Audio By Carbonatix

The Executive Secretary of the Independent Tax Appeals Board (ITAB), Muhammed Nayyar, has called on businesses and individuals who previously filed tax appeals before the Local Inspectorate (LI) to refile their cases with the Board.

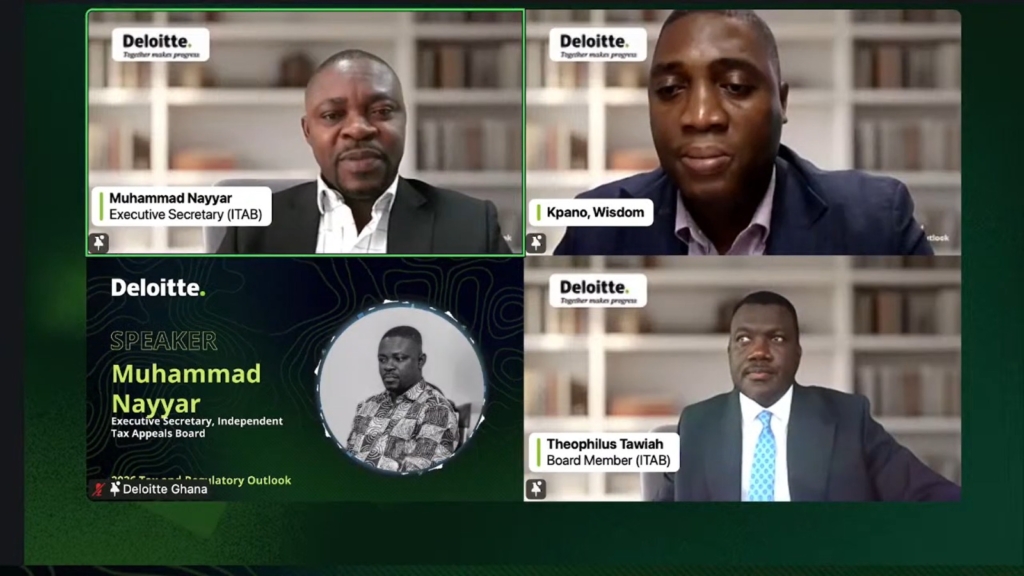

Speaking at the Deloitte Ghana 2026 Tax and Regulatory Outlook in Accra, Mr. Nayyar emphasised that the move is aimed at providing a fair, transparent, and efficient mechanism for resolving tax disputes between taxpayers and the Ghana Revenue Authority (GRA).

“The Board is committed to ensuring that all taxpayers have access to an impartial platform where disputes can be resolved in accordance with best practices,” he said.

Mr. Nayyar explained that refiling earlier cases will enable the Board to review disputes under its current mandate and procedures, ensuring taxpayers receive a fair hearing. He encouraged those with outstanding issues to take advantage of the Board’s processes

The Independent Tax Appeals Board, established to strengthen trust between taxpayers and the GRA, is expected to play a key role in enhancing voluntary tax compliance and improving revenue mobilisation by resolving disputes promptly and fairly.

The event was designed to highlight key updates in the tax and regulatory landscape, and to draw attention to areas that businesses and investors should be mindful of.

With the recent Value Added Tax (VAT) reforms and the operationalisation of the Independent Tax Appeals Board, Lead Tax Partner at Deloitte, George Ankomah said there is an increasing interest in how these changes will shape the regulatory environment.

The session was divided into two parts. The first part featured a discussion with members of the Independent Tax Appeals Board (ITAB), where they explored the structure, core mandate, and responsibilities of the Board under the new regulations. The second part was a panel discussion focusing on the VAT reforms and other significant regulatory changes businesses and investors should be aware of.

Latest Stories

-

Medikal named ambassador for National Youth Authority’s ‘Red Means Stop’ drug campaign

53 seconds -

Danish PM calls snap election with Greenland issue centre-stage

2 minutes -

Girl, 14, shot dead as South Africa’s ‘taxi wars’ hit school

2 minutes -

Mahama’s Accra Reset calls for sovereignty and private capital to drive job creation

12 minutes -

Hillary Clinton to appear before US House panel investigating Epstein

54 minutes -

All 59 fishermen rescued in armed raid by ‘Black Boat’ pirates – Awutu Senya West MP confirms

57 minutes -

DVLA reviews plan to send staff abroad after public backlash

57 minutes -

PURC says it has no dedicated system to monitor usage of ECG prepaid credits

57 minutes -

Loyal customer wins Dubai trip in MTN and Emirates campaign

58 minutes -

Ghana Baptist University President calls for government’s support for private universities

1 hour -

How to check 2025 WASSCE private candidates results on phone

1 hour -

Senya Beraku raid: 22 fishermen rescued following violent attack at sea

1 hour -

Tomato traders complete first trip to Burkina Faso after terror attack

1 hour -

Private WASSCE 2025: WAEC withholds over 800 candidates results over malpractice

2 hours -

Senya Beraku gunmen raid: GAF launches search and rescue operation at sea

2 hours