,000-basis-point cumulative cut to its monetary policy rate in 2025.

Deloitte predicted further rate cuts toward 17% by the end of 2026, highlighting, “While these reductions are expected to ease financing constraints and stimulate credit and domestic demand, excessive easing may jeopardise progress made in inflation control”.

Cedi Performance

The cedi strengthened by over 40% in the first nine months of 2025—to an average of around GH¢13 (retail market) per US dollar, driven by higher gold revenues, frequent Bank of Ghana interventions, successful debt restructuring, and initiatives like the Ghana Gold Board.

Deloitte therefore projected an average GH¢13.01 per US dollar in 2026.

However, it warned that potential monetary policy easing could reverse some of these recent gains, especially if the demand for gold diminishes along with declining global uncertainty.

Latest Stories

-

Tano North MP begins paving project at Bomaa Market to improve sanitation

16 minutes -

Gov’t hopes to clear cocoa farmer arrears within 2–3 weeks – Otokunor

20 minutes -

Ghanaian defender Oscar Naasei shines for Granada in victory over Deportivo

22 minutes -

Bitter times for cocoa farmers as chocolate market slumps

39 minutes -

Australians must prove they are over 18 to access porn under new laws

46 minutes -

Ghana not immediately threatened by fuel shortages – Energy Ministry

50 minutes -

Ghana records eight deaths, over 1,000 mpox cases since May 2025 – Health Minister

50 minutes -

X probes offensive Grok chatbot posts as AI safety concerns intensify

52 minutes -

Planet One announces TVET projects worth $327m in three West African countries

59 minutes -

UN Chief condemns attack on Ghanaian peacekeepers in Lebanon, demands accountability

1 hour -

US-Israeli air campaign hits hundreds of military targets in new wave of Iran strikes

1 hour -

Ghana must lead Africa in criminalising environmental destruction – Annoh-Dompreh

1 hour -

US-Israeli war against Iran enters new phase with rise of hardline successor Mojtaba Khamenei

1 hour -

Kofi Adu Domfeh honoured with Excellence in Climate Journalism and Advocacy Award

1 hour -

WPL 2025/26: Hasaacas, Ampem Darkoa Ladies close in on another final

1 hour