Audio By Carbonatix

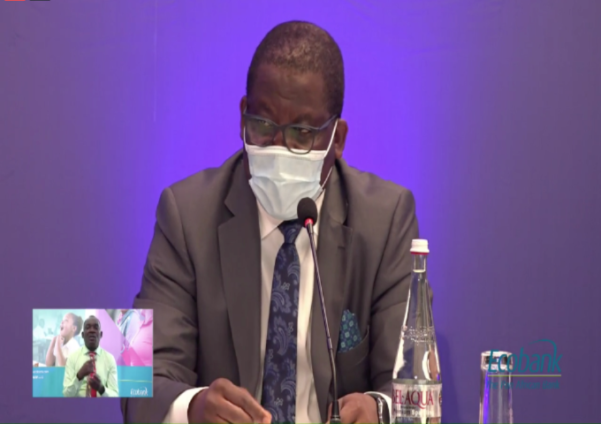

Managing Director of Ecobank Ghana, Daniel Sackey has disclosed that the bank leveraged on its scale and technology to make banking easier for its clients.

He told the Board and shareholders at this year's AGM that this enabled their customers to "bank seamlessly with us, using their preferred digital channels."

“In 2019, we demonstrated our ability to navigate the difficulties associated with an increasingly complex environment, after a challenging period in the banking sector," he said.

Mr Sackey said Ecobank Ghana drove growth by deepening relationships with its existing customers, whilst attracting new ones.

"We also utilised our growing partnership propositions with key actors in the retail sector to launch our first consumer digital lending scheme called Express Loans. This enabled our customers to borrow from the Bank using their mobile phones.

"In the seven months of the product launch, we have advanced loans to over one million customers. This is a significant step in our digital drive and our efforts towards providing our clients with convenience and meeting their financing needs within affordable price points. We do this to promote financial inclusion and to positively impact their lives”.

Mr Sackey also stated that during the year under review, Ecobank carried out several upgrades on its digital platforms in response to customer feedback.

This includes the enhancement of the Bank’s award-winning Ecobank Mobile, which in addition to an improved “look and feel”, now offers greater security and more features.

The Bank also upgraded its core banking application through the enhanced Omniplus and Omnilite product solutions, thereby providing a versatile and robust suite of digital solutions for business customers.

All these upgrades, he said, have significantly improved the Bank’s operations and allowed it to champion its self-onboarding agenda.

He said now, Ecobank provides self-onboarding capabilities to both individuals and businesses. These strategies have contributed immensely to the Bank’s customers benefiting from more affordable, convenient and safer banking services.

He further threw light on the support that the Bank is providing to both customers and the communities within which the Bank operates, especially during the COVID-19 pandemic.

Some of the measures he touched on included payment holidays and the provision of financial advisory services. Ecobank, under the auspices of the Ecobank Foundation, is also supporting government’s effort in the fight against the pandemic thus, contributing generously to the Ghana Private Sector Fund and other groups in cash and in kind.

He concluded by thanking shareholders and customers for the confidence they have reposed in the management of the Bank and the employees for their hard work and unwavering commitment to customers.

Latest Stories

-

Flights in and out of Middle East cancelled and diverted after Iran strikes

11 minutes -

Dr Maxwell Boakye to build 50-bed children’s ward at Samartex Hospital in honour of late mother

22 minutes -

One killed and 11 injured at Dubai and Abu Dhabi airports as Iran strikes region

28 minutes -

Former MCE, 8 others remain in custody over alleged land fraud in Kumasi

34 minutes -

Black Queens players stranded in UAE over Israel-Iran conflict

1 hour -

James Owusu declares bid for NPP–USA chairman, pledges renewal and unity

2 hours -

Trump threatens strong force if Iran continues to retaliate

2 hours -

Lekzy DeComic gears up for Easter comedy special ‘A Fool in April’

3 hours -

Iran declares 40 days of national mourning after Ayatollah Ali Khamenei’s death

4 hours -

Family of Maamobi shooting victim makes desperate plea for Presidential intervention

5 hours -

Middle East turmoil threatens to derail Ghana’s single-digit gains

6 hours -

Free-scoring Semenyo takes burden off Haaland

6 hours -

Explainer: Why did the US attack Iran?

7 hours -

Peaky Blinders to The Bride!: 10 of the best films to watch in March

7 hours -

Crude oil price crosses $91 as Strait of Hormuz blockade chokes 22% of global supply

8 hours