Audio By Carbonatix

The Social Security and National Insurance Trust (SSNIT) has assured contributors of protecting their investments.

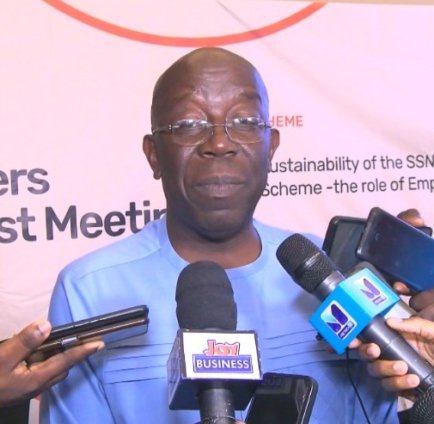

According to the Director General, Dr. John Ofori Tenkorang, though the scheme has recorded some negative returns on investment portfolios in the past, the Trust is committed to restructuring all non-performing investments to yield the needed benefits.

Speaking at the 2022 SSNIT Employers’ Breakfast Meeting, Dr. John Tenkorang explained that a lot of the non-performing investments are legacy assets that may have decreased in value over a long period of time.

“I want to assure members and clients that we are very much engaged in managing our investment portfolio. You know investment goes in cycles, some may do well and others may not do well. So we have an investment team that is fully engaged in making sure that all investments are restructured to yield the needed benefits”.

“A lot of the investments which appear not to be doing well are all legacy projects which were done long ago. They are not investments we recently did”, he stressed.

“So we are restructuring all old investments. Those that we feel that we are not suited to be a majority shareholder and we need to invite people who are business minded to come and partner with us, we are doing same”, he added.

On the importance of engaging stakeholders, Dr. Ofori Tenkorang said such engagements deepen the understanding and explore ways to improve the operations of the scheme.

“Stakeholder engagements like this is very important because when the various stakeholders understand what we do and the value that it brings to them, then issues like compliance become easy”.

The SSNIT Employers’ Breakfast Meeting was organised under the theme: “Sustainability of the SSNIT Scheme: the role of Employers”. The forum provided a platform to discuss challenges facing employers concerning the SSNIT Scheme and how they can be resolved.

A second meeting is expected to be held in Takoradi later this month.

Latest Stories

-

ECG initiates audit of metering systems following public outcry

8 minutes -

Ayawaso East by-election: NDC will win; NPP only came to escort us – Gbande

30 minutes -

Energy Minister engages petroleum stakeholders over fuel security amid Middle East crisis

35 minutes -

Goldbod foots bill for 13-year-old’s brain surgery

36 minutes -

JICA enhances GRA’s capacity to support cross-border women traders and sustainable AfCFTA trade facilitation

36 minutes -

Voting ends in Ayawaso East by-election, sorting and counting underway

39 minutes -

Mafia boss behind notorious murders in Italy dies behind bars in Milan

40 minutes -

I’m not motivated by material things, I’m here to serve – Baba Jamal

49 minutes -

Pink Ladies Cup: Hong Kong withdraw from tournament following unrest in Middle East region

1 hour -

FHU Medical Matriculants charged to champion Health-for-All

1 hour -

A $36 Million Ghost : Why the Komenda Sugar Factory demands an immediate presidential rescue

1 hour -

Gold for Reserves: Uganda latest African country to follow Ghana’s lead

1 hour -

Next Gen InfraCo Ltd switches on Ghana’s 5G Backbone; platform live and scaling nationwide

2 hours -

Africa Press Day 2026: Roche convenes journalists, health experts, others in Nairobi to discuss health investment, equity and sovereignty

2 hours -

9 arrested after Customs intercepts undeclared Tramadol at Tema Port

2 hours